GBP/USD: How far the bull run can go? [Video]

![GBP/USD: How far the bull run can go? [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/GBPUSD/new-twenty-pound-notes-3079030_XtraLarge.jpg)

GBP/USD

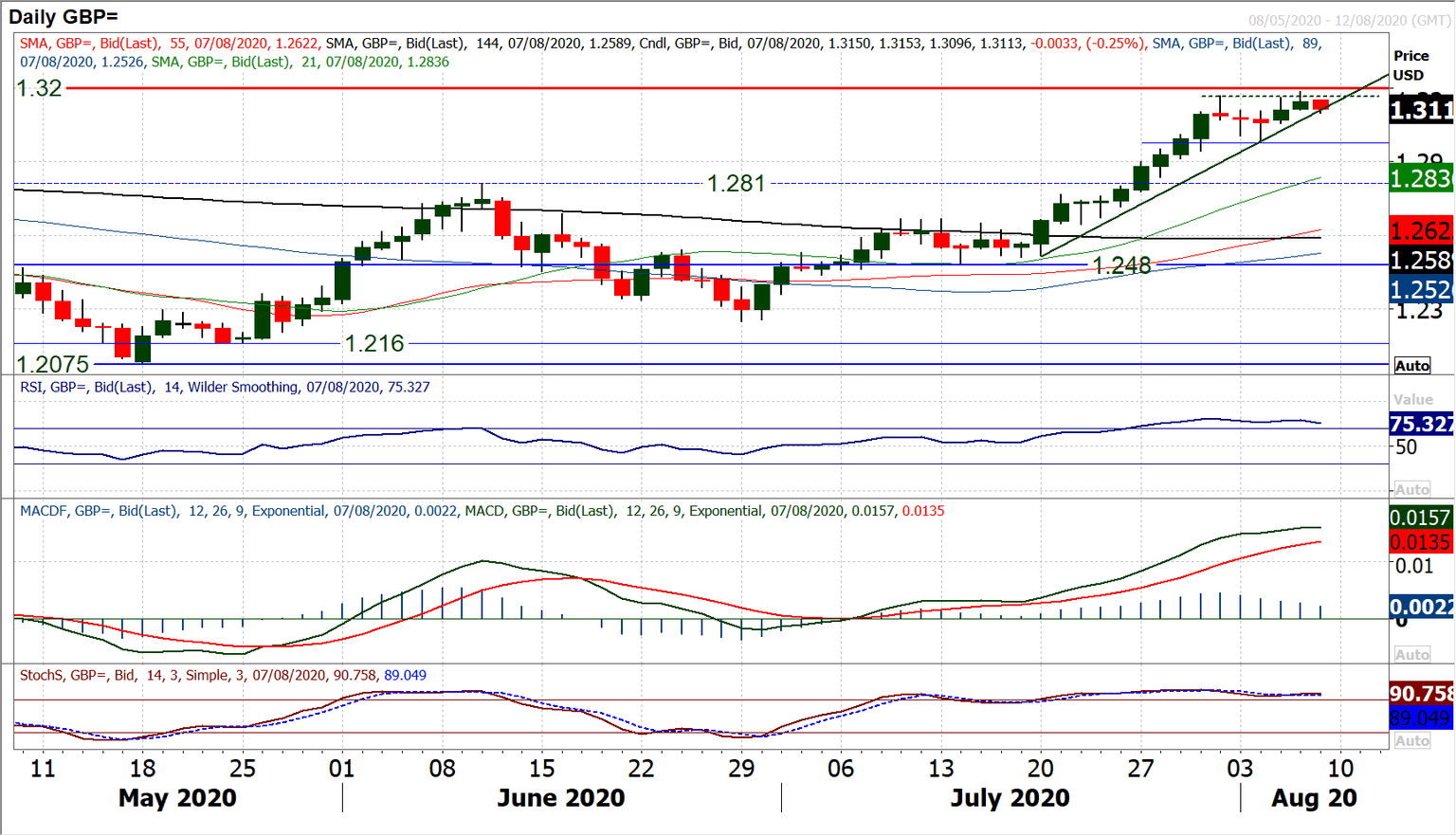

After such a strong run higher, inevitably the questions will be asked of just how far the bull run can go. Similar to the outlook for EUR/USD, there was a failed breakout yesterday when Cable moved above 1.3170 only to flounder at 1.3185 and to turn back. The fact that this is coming just under old key resistance around 1.3200 will be a concern for the bulls. This morning we see the market trading slightly lower and putting pressure on an almost three week uptrend. However, still there are no real exhaustion signals to be seen yet on incredibly strong daily momentum. The hourly chart is beginning to suggest a ranging outlook forming. There is a near term pivot around 1.3100 will be seen as a gauge moving into the payrolls data later today. Under 1.3100 the bull run begins to look a little less secure, however, would not turn corrective until a break under 1.2980. The bulls would certainly have eyes on a test of the resistance around 1.3200/1.3215 which is a band were key highs of January and March formed.

Author

Richard Perry

Independent Analyst