GBP/USD holds mid-range as Dollar tests resistance levels: Breakout or breakdown?

- GBP/USD remains range-bound near 1.35, lacking conviction ahead of key U.S. data.

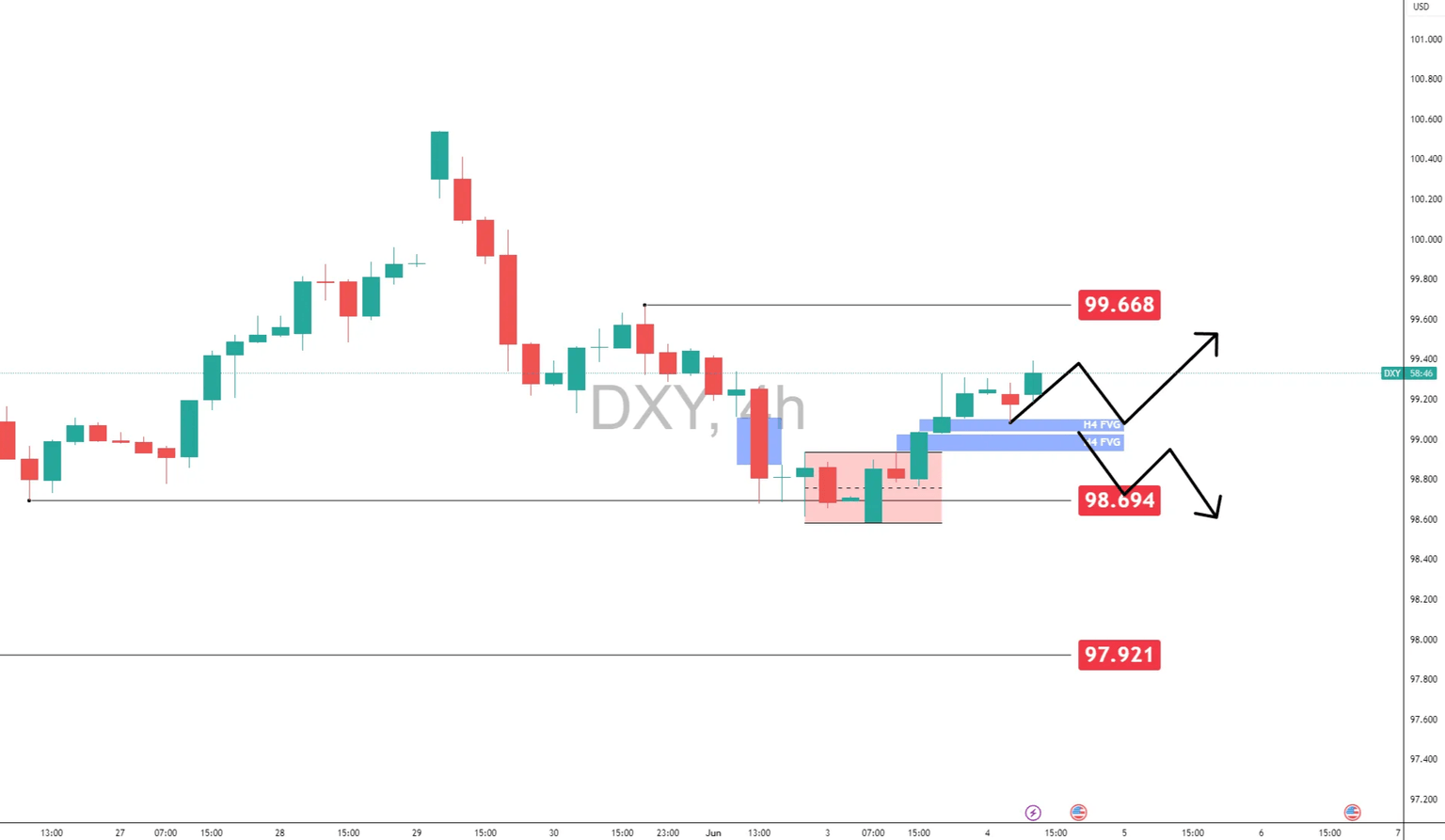

- DXY holds firm below 99.668 resistance, with upside or rejection likely to set the tone.

