GBP/USD takes a breather before next bullish move

-

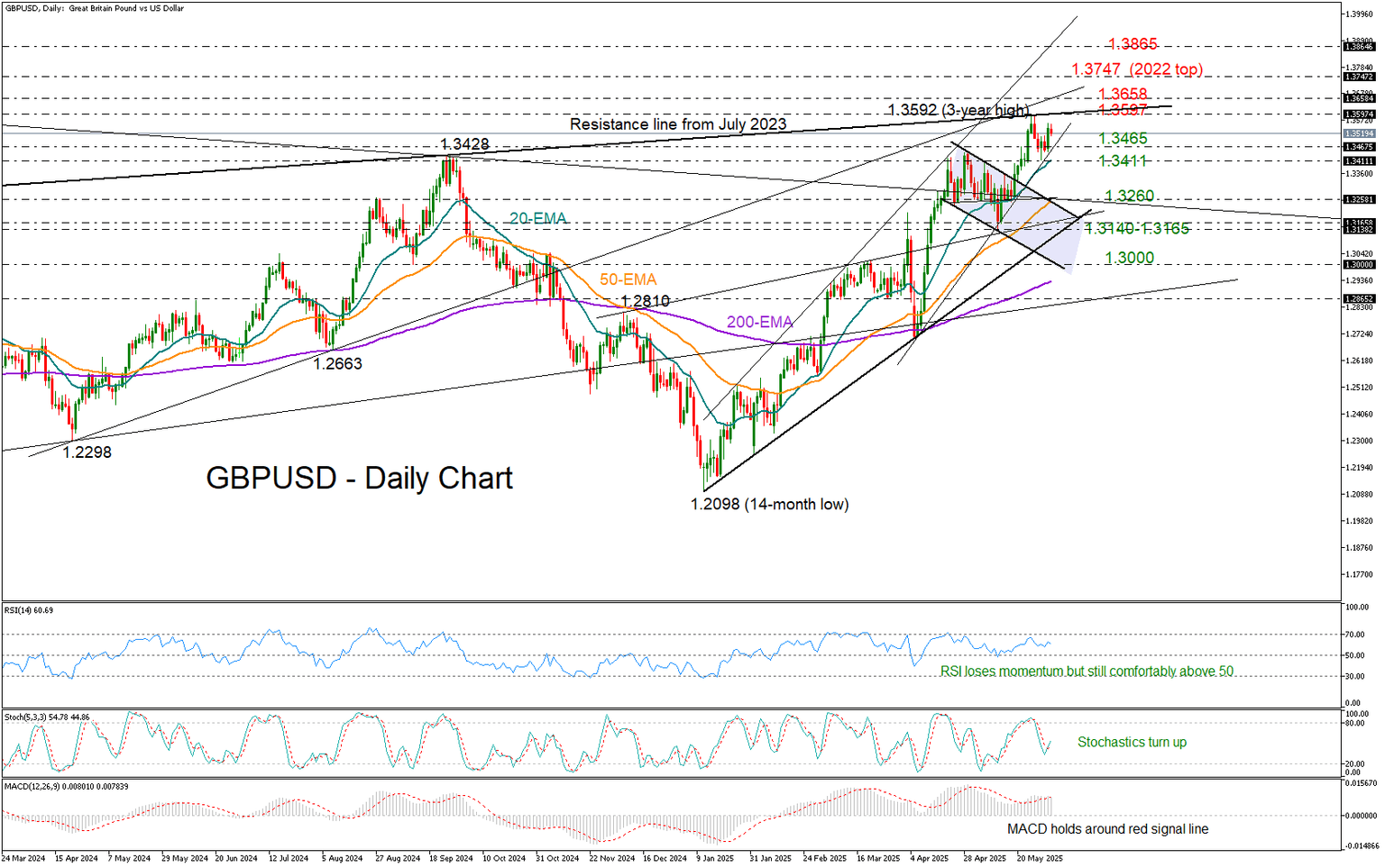

GBP/USD consolidates gains near 3-year high.

-

Short-term bias remains positive; focus on 1.3597 resistance.

GBPUSD has eased slightly below May’s three-year high of 1.3592, but Monday’s solid rebound has renewed optimism that the bulls are still in control.

For further upside momentum, the price needs a decisive close above the resistance line from July 2023 at 1.3597, which capped gains last week. A breakout above the key constraining zone of 1.3658 could trigger a more exciting rally toward the 2022 peak at 1.3747. Beyond that, attention could shift to the ascending trendline around 1.3865.

From a technical perspective, the short-term risk remains skewed to the upside, supported by the upturn in the stochastic oscillator and the fact that the RSI continues to hover comfortably above its neutral 50 level, despite showing signs of fatigue.

Should the support trendline near 1.3465 or the 20-day exponential moving average (EMA) provide a solid base—much like in mid-May—the bulls may regain control. Otherwise, increased selling pressure could push the pair down to the 1.3260 area, where the 50-day EMA currently lies. The 1.3240–1.3165 trendline zone may serve as the last line of defense before the broader uptrend entirely loses its shine.

In summary, GBP/USD remains in a consolidation phase, with the potential for fresh highs if the 1.3597 resistance is convincingly broken.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.