Gold and Silver are unstoppable as we continue to hit new all time highs

Gold

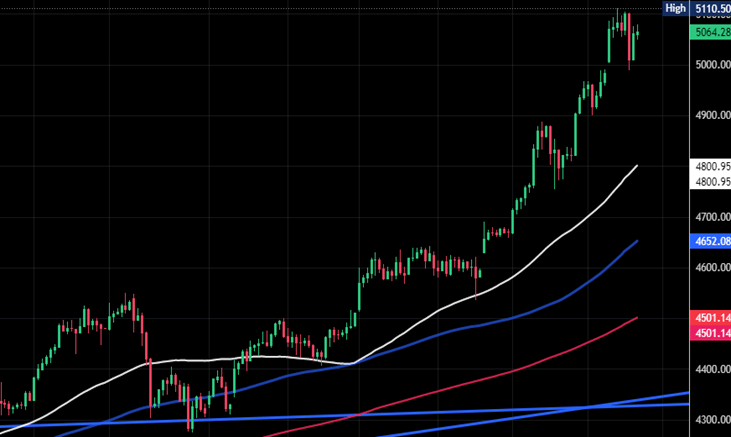

- Gold hit the next targets of 5060/63, 5075, 5085. 5095 & as 5110, with a new all time high exactly here (for now).

- Longs at support at 5030/5020 worked on the correction & we were offered a quick profit on the bounce to 5061.

- However this level was soon broken and we traded down to 4889.

- New levels for today:

- Strong support at 4980/70 & longs need stops below 4955.

- A break lower risks a slide to 4920/4905 & longs need stops below 4885.

- Next targets are 5128/5130, 5145/46, 5165/68.

Silver

Silver continues higher as predicted & hit all targets again as we race as far as 117.69.

The speed of the move is remarkable and the volatility is becoming frightening!!

At one stage, having jumped an astounding 15% on Monday, we wiped out the whole gain in the evening.

From Monday’s low, we have now recovered by $8 to $110 as I write over night.

I see good support at 100.00/99.00 today & longs need stops below 97.50.

A break lower however can target 9420/9350.

Holding above 106.50/106.00 is positive for today & can allow a retest of the new all time high at 117.69.

A break higher can target 119.80, 121.20, 122.20, 123.30, 124.90.

Author

Jason Sen

DayTradeIdeas.co.uk