GBP/USD Weekly Forecast: UK data raises doubts about local economic health

- UK employment and inflation figures disappointed, weighing on Sterling Pound.

- United States President Donald Trump spurred risk aversion, helping the US Dollar.

- The GBP/USD pair fell for a third consecutive week and aims for lower lows.

GBP/USD fell for three weeks in a row as risk aversion favored demand for the US Dollar (USD), while tepid United Kingdom (UK) data undermined demand for the Sterling Pound (GBP). The pair bottomed at 1.3365 mid-week, its lowest since May, recovering roughly 100 pips ahead of the weekly close.

US political and fiscal concerns weighing on sentiment

Investors spent the week on their toes amid United States (US) fiscal and political woes. On the one hand, concerns revolved around US President Donald Trump’s rage against Federal Reserve (Fed) Chairman Jerome Powell, following the latter's decision to keep interest rates floating between 4.25% and 4.50%.

Throughout the week, tensions mounted as President Trump demanded lower rates, claiming that the benchmark interest rate should be at least 3 points lower than its current level.

The USD ran on Wednesday, following news that Trump asked a group of House Republicans whether he should fire the Fed’s Chair in a meeting that took place in the Oval Office on Tuesday night, while the New York Times reported that Trump had already drafted a letter to fire the Fed Chair. The news was quickly denied by the US President, who told Reuters he is not planning on doing anything and that any change will occur in the next eight months. It is worth remembering that Powell’s term ends in May 2026.

Meanwhile, Trump posted on Truth Social that there is “virtually no inflation” in the US, right after the country released the June Consumer Price Index (CPI), which came in line with expectations, albeit hotter than in May. The index was up by 0.3% in the month and by 2.7% on a yearly basis, matching the market’s expectations yet above the previous 0.1% and 2.4% respectively. Core annual inflation hit 2.9%, up from the previous 2.8%, although below the 3.0% expected by market analysts.

The headlines triggered quite a volatile price reaction, with the GBP/USD pair seesawing in a 100 pips range.

UK macroeconomic figures added pressure on the Pound Sterling

The UK CPI advanced by 3.6% YoY in June after reporting a 3.4% growth in May, higher than the 3.4% anticipated. The core annual CPI rose 3.7% YoY, surpassing the 3.5% posted in May. The Bank of England (BoE) 2% inflation goal seems further away after the June figures.

UK employment-related figures were also discouraging as the UK ILO Unemployment rose to 4.7% in the three months to May after reporting 4.6% in the quarter to April, and above the market’s consensus of 4.6%. Additionally, the number of people claiming jobless benefits increased 25.9K in June, compared with a revised increase of 15.3K in May, above the expected 17.9K figure.

Also, BoE Governor Andrew Bailey gave his annual ’Mansion House’ address to London's financial sector on Tuesday, along with finance minister Rachel Reeves.

Calling for greater cooperation between countries, referring to the US and China, to resolve “unsustainable” trade and financial imbalances that are distorting economies and lie behind escalating political tensions.

The US also reported that the Producer Price Index (PPI) in June rose by less than anticipated, up 2.3% YoY vs the 2.5% anticipated and the previous 2.6%. Additionally, Retail Sales were up by 0.6% MoM in June, better than the 0.1% advance expected and the previous 0.9% slide.

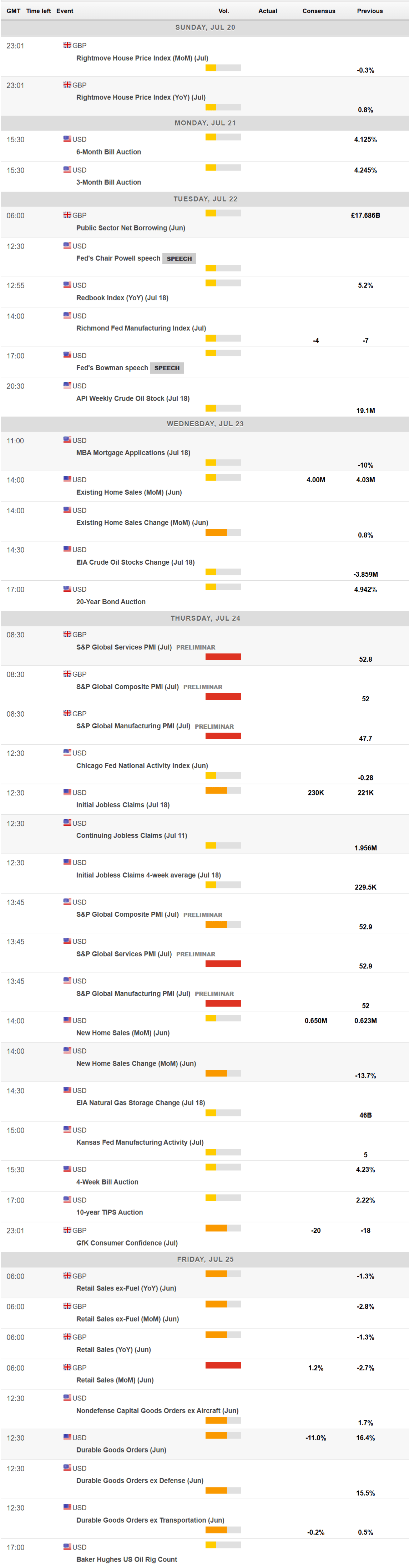

The upcoming days will bring the preliminary estimates of the UK Hamburg Commercial Bank (HCOB) and the US S&P Global Purchasing Managers’ Indexes (PMIs). The UK will also release Retail Sales, while the US will unveil Durable Goods Orders.

