GBP/JPY sets a foothold but bears still around [Video]

![GBP/JPY sets a foothold but bears still around [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Crosses/GBPJPY/iStock-1151541926_XtraLarge.jpg)

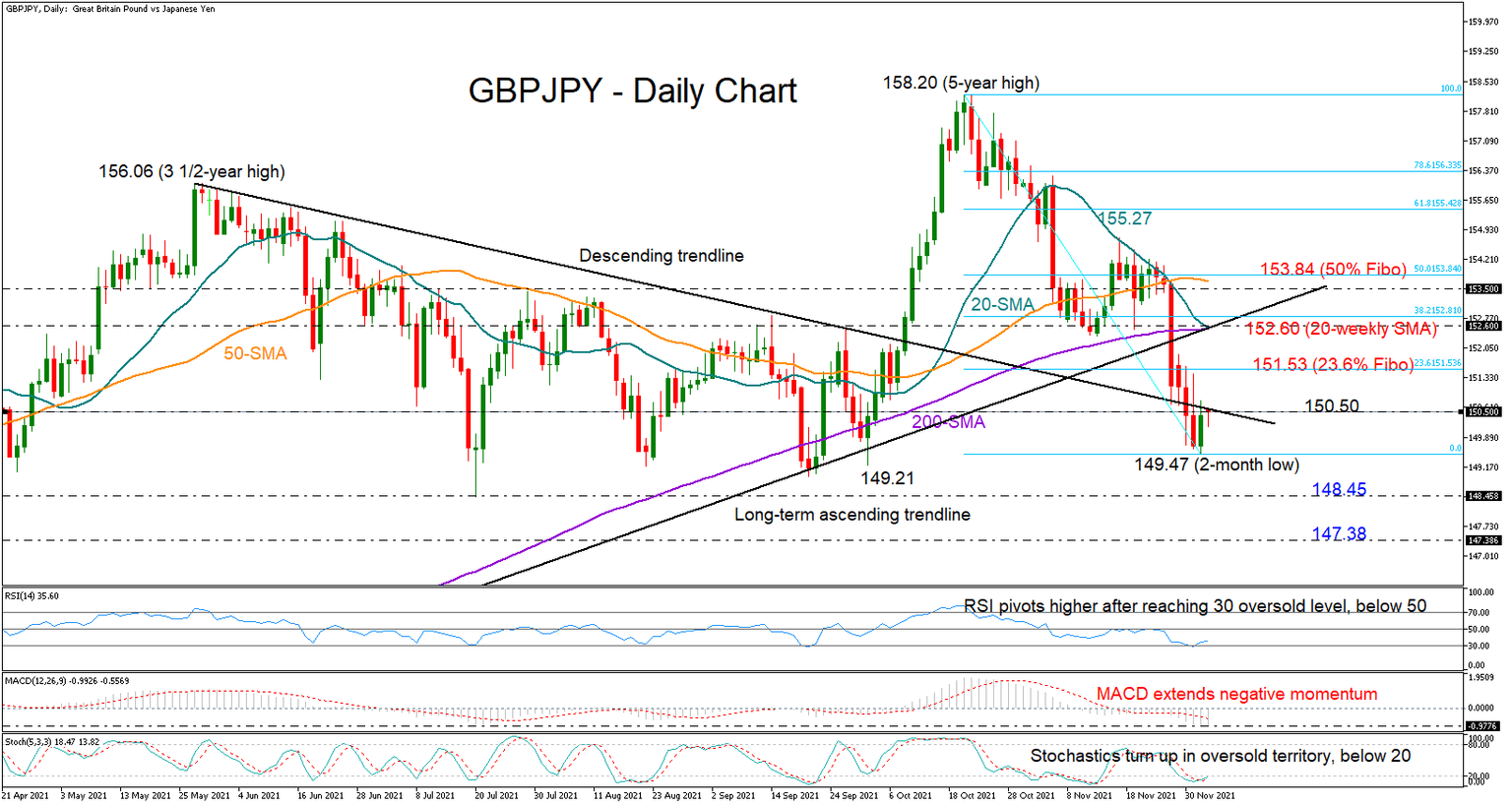

GBPJPY is capped by the descending line at 150.50, which has been hindering market actions since mid-May, questioning the oversold signals coming from the RSI and the Stochastics.

GBPJPY is capped by the descending line at 150.50, which has been hindering market actions since mid-May, questioning the oversold signals coming from the RSI and the Stochastics.

Even though the aforementioned indicators seem to have set up a foothold within the oversold territory, the bulls will need to successfully overcome the 150.50 bar in order to deviate above the two-month low of 149.47 and advance towards the 23.6% Fibonacci level of the latest downleg at 151.53. Then, a decisive close above the 152.60 barrier, where the 20- and 50-day simple moving averages (SMAs) are currently intersecting the broken long-term ascending trendline, could be a bigger achievement and an incentive to reach the 50-day SMA and the 50% Fibonacci of 153.84.

Alternatively, a downside reversal cannot be ruled out given the persisting negative momentum in the MACD. Therefore, if the 150.50 resistance stands firm, the price could drift lower to encounter its recent low of 149.47 before tumbling towards July’s support of 148.45. If the latter fails to cease selling pressures, the next stop could be around 147.40 taken from February’s limits.

Looking at the big picture, the decline below 156.00 has re-shaped the market structure from bullish to neutral. A drop below 148.38 could further worsen this outlook.

In brief, GBPJPY seems to be creating a base for its next upside reversal, though only a clear move above the 150.50 barrier could activate new buying orders.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.