Gold and Silver plunge was a deleveraging reset not a collapse

Gold and silver’s recent plunge was not a verdict on their role as safe havens. It was a classic deleveraging episode that unfolded within the leveraged layer of the market rather than a structural breakdown in precious metals fundamentals.

What looked like a collapse in confidence was in reality a rapid reset driven by volatility, margin dynamics and positioning stress. The speed of the drop and the stabilization that followed are hallmarks of mechanical unwinds rather than long term repricing.

The price action revealed forced positioning adjustments

The first clue lies in the nature of the move itself. The decline was violent and concentrated in a short window, followed by a period of stabilization rather than a persistent orderly downtrend. When long term macro narratives change, markets usually trend in a more sustained fashion. Here, price behaved like an overcrowded position that had to be cut quickly.

Systematic strategies and risk controlled funds play a major role in modern markets. Many operate using volatility targets and value at risk models rather than discretionary macro views. When volatility spikes, these models force an automatic reduction in exposure. That mechanical selling can amplify price moves well beyond what fundamentals alone would justify.

Volatility stress confirmed pressure in the leveraged layer

Options markets reflected the same stress. Implied volatility in near the money precious metals options rose sharply during the episode, signaling heightened expectations of price swings. Higher implied volatility makes options more expensive and typically feeds into higher margin requirements in related futures markets.

As margins rise, leveraged traders must commit more capital to maintain positions. Those unable or unwilling to do so are forced to reduce exposure. This is how volatility becomes a transmission channel. It does not signal that gold or silver have lost their long term value. It signals that the risk environment has tightened and balance sheet constraints are forcing deleveraging.

In this context, the spike in implied volatility confirmed that the plunge was concentrated in the derivatives layer rather than in the core investment thesis for precious metals.

Silver amplified the move for structural reasons

Silver tends to move further and faster than gold during stress episodes because its market structure is more sensitive to speculative flows. It has a larger participation of retail investors and leveraged vehicles, and it often behaves like a higher beta version of gold when positioning is stretched.

When deleveraging hits, silver’s thinner liquidity and higher speculative intensity can magnify percentage moves. That does not necessarily mean its industrial or monetary fundamentals deteriorated more rapidly. It means its market structure is more vulnerable to forced risk reduction.

Long term holders behaved differently from short term traders

One of the most important signals during the episode was what did not happen. There was no broad based capitulation among long term holders of physically backed exposure. While leveraged futures positions were being cut aggressively, strategic allocations linked to inflation hedging, currency risk and geopolitical uncertainty did not unwind at the same speed.

That divergence suggests that the stress was concentrated among short term and leveraged participants rather than among investors holding precious metals as part of a longer term portfolio framework.

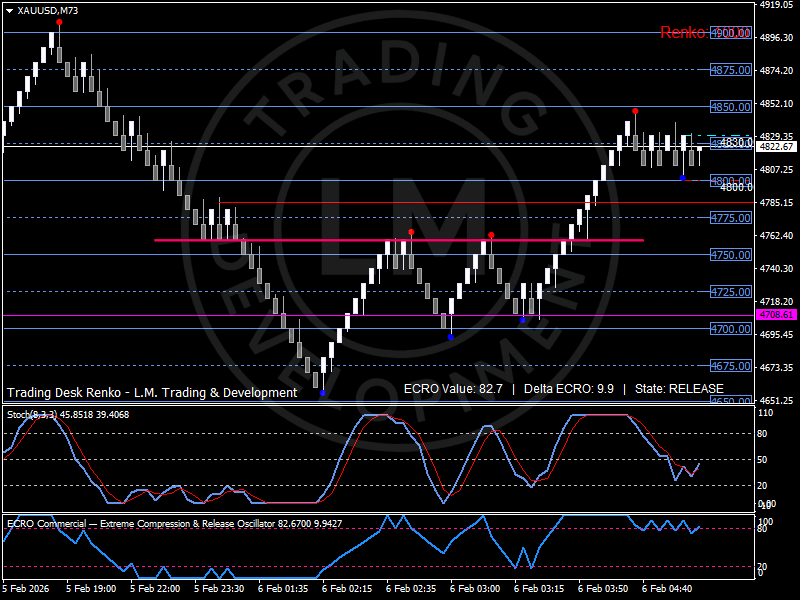

Renko structure shows a release phase followed by stabilization

The Renko 100 chart reinforces the idea of a mechanical release rather than a structural trend reversal. Renko filters out time and focuses purely on price structure, which makes it useful for identifying when a move is driven by momentum expansion versus slow distribution.

The recent sequence shows a sharp downside release followed by a compression phase. Momentum has cooled and the state reading has shifted away from extreme directional pressure. This is consistent with a market that has already gone through a significant deleveraging wave and is now attempting to stabilize.

Importantly, the broader structure does not yet show the characteristics of a sustained bear regime. Instead, it reflects a violent corrective leg within a market that had previously advanced on strong positioning.

A cleansing phase rather than a verdict on the macro story

Seen in this light, the plunge looks less like the end of a bull case and more like a cleansing phase. Excess leverage was removed, speculative positions were reduced and positioning became less stretched. Such resets are often painful in the short term but can create the conditions for more stable price behavior once forced selling pressure subsides.

For traders and investors, the lesson is not that gold and silver have failed as hedges. The lesson is that the way exposure is held matters. Leveraged futures positions can behave very differently from longer term unlevered holdings when volatility spikes and liquidity thins.

Outlook

The recent episode highlights how modern markets are layered. Beneath long term macro themes lies a web of leverage, risk models and margin constraints. When that layer comes under stress, price moves can be dramatic and disconnected from slow moving fundamentals.

Now that volatility expectations have been repriced and positioning has been reduced, precious metals may trade in a more balanced way, with price behavior again more closely linked to macro drivers such as real yields, currency trends and geopolitical risk.

Author

Luca Mattei

LM Trading & Development

Luca Mattei is a market analyst focusing on FX, metals, and macroeconomic trends. He develops trading tools for retail and professional traders, coding indicators and EAs for MT4/MT5 and strategies in Pine Script for TradingView.