GBP/USD Weekly Forecast: A temporary bottom in place?

- GBP/USD recorded fourth straight weekly lows, hitting two-year lows.

- King dollar dominated amid renewed growth and inflation fears.

- Oversold conditions could trigger a technical rebound ahead of UK inflation.

The pound battering continued for the fourth straight week, as bears refused to give up. GBP/USD lost more than 200 pips to hit a new two-year low at 1.2157, breaking through several critical support levels. The US dollar emerged the most favored safe haven amid a revival of global growth and inflation fears. Heading into a new week, cable is looking to find a bottom, with all eyes on the US Retail Sales and UK inflation data.

GBP/USD: UK recession on the way

Nothing changed for GBP/USD, as the fundamental factors impacting the currency pair remained more or less the same. The Bank of England’s (BOE) policy announcements-led sell-off extended into a second week, with cable making fresh multi-month lows almost each new trading day.

The BOE projected a recession in the final quarter of this year after delivering a hawkish 0.25% rate hike at its monetary policy decision on May 5. The R-word offered the much-needed zest to GBP bears while the hawkish Fed commentary and risk-off flows kept the sentiment buoyed around the greenback.

China’s zero-Covid policy and a protracted Russia-Ukraine war-induced supply chain crisis and its impact on global growth raised concerns, with the world’s second-largest economy experiencing a slowdown. The flight to safety bolstered the dollar’s safe-haven demand, adding to GBP/USD’s plight.

Hotter-than-expected US Consumer Price Index (CPI) intensified the global growth concerns, as it revived aggressive Fed tightening calls. At the same time, the UK economy contracted 0.1% MoM in March while recording a meager 0.8% expansion in Q1 2022, exacerbating the pain in the pound. GBP/USD sold-off aggressively in the second half of the week, as the macroeconomic, as well as, monetary policy divergence between the UK and US returned to the fore. Further, markets witnessed a classic risk-off profile that favored the ultimate safe-haven, the dollar, in times of mounting growth worries.

A relief rally seeped into the final trading day of the week, offering temporary reprieve to GBP bulls, as the dollar corrected amid an improving mood. Although the US Treasury yields continued its week-long upsurge to near multi-year peak on the hawkish Fed commentary.

Week ahead: US Retail Sales, UK inflation stand out

It now remains to be seen whether the rebound in the GBP/USD pair could extend into the new week, which is likely to be a busy one.

On Monday, Chinese activity data will drop in the Asian session, which could have a significant impact on the market’s perception of risk sentiment. Eventually, it could set the tone for markets for the week ahead.

