Gold, Chart of the Week: XAU/USD bulls eye a test of $1,810

- Gold has respected key support structures and is poised for further gains.

- A bullish extension could unfold in the coming week.

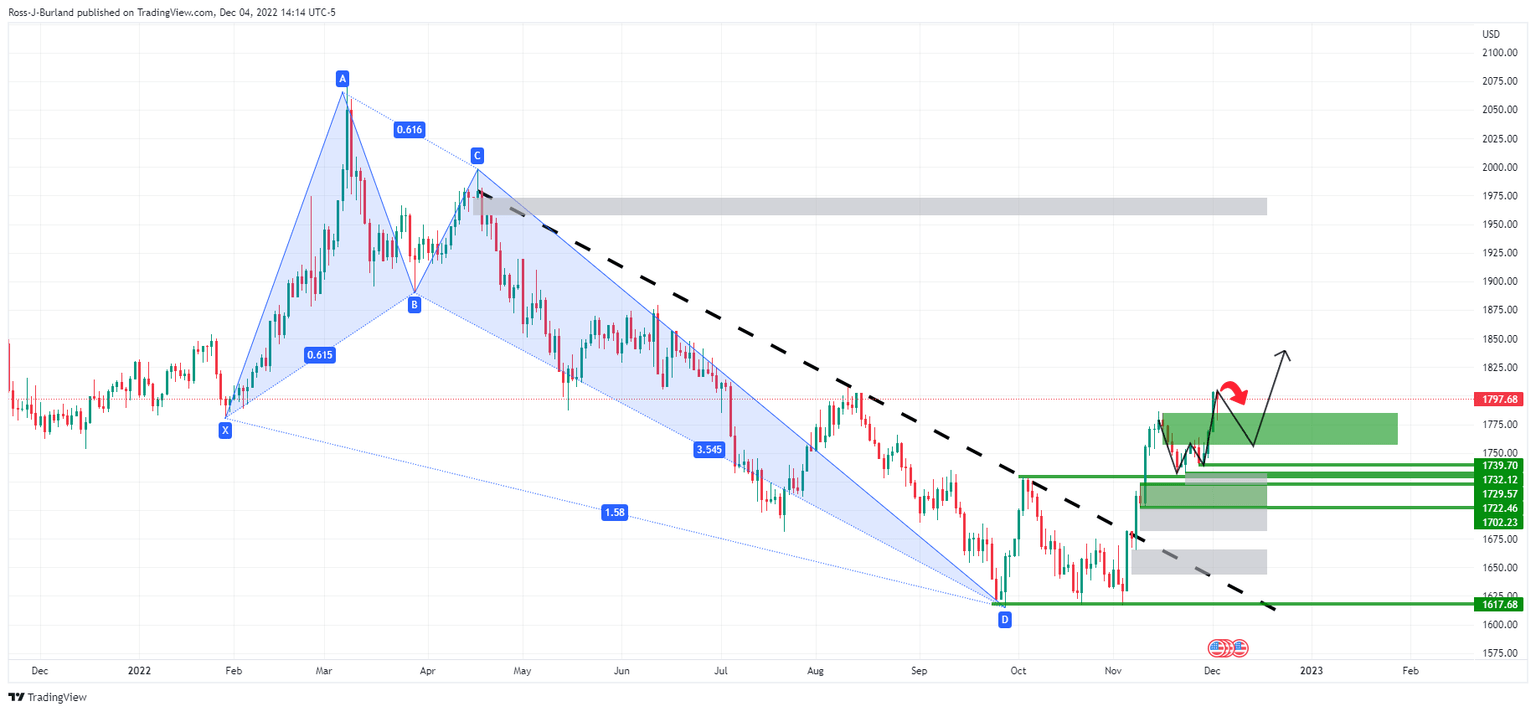

As per the prior analysis, Gold, Chart of the Week: XAU/USD bears eye a typical corrective opportunity below critical resistance, the gold price has respected key structure and would now be expected to break prior daily resistance.

