GBP/USD: Gains are likely to be limited

GBP/USD, EUR/GBP, GBP/NZD

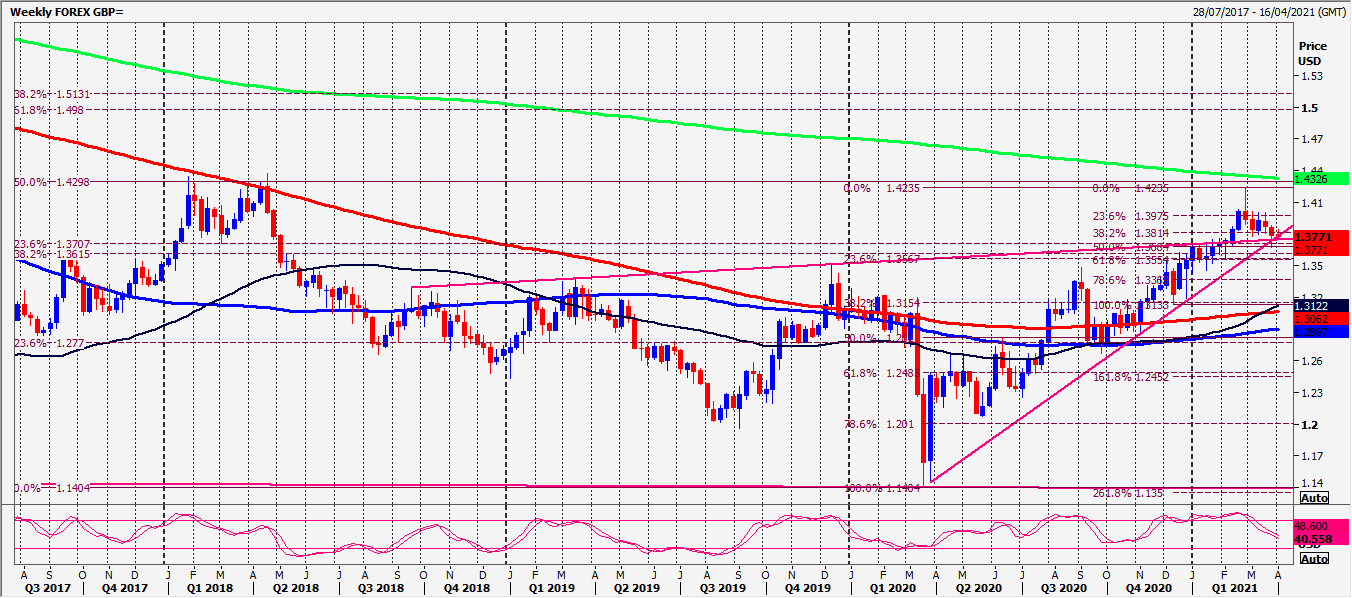

GBPUSD initial break below 100 month moving average support at 1.4080/60 was very frustrating with an unexpected bounce back to 1.4132 before the pair collapsed on the Fed minutes.

EURGBP remains in a triangle pattern from support at the May/June low at 8563/8558 to strong resistance at 8635/45. Both of which are holding perfectly so far this week.

GBPNZD broke higher to 1.9864 but unexpectedly collapsed to 1.9700.

Daily analysis

GBPUSD finally broke the 100 month moving average at 1.4080/60 for a sell signal this week targeting 1.4025/15 & 1.3970/60. We bottomed exactly here but are likely to test the 100 day moving average at 1.3940/35, perhaps today. A break below 1.3925 risks a slide to 1.3880/70 & a.3840/30.

Gains are likely to be limited with first resistance at 1.4030/40. Unlikely but if we continue higher expect strong resistance at 1.4070/80. Stop above 1.4100.

EURGBP minor support at 8590/80, then better support at the May/June low at 8563/8558. A break lower to is a sell signal targeting 8538, 8505, 8490, perhaps as far as 8475/70.

Expect strong resistance at 8630/40. Shorts need stops above 8645. A break higher is a medium term buy signal.

GBPNZD has already wiped out Wednesday’s gains over night. Support at 1.9700/1.9690. Further losses meet support at 1.9620/00.

A break above 1.9865 can target 1.9910/30 & 1.9965/70, perhaps as far as 2.0035/45.

Chart

Author

Jason Sen

DayTradeIdeas.co.uk