Gold analysis: Breaks out of sideways range

Gold

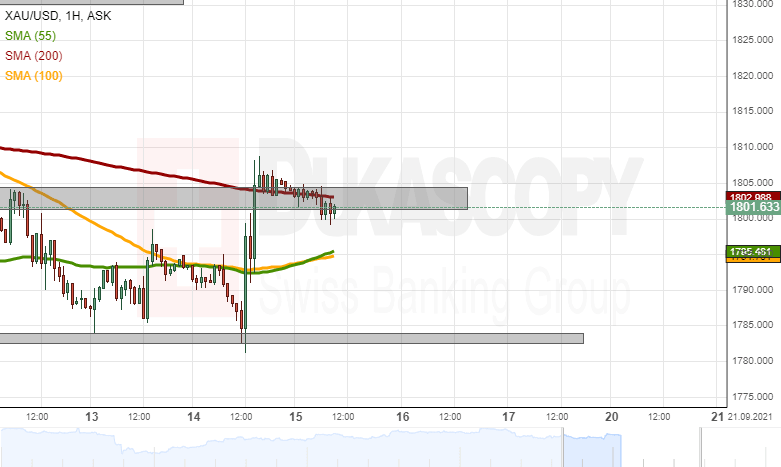

As the price for gold was testing the support zone below the 1,785.00 level, the US Consumer Price Index was released. The worse than forecast US data caused a drop of the value of the USD. Subsequently, the price of gold jumped.

During the three hour surge, the bullion broke above the resistance of the 200-hour SMA and the 1,800.00/1,805.00 resistance zone. The event signals that the price for gold might end sideways trading. However, by the middle of Wednesday's trading, the price had reached below the 200-hour SMA and the 1,800.00 level.

If the yellow metal declines, support could be provided by the 55 and 100-hour SMAs near 1,795.50. However, these levels failed to impact the price throughout this week. Due to that reason, it is a high possibility that the support zone below 1,785.00 could once again be reached.

On the other hand, a surge of gold would test the 200-hour SMA and the 1,800.00/1,805.00 zone before reaching new high levels like the summer high zone at 1,830.00/1,835.00.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.