Gold, prior analysis

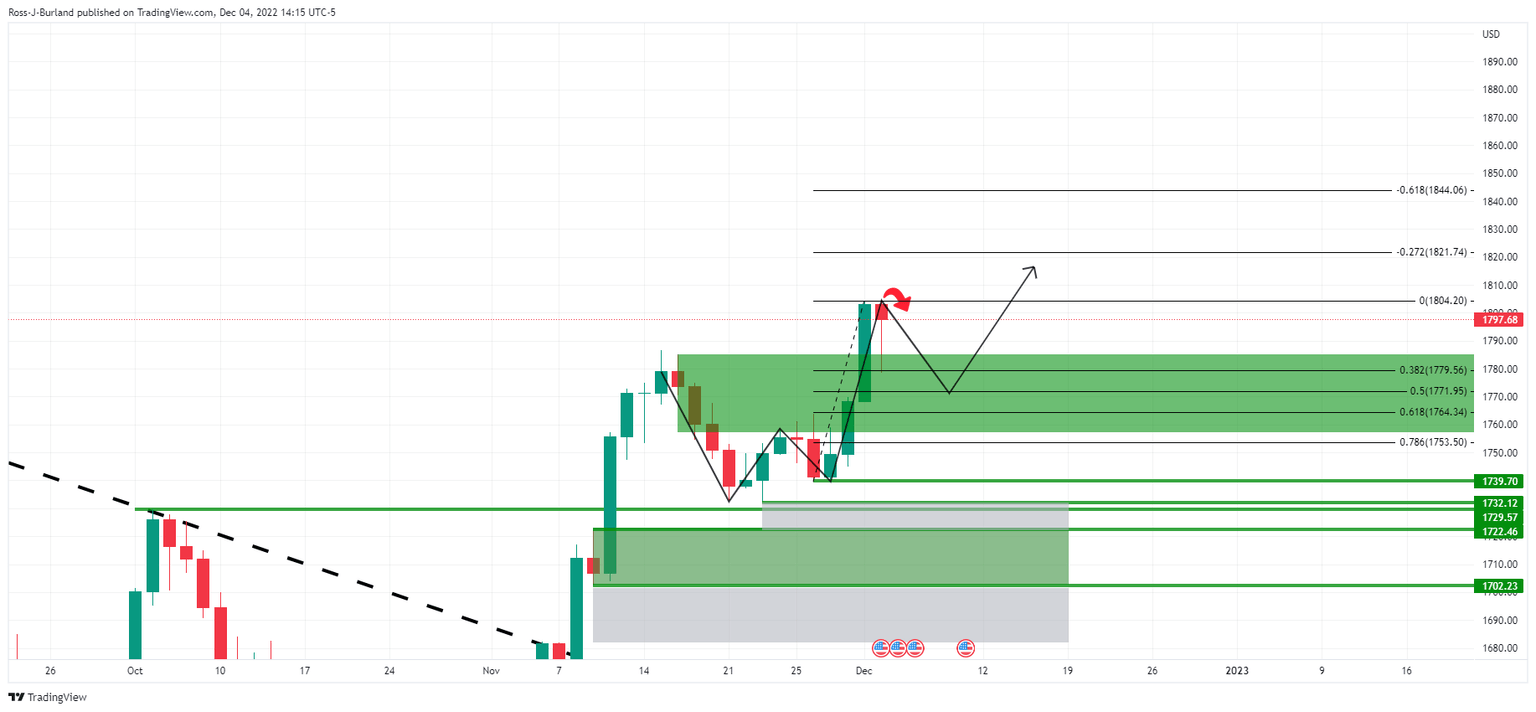

On the back side of the trend, it was noted that the price was bullish as per the harmonic pattern while above the W-formation's lows near $1,730.

Zooming in ...