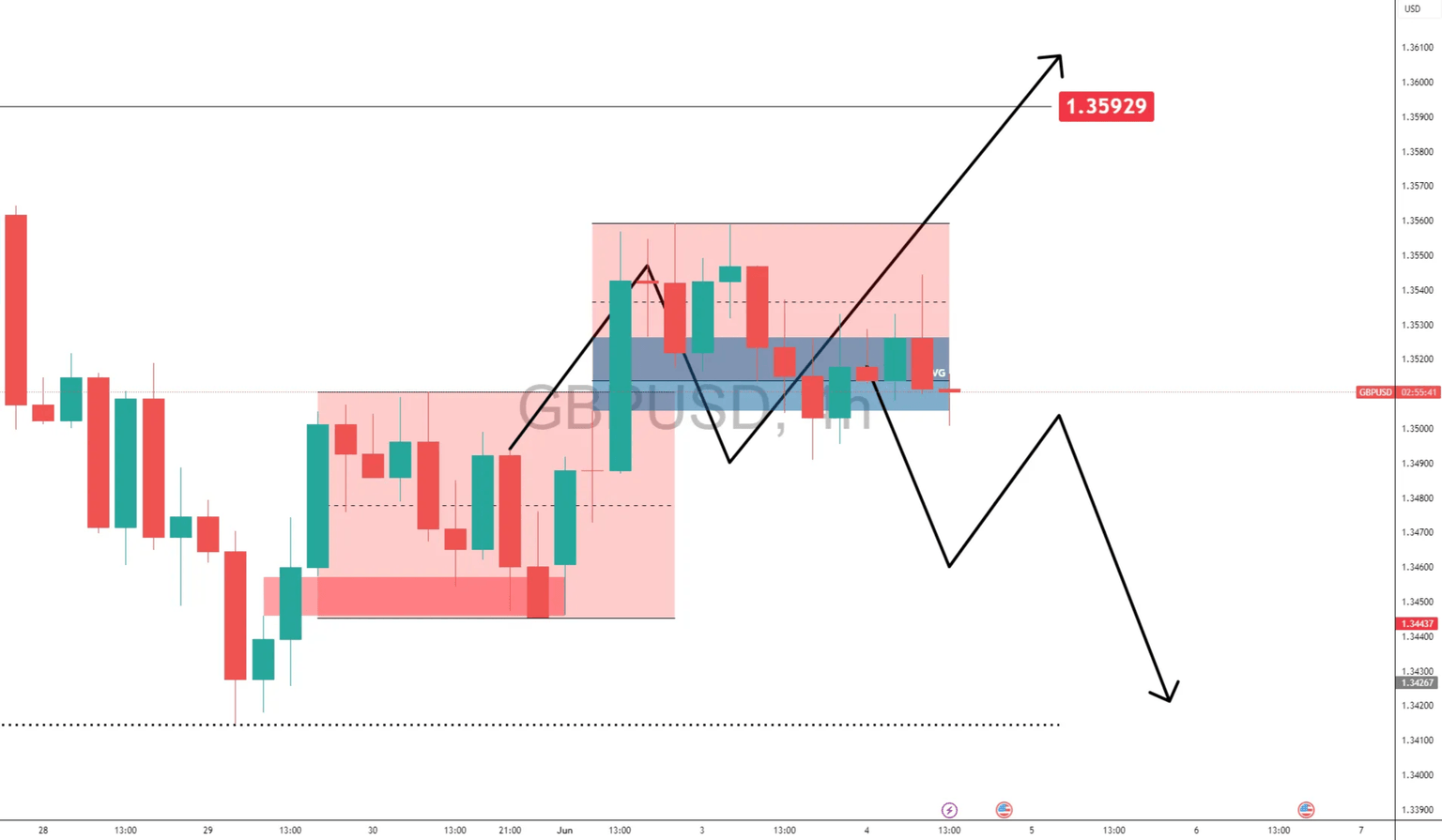

- Pound’s 4H FVG support is weakening, and a breakout above 1.356 is needed for fresh highs.

Pound in a tight range, awaiting catalyst

The British pound remains caught in a tight range on the daily timeframe against the U.S. dollar, with GBP/USD trading just above the 1.35 level as the market awaits further confirmation from U.S. economic data, particularly, the non-farm payroll this Friday.

Greenback holding its ground between the 99-99.6 level

Despite recent bullish structure, the pair is showing signs of hesitation as the Dollar approaches a major resistance level at 99.668. The U.S. dollar has recovered sharply from its May lows, bouncing off the 98.700 level and invalidating a 4-hour Fair Value Gap between 99.112–98.871. Currently, USD is testing a level of potential reaction just below 99.668, with a strong impulsive move suggesting demand still favors the greenback.

If this level breaks, GBP/USD could face added pressure. However, if dollar fails to sustain above it, we may see the pound regain upside traction.

Consolidation within bullish structure

On the 4-hour timeframe, GBP/USD has formed a consolidation just above the 1.35 level. Price has pulled back slightly after tagging the upper edge of the FVG near 1.3530, and pound seems to be waiting for a catalyst to drive the next move. The 4-hour bullish FVG still valid but showing signs of deterioration as price is still consolidating at the level. A good FVG should exhibit a strong reaction for upside after it has been tagged which is not currently materializing at the moment.

Key levels and what to watch

- GBP/USD must stay above 1.3480-1.35 to keep bullish continuation intact

- A confirmed break above 1.3540–1.356 could open the door for a move toward 1.36 and beyond.

- Watch Dollar’s reaction to **99.668-**a break or rejection here will likely dictate whether GBP/USD rallies or rolls over.

With U.S. ADP and ISM data still ahead, the next move in the dollar will be critical.

Author

Jasper Osita

Independent Analyst

Jasper has been in the markets since 2019 trading currencies, indices and commodities like Gold. His approach in the market is heavily accompanied by technical analysis, trading Smart Money Concepts (SMC) with fundamentals in mind.