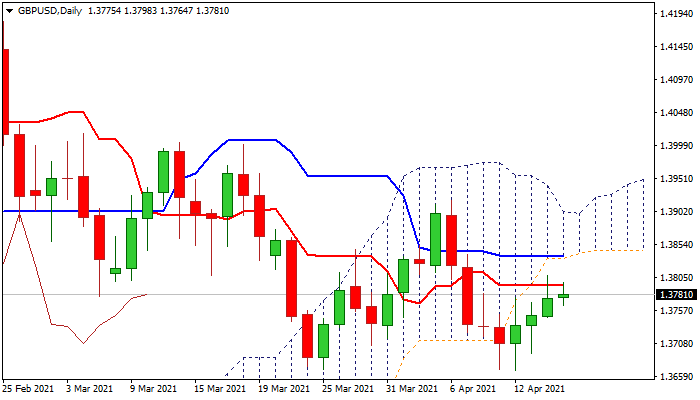

GBP/USD outlook: Bulls lose steam at 1.3800 resistance zone

GBP/USD

Fresh bulls off 1.3670 support are struggling at 1.3800 zone as Wednesday’s candle with long upper shadow and failure to close above daily Tenkan-sen (1.3794) signal that three-day rally might be running out of steam.

South-heading momentum on daily chart is cracking the centreline and adding to negative signs.

Near-term action is expected to remain biased higher above 5DMA (1.3750) while break lower would expose pivotal 100DMA (1.3696).

Bullish scenario requires lift above 1.3800 to challenge 30 DMA (1.3820) and more significant daily Kijun-sen / cloud base (1.3836/41) break of which would accelerate recovery.

Res: 1.3808; 1.3820; 1.3841; 1.3869.

Sup: 1.3764; 1.3750; 1.3696; 1.3670.

Interested in GBP/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.