There were prospects of a correction towards the neckline of the W-formation as illustrated above, but If the bulls were to commit, however, a break towards $1,860 would have been on the cards as per the daily chart:

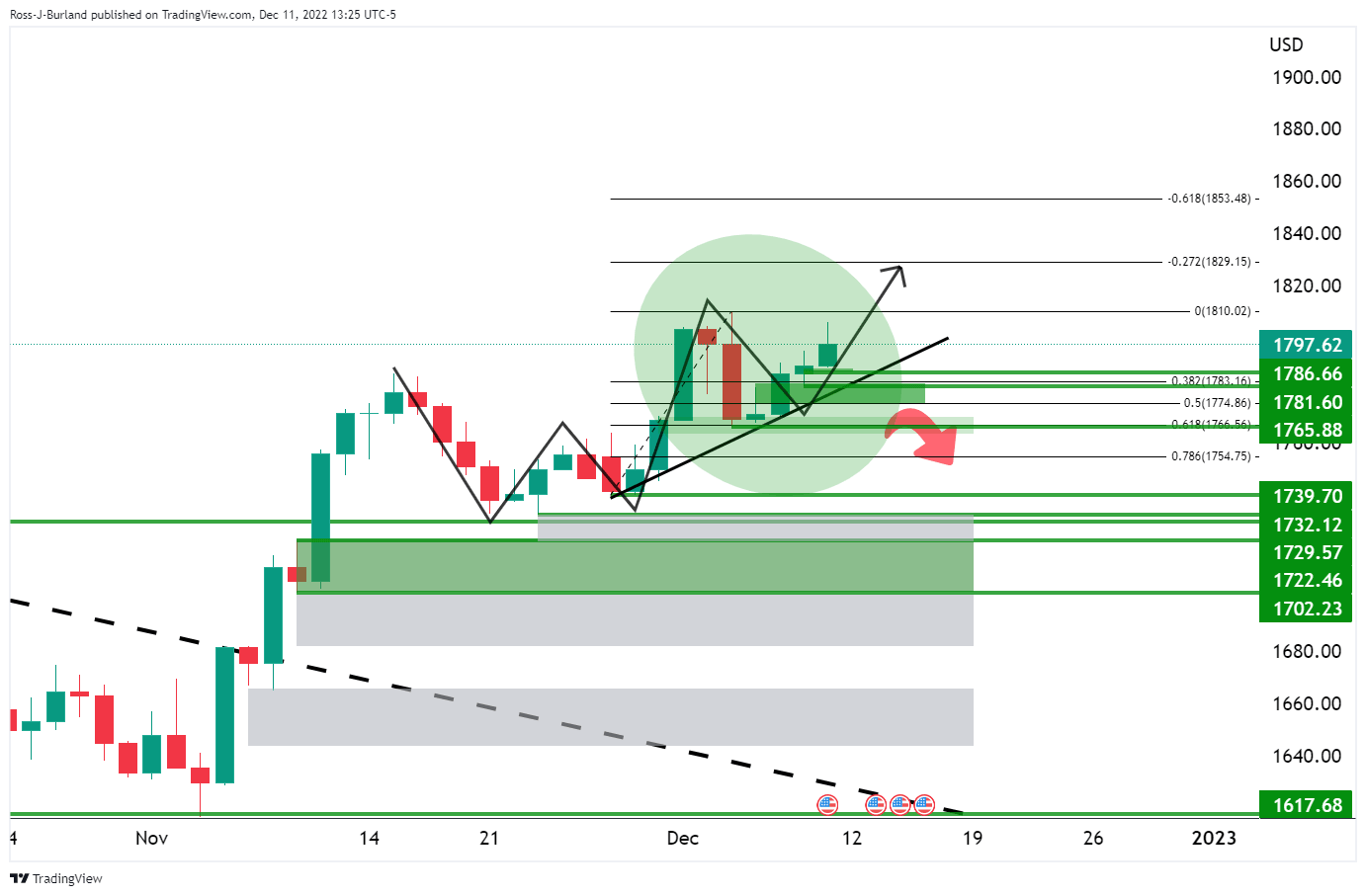

Gold update

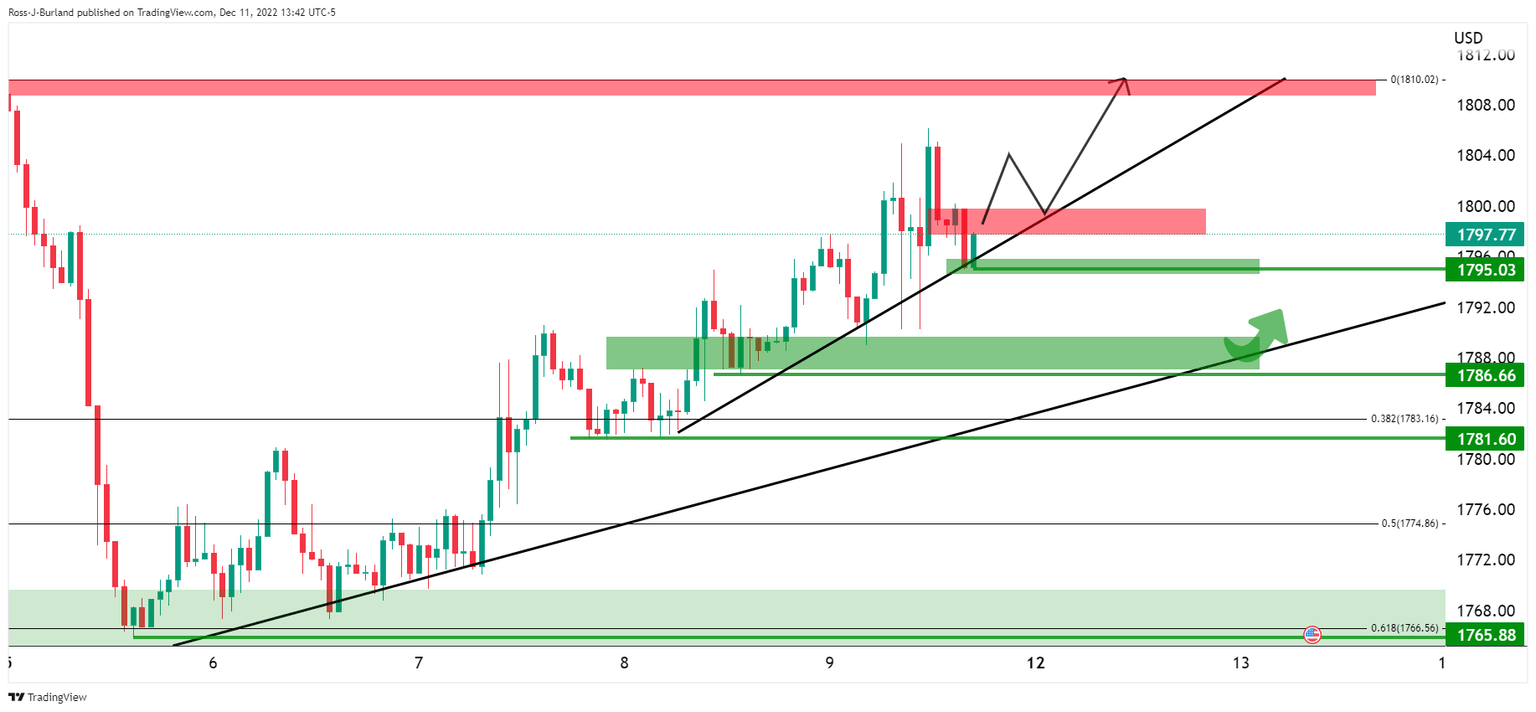

The price has respected the 61.8% ratio as support and has carved out a bullish micro trendline for the bulls to lean against for the days ahead.

From an hourly perspective, bulls have carved out an inside trendline and remain on the front side which is bullish for the open, exposing $1,800.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.