GBP/USD Outlook: Bulls might target 1.2300 on sustained strength beyond 200-day SMA

- GBP/USD steadily inches back closer to the weekly high amid sustained USD selling bias.

- The overnight dovish remarks by Fed Chair Powell continue to weigh on the greenback.

- Traders now look forward to the US Core PCE Price Index and ISM Manufacturing PMI.

The GBP/USD pair builds on the previous day's goodish rebound from a one-week low and gains traction for the second successive day on Thursday. The momentum lifts spot prices back closer to the weekly high and is sponsored by a weaker US Dollar. The US Federal Reserve Chair Jerome Powell sounded dovish on Wednesday and said that it was time to slow the pace of coming interest rate hikes. The message was clear that the US central bank will soften its stance amid looming recession risk, triggering a steep decline in the US Treasury bond yields and a massive rally in the US equity markets. This, in turn, is seen weighing on the safe-haven greenback and acting as a tailwind for the major.

On the economic data front, the ADP report released on Wednesday missed market expectations and showed that the US private-sector employers added 127K jobs in November. The disappointment, however, was offset by an upward revision of the US Q3 GDP print, though failed to provide any respite to the buck. In fact, the preliminary report (second estimate) revealed that the US economy expanded by 2.9% annualized pace during the third quarter against 2.6% reported previously. Nevertheless, the USD posts its worst monthly losses since 2010 and lends support to the GBP/USD pair. Bulls seem unaffected by the overnight dovish remarks by Bank of England (BoE) Chief Economist Huw Pill.

Speaking at an online event, Pill noted that inflation is expected to fall rapidly in the 2nd half of 2023 as supply chain problems seem to be improving. Pill added that he did not envisage raising rates to the levels priced in the markets, though said that more interest rate hikes will likely be needed to return inflation to the 2% target sustainably. This comes on the back of a bleak outlook for the UK economy and might keep a lid on any further gains for the GBP/USD pair, at least for the time being. There isn't any relevant macro data due for release from the UK, while the US economic docket highlights Core PCE Price Index (the Fed's preferred inflation gauge) and ISM Manufacturing PMI.

Apart from this, the US bond yields and the broader risk sentiment, will influence the USD price dynamics and produce short-term trading opportunities around the GBP/USD pair. The market focus will then shift to the release of the closely-watched US monthly jobs report, popularly known as NFP on Friday.

Technical Outlook

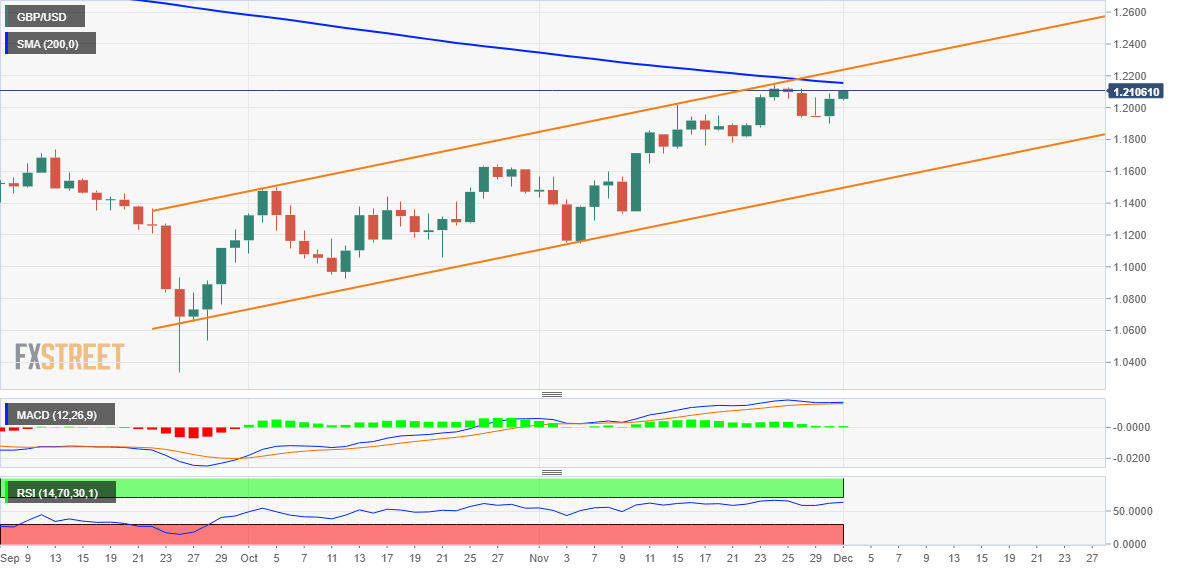

From a technical perspective, any subsequent move up is likely to confront resistance near the very important 200-day SMA, currently around the 1.2150 region. Given that oscillators on the daily chart are holding in the bullish territory and are still far from being in the overbought zone, a sustained move beyond should allow the GBP/USD pair to reclaim the 1.2200 mark. The momentum could further get extended and lift spot prices to the top boundary of over a two-month-old ascending channel, currently pegged near the 1.2300 round figure.

On the flip side, the Asian session low, around the 1.2045 region, now seems to protect the immediate downside. That said, failure to defend the said support level might prompt some technical selling and drag the GBP/USD pair back toward the 1.2000 psychological mark. Some follow-through selling will expose the 1.1945-1.1940 horizontal support. The latter should act as a strong base for spot prices, which if broken decisively will negate any near-term positive bias and pave the way for a deeper corrective decline.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.