Gold: A place to hide

Incentives matter.

Policymakers ignore this axiom at their own risk.

The U.S. government’s weaponization of the dollar has made many countries wary of holding greenbacks, and we’ve seen an accelerating de-dollarization over the last few years.

Now the U.S. government has weaponized trade.

Many countries have responded by positioning themselves to minimize exposure to the dollar – and thus shield themselves from U.S. interference. To accomplish this, they have turned to gold.

Gold has historically served as a safe place to hide during times of chaos and trouble. Now, countries are realizing that they can use the yellow metal as a haven from U.S. economic coercion.

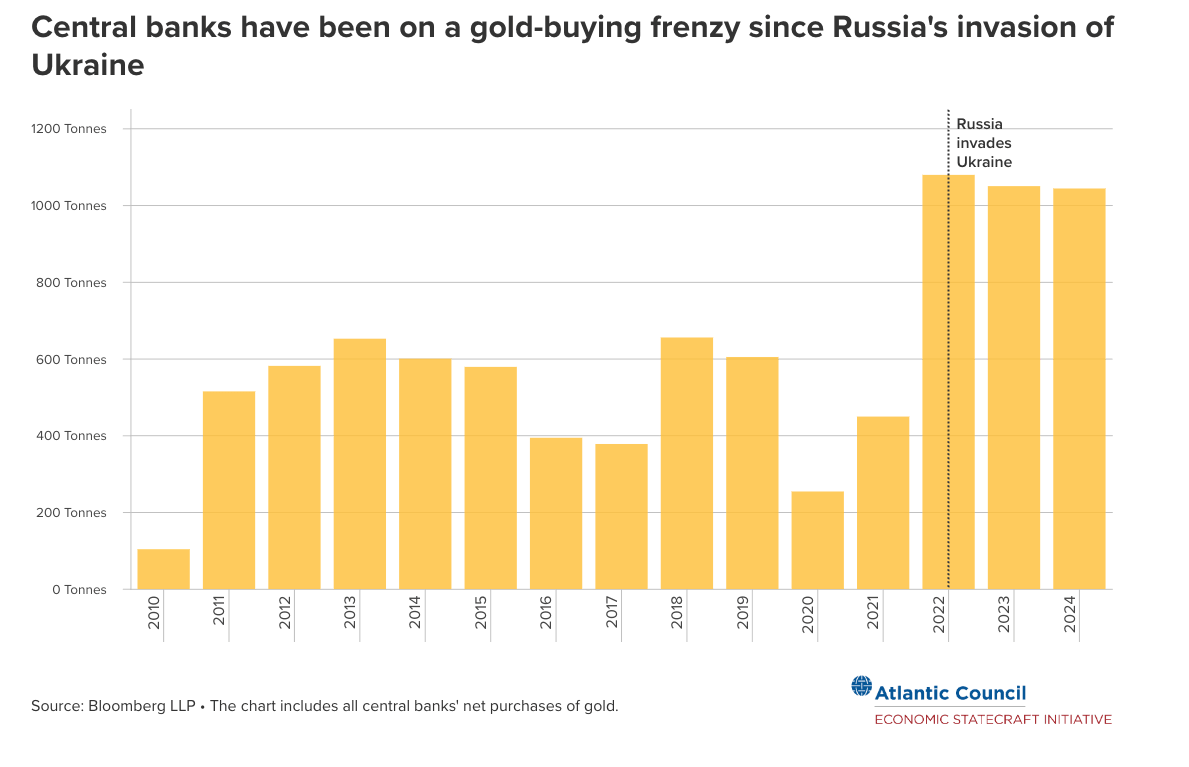

In an article published by the Atlantic Council, Kimberly Donovan and Maia Nikoladze point out that “central banks that are worried about getting sanctioned, want to protect themselves from a potential global financial crisis, or both have been stacking up gold at record levels.”

The data backs up this claim.

On net, central banks officially increased their gold holdings by 1,044.6 tonnes in 2024. It was the 15th consecutive year of expanding gold reserves.

Last year was the third-largest expansion of central bank gold reserves on record, coming in just 6.2 tonnes lower than in 2023 and 91 tonnes lower than the all-time high set in 2022. (1,136 tonnes). 2022 was the highest level of net purchases on record, dating back to 1950, including since the suspension of dollar convertibility into gold in 1971.

Meanwhile, the dollar’s share of global reserve currencies slid further last year. As of the end of 2024, dollars made up 57.8 percent of global reserves. That is the lowest level since 1994, representing a 7.3 percent decline over the last decade. In 2002, dollars accounted for about 72 percent of total reserves.

Donovan and Nikoladze also note that many countries are experimenting with gold-backed digital assets and trading systems to bypass the dollar-denominated global financial system.

“In many cases, these initiatives are for purely economic benefits. However, gold is also being used by U.S. adversaries to evade sanctions or finance activities that counter U.S. national security interests.”

Russia provides a case study in the protective power of gold.

The Bank of Russia was one of the biggest central bank gold buyers in the years before it invaded Ukraine. At the same time, the central bank divested itself of most of its U.S. Treasury holdings.

When the war began, Russia held about half of its reserves in dollar, euro, and pound sterling assets. The other half was in yuan and gold, which remain accessible.

The Russians also made a shrewd move before the invasion of Ukraine, transferring their National Welfare Fund holdings into yuan (60 percent) and gold (40 percent). A RAND Corporation study notes, “This was an indication that Russia was preparing for increased Western economic pressure. During the war, Russia has been using these funds to support the budget.”

The strategy paid off.

In the last year alone, the value of Russian gold reserves has increased by $96 billion due to the rapidly rising gold price, offsetting about one-third of the country’s frozen assets.

In tonnage terms, Russia’s gold reserves have remained relatively unchanged since the invasion of Ukraine, however, Donovan and Nikoladze said the Russian central bank has likely been buying gold from domestic producers without reporting it.

Russia mines a significant amount of gold. In 2023, the country tied with Australia as the world’s number two gold producer.

Despite their best efforts, the West has found it difficult to stop Russia from using its gold due to its fungible nature (easy to exchange) and the global demand for the precious metal.

Gold is money, and it is recognized as such everywhere. Even if they don’t want dollars or some other fiat currencies, everybody wants gold.

The Russians have used their gold holdings to maintain trade in the face of economic sanctions. Donovan and Nikoladze noted that the UAE and Turkey have engaged in “cash for gold” trade with Russian banks.

“The Russia-based Lanta Bank and Vitabank received twenty-one shipments of currencies such as U.S. dollars, euros, UAE dirhams, and Chinese renminbi worth $82 million from the UAE and Turkey in exchange for Russian gold.”

Donovan and Nikoladze offered some advice to U.S. policymakers.

“The United States has the power to indirectly reduce gold prices and encourage the adoption of dollar-backed assets by returning to being the provider of stability in the global economy. That can be achieved by dialing down the use of tariffs and other economic measures that could cause governments and private actors to turn to gold.”

However, it seems unlikely that the U.S. government will be able to resist the temptation to use its economic clout as a foreign policy tool.

That's not to say U.S. policy isn't justified or that it won't be effective in the long run. But it does underscore the fact that it is foolish to ignore the incentives and potential blowback inherent in any policy decision.

To receive free commentary and analysis on the gold and silver markets, click here to be added to the Money Metals news service.

To receive free commentary and analysis on the gold and silver markets, click here to be added to the Money Metals news service.

Author

Mike Maharrey

Money Metals Exchange

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.