GBP/USD technical outlook

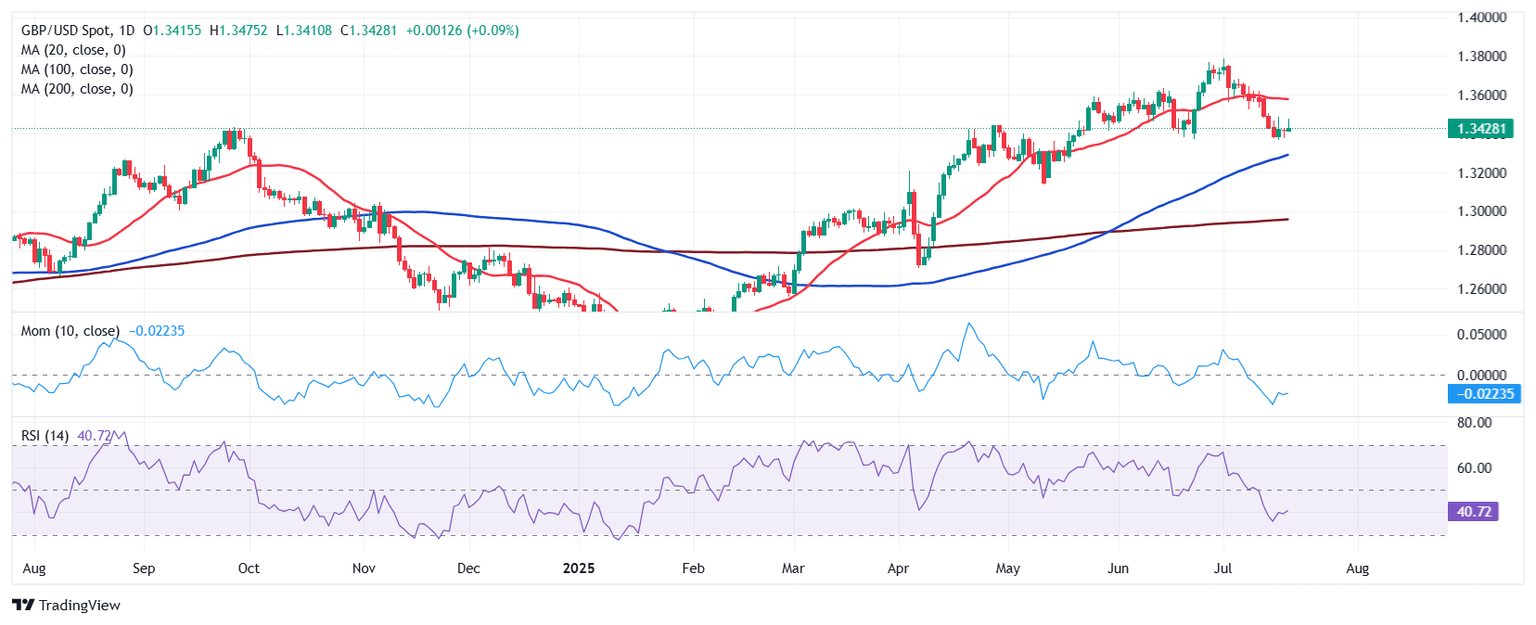

The weekly chart for the GBP/USD pair shows it fell for a third consecutive week, and that there’s room for another leg south. The pair develops above all its moving averages, with the 20 Simple Moving Average (SMA) maintaining its bullish slope while providing dynamic support at around 1.3300. The 100 and 200 SMAs, in the meantime, lack clear directional strength far below the shorter one. Finally, technical indicators head firmly south within positive levels, reflecting sellers’ strength.

In the daily chart, GBP/USD may have found an interim bottom, yet needs to recover past 1.3500 to confirm so. The pair is holding above a bullish 100 SMA, while the 20 SMA lies flat above the current level. Technical indicators, in the meantime, turned flat within negative levels, and slowly ground higher.

Beyond 1.3500, the recovery could initially extend towards 1.3620, while beyond the latter, GBP/USD could retest its recent highs in the 1.3730 region. A slide through 1.3360, on the other hand, exposes the 1.3300 threshold, en route to the 1.3220 price zone.

US-China Trade War FAQs

Generally speaking, a trade war is an economic conflict between two or more countries due to extreme protectionism on one end. It implies the creation of trade barriers, such as tariffs, which result in counter-barriers, escalating import costs, and hence the cost of living.

An economic conflict between the United States (US) and China began early in 2018, when President Donald Trump set trade barriers on China, claiming unfair commercial practices and intellectual property theft from the Asian giant. China took retaliatory action, imposing tariffs on multiple US goods, such as automobiles and soybeans. Tensions escalated until the two countries signed the US-China Phase One trade deal in January 2020. The agreement required structural reforms and other changes to China’s economic and trade regime and pretended to restore stability and trust between the two nations. However, the Coronavirus pandemic took the focus out of the conflict. Yet, it is worth mentioning that President Joe Biden, who took office after Trump, kept tariffs in place and even added some additional levies.

The return of Donald Trump to the White House as the 47th US President has sparked a fresh wave of tensions between the two countries. During the 2024 election campaign, Trump pledged to impose 60% tariffs on China once he returned to office, which he did on January 20, 2025. With Trump back, the US-China trade war is meant to resume where it was left, with tit-for-tat policies affecting the global economic landscape amid disruptions in global supply chains, resulting in a reduction in spending, particularly investment, and directly feeding into the Consumer Price Index inflation.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.