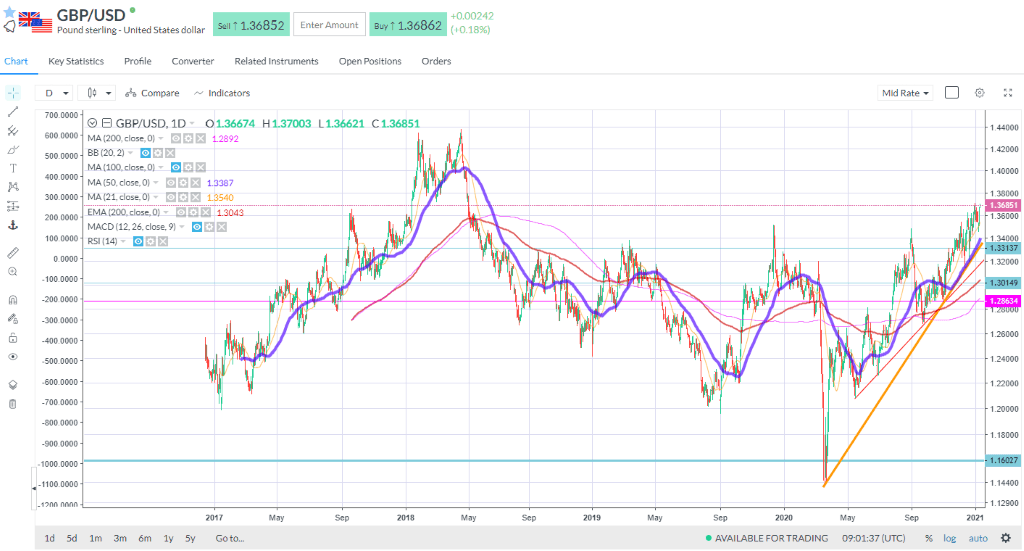

GBP/USD hits 1.37, highest in almost three years

-

European stocks flat after tame Wall Street session.

-

Fed officials dial back taper talk.

-

GBPUSD hits 1.37, highest in almost 3 years.

European stock markets were flat in early trade on Wednesday after a mildly positive session on Wall Street and mixed bag in Asia. Reflationary pressures continued as US 10-year rates rose close to 1.2% and the 2s10s curve steepened to its widest since May 2017. Equity markets are coming off record highs and the chop sideways reflects a degree of uncertainty as investors pick their way through the minefield of cases, vaccines, stimulus, reflation and an upcoming earnings season.

Coronavirus cases are picking up in China, raising concerns about a fresh wave in Asia's largest economic driver. Chinese stocks were lower, while shares in HSBC and Standard Chartered led the decliners on the FTSE 100 at the open. But progress in vaccinating populations in the UK and US, with Europe moving more slowly but still in the right direction, continues to underpin a broadly positive risk outlook, even if valuations are stretched and rising rates could cause trouble down the line. Investors are probably now looking for a bit of a consolidation and some more visibility over what is coming over the hill in terms of stimulus and vaccines.

In terms of the Fed, it seems the ‘taper talk' of Monday is part of an intellectual discussion playing out that is designed to focus our attention on the possibility of tapering to avoid complacency without spooking markets later. James Bullard, the St Louis Fed president, says the FOMC is not even close to redoing the 2013 taper exercise, whilst Boston Fed President Eric Rosengren said any debate about tapering was ‘a little while away'. We should note that Richard Clarida spoke last week about maintaining asset purchases at the current level through the whole of 2021. The Fed needs to lay down the framework for a taper at some future stage nice and early without committing to one.

Sterling has risen and enjoyed a decent bump back above $1.36 as the Bank of England distanced itself from negative rates. Governor Andrew Bailey said yesterday that negative rates are ‘controversial' and have ‘a lot of issues'. It looks like for now NIRP is likely to stay in the toolbox but clearly there is no real appetite at the BOE to go this way unless there's an emergency of some sort. GBPUSD has touched 1.37 again this morning, close to Apr 2018 highs touched on Jan 4th. Meanwhile, EURGBP dipped to its weakest since late November – look for the support around. 0.8866. Sterling is clearly undervalued and ready to break to the upside once the UK economy gets moving again. Chatter of negative rates is a persistent drag that will only be solved by a strong economic recovery this year.

Shares in BP and Shell rose again as crude prices made further gains after API reported a draw in crude oil inventories of more than 5.8m barrels last week. This lifted crude prices to their best in almost a year, with WTI cementing gains above $5 and Brent trading north of $57. Although there are near-term demand pressures, markets remain buoyed by the prospect of vaccines, the prospect of economic stimulus in the US and a cyclical bounce back in the global economy. A 1.876m-barrel build in gasoline inventories highlighted the near-term pressures from reduced mobility caused by the pandemic. EIA inventories today are expected to show a draw of -3.2m vs the massive -8m draw last week.

Equities

A couple of Covid winners today. First up, Just Eat Takeaway.com continues to do well under the conditions created by the pandemic. Delivery orders in the UK rose 387% in Q4 2020, compared with the same period in 2019. Rest of the World grew 47% in the same period, with Australia (+166%) doing particularly well.

Asos is another play on pandemic-driven trends in consumer behaviour. Today it notes that revenue growth in the four months to Dec 31st exceeded expectations. In fact lockdowns are a help not just because it means we have only online shopping available. Renewed social restrictions also meant lower returns rates. ‘With restrictions likely to be in place for the balance of the first half we expect a net COVID PBT benefit1 of at least £40m in H1," management say. Whilst the outlook is unchanged due to the ongoing uncertainty, Asos says it now expects FY21 PBT to be at the top end of current market expectations at around £170m.

Author

Neil Wilson

Markets.com

Neil is the chief market analyst for Markets.com, covering a broad range of topics across FX, equities and commodities. He joined in 2018 after two years working as senior market analyst for ETX Capital.