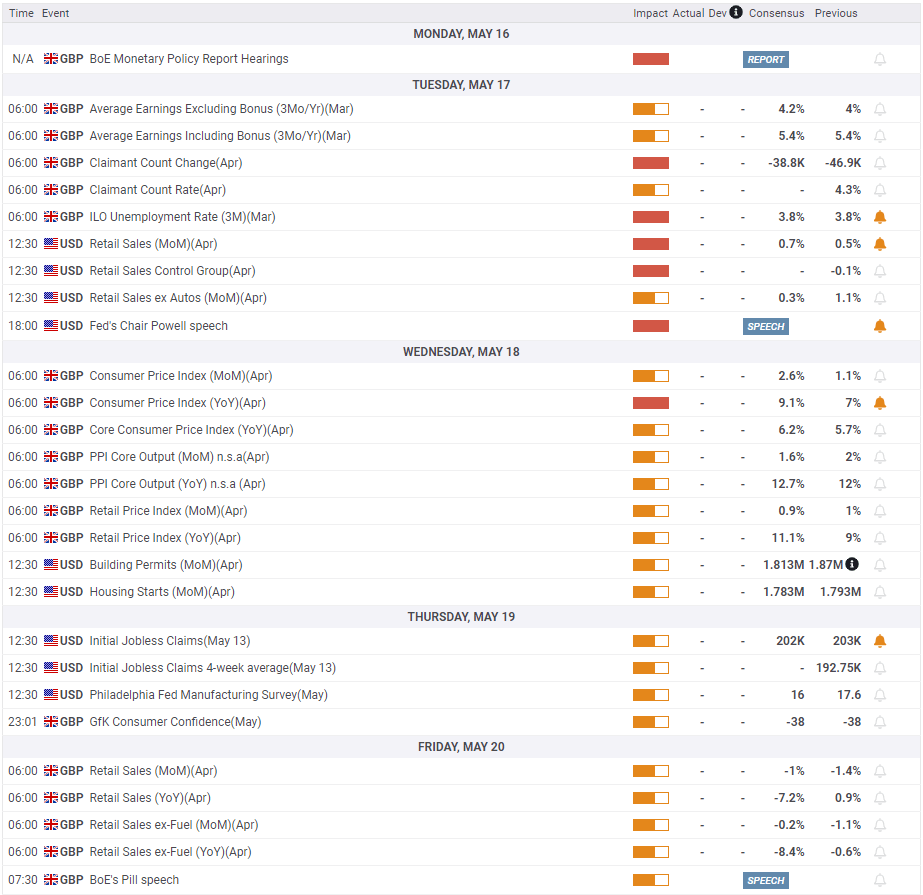

The UK and the US calendars remain data-light on Monday, with only BOE Monetary Policy Report Hearings scheduled.

The British labor market data will drop in at 06:00 GMT on Tuesday ahead of the US Retail Sales release. On the same day, amidst a slew of Fedspeak, Chair Jerome Powell’s speech will be closely followed, as he is likely to speak about inflation at Wall Street Journal's Future of Everything Festival.

The UK CPI on Wednesday will hog the limelight after the inflation rate hit a fresh multi-decade high at 7.0% YoY in March, which will be followed by the weekly US jobless claims and Existing Homes Sales data from the US on Thursday.

Friday will see monthly UK Retail Sales, which showed a sharp contraction in consumer spending a month ago. Meanwhile, BOE Chief Economist Huw Pill’s speech will be eyed as well. Besides the macroeconomic events, the Fed expectations and broader market sentiment will be closely followed for any significant impact on the major.

