Gold: A three week uptrend is being severely tested this morning [Video]

![Gold: A three week uptrend is being severely tested this morning [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Gold/safe-investment-gm147322399-17568598_XtraLarge.jpg)

Gold

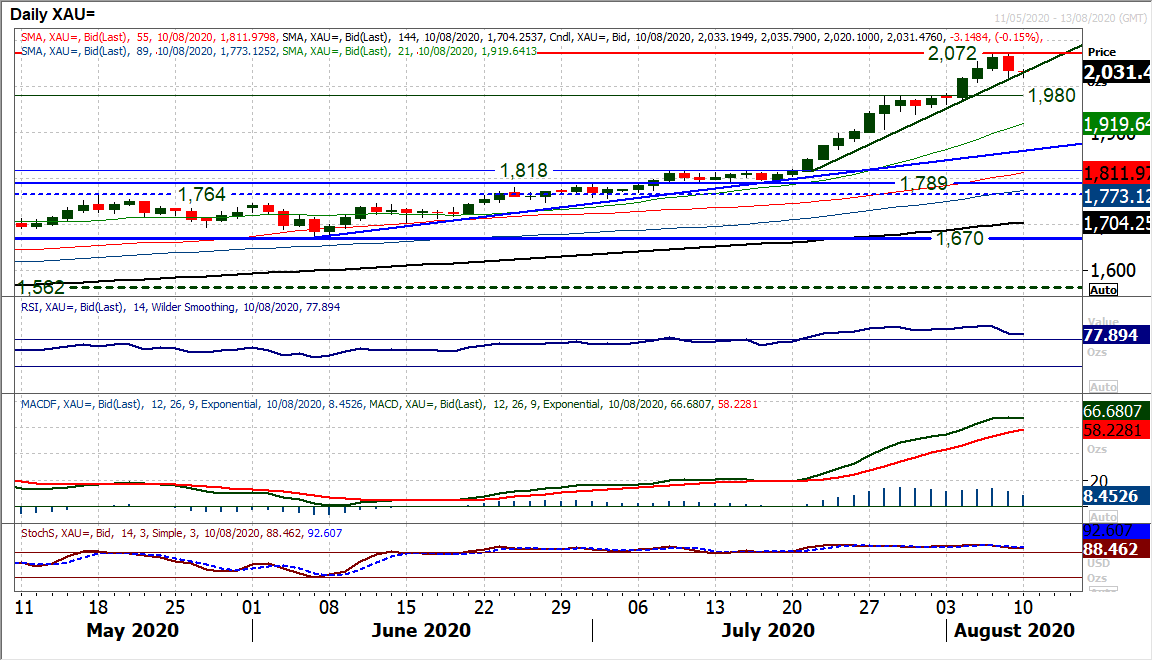

The bull rally on gold was already beginning to stumble ahead of Friday’s payrolls report, but the risk positive/dollar positive report has finally started to see gold dragged back. After a loss of -$28 on the session, there is a real risk of this turning into something bigger now. How the market responds in the coming days to the price pulling back around $40/$50 off its highs will be important as to the near to medium term outlook. A fall back to $2015 has stabilised initially today, but if the selling pressure ramps up again to breach this reaction low, then the momentum in a correction could begin to develop. If one strong negative candle turns into another, then the market could start to see some greater profit-taking. A three week uptrend is being severely tested this morning (coming in at $2031). There is effectively now a small topping pattern that would form and be confirmed below $2009. This would then open for a deeper correction back into the $1940/$1980 consolidation band. As the market consolidates early today, there is initial resistance at $2036 and then $2048 to overcome for the bulls to get back on track.

Author

Richard Perry

Independent Analyst