Gold analysis: Remains near 1,825.00

Gold

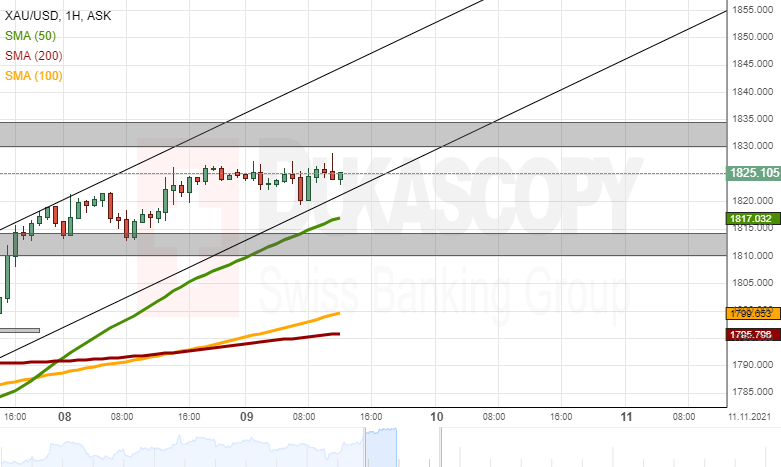

Since the middle of Monday's European trading hours, the price for gold has remained near the 1,825.00 level. Moreover, it appears that the price has been trading almost flat with no volatility. However, from a technical analysis perspective, the sideways trading appears normal, as the rate is consolidating previous gains by remaining flat in the borders of a channel-up pattern.

A potential surge might start, as soon as the price reaches the support of the channel up pattern and the 50-hour simple moving average, which are both approaching the pair. A move upwards would test the resistance of the summer high-level zone at 1,830.00/1,835.00.

If the support levels fail, the price could drop. A drop might find support in the 1,810.00/1,814.00 zone, which has shown to be capable of providing both support and resistance. Further below, note the 1,800.00 mark and the 100 and 200-hour simple moving averages near that level.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.