GBP/USD: Technical analysis

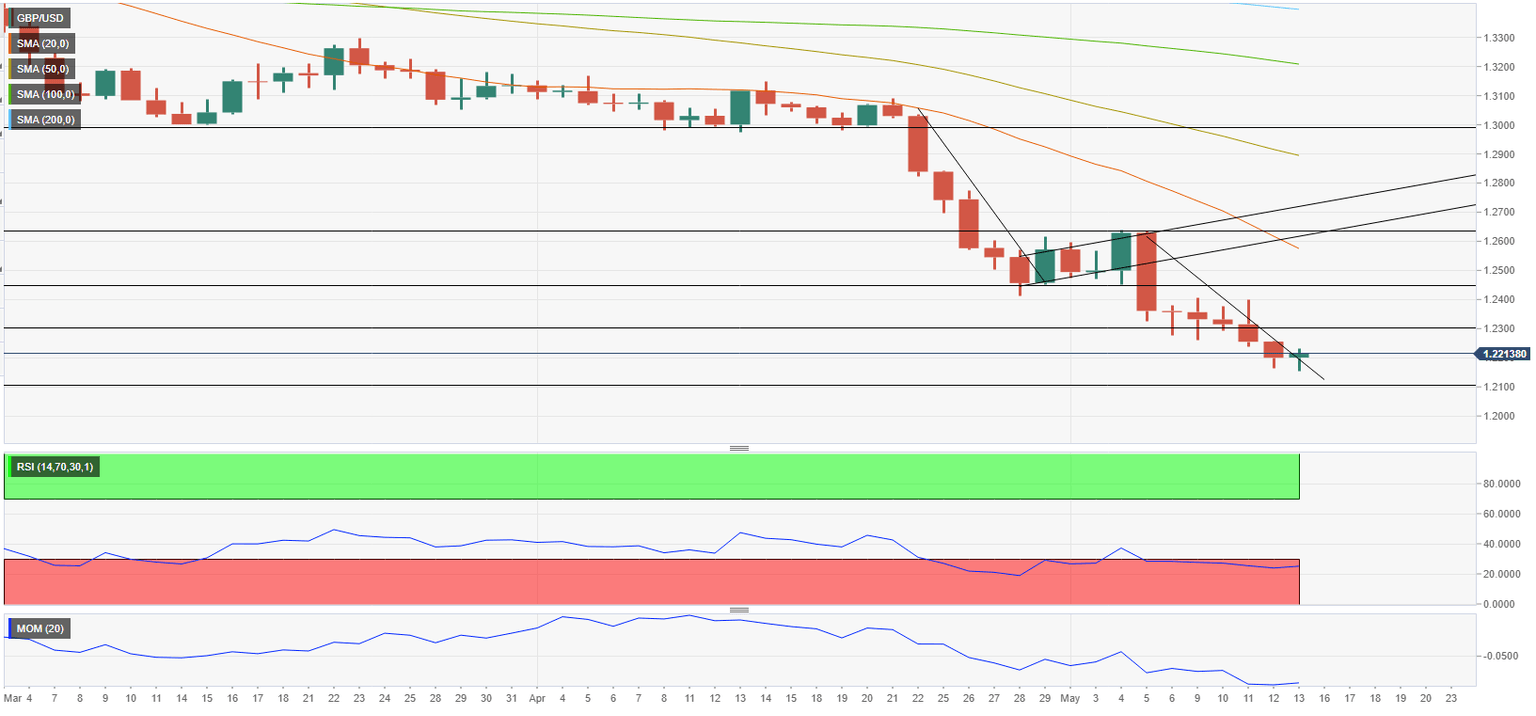

The bear flag formation that appeared on the daily chart last week seems more or less complete. Moreover, the Relative Strength Index (RSI) and the momentum indicators on the daily chart both point to extremely oversold conditions, suggesting that the pair could stage a rebound in the near term.

On the upside, 1.2300 (psychological level, former support) aligns as a potential recovery target. With a daily close above that level, additional gains toward 1.2400 (psychological level) and 1.2450 (static level, former support) could be witnessed.

On the other hand, buyers could remain reluctant to bet on a correction if GBP/USD makes a daily close below 1.2200 (psychological level) and starts using that level as resistance. In that case, the next bearish targets align at 1.2100 (psychological level, May 15, 2020, low) and 1.2020 (static level from August 2019).

GBP/USD: Sentiment poll

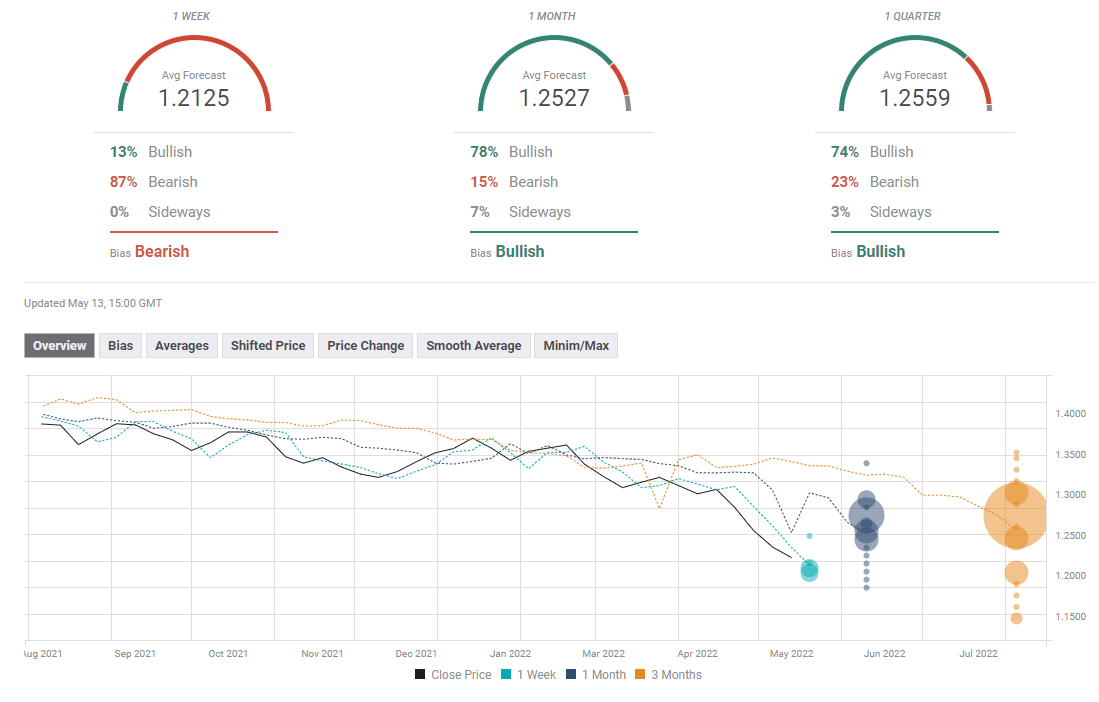

The FXStreet Forecast Poll points to an overwhelmingly bearish view on the one-week outlook with the average target sitting at 1.2125. The one-month view, however, leaves the door open for a strong recovery.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.