GBP/USD outlook: Consolidation to precede fresh weakness

GBP/USD

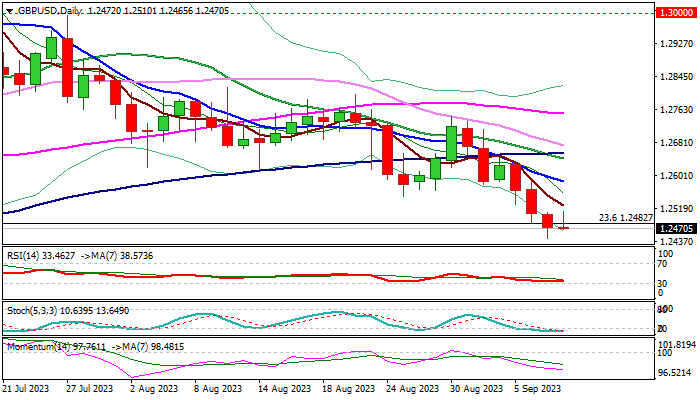

GBPUSD is taking a breather at 1.2500 zone as larger bears face headwinds on approach to pivotal 200DMA support (1.2425).

Bounce from Thursday’s new multi-week low (1.2445) was so far limited and unable to sustain gains above 1.2500 mark, suggesting that bears hold grip.

Weekly close below cracked 100WMA (1.2521) will deliver initial bearish signal, with close below 1.2482 (Fibo 23.6% of 1.0348/1.3141) to strengthen bearish structure for break through 200DMA, which would spark fresh acceleration and expose next key support at 1.2307 (May 25 trough).

BOE Governor Bailey said that the central bank is much nearer to the top of its tightening cycle, although with possibility further hikes if inflation remains stubbornly high, adds to pound’s growing negative sentiment.

Near-term action is expected to remain biased lower while capped by falling 10DMA (1.2586).

Res: 1.2482; 1.2500; 1.2521; 1.2586.

Sup: 1.2445; 1.2425; 1.2368; 1.2307.

Interested in GBP/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.