GBP/USD Forecast: Three dark clouds hit sterling, bulls look to Biden, UK vaccines

- GBP/USD has been falling from the highs amid a mix of concerns on both sides of the Atlantic.

- President Biden's economic speech and the accelerated UK vaccination campaign may boost sentiment.

- Friday's four-hour chart continues showing a bullish picture.

Reduced restrictions after Valentine's Day – that hope has been fading away amid reports that the government may extend the lockdown until the summer. Britain's hospitals have been struggling under an ever-growing flow of patients, and easing restrictions may come later and be extended.

These concerns have been weighing on sterling, alongside two other developments. UK Retail Sales rose by only 0.3% in December, far worse than expected. The consumer had carried the economy forward, but such private expenditure has its limits.

Last and not least, GBP/USD has been on the back foot amid a souring market mood. President Joe Biden has been running into opposition to his $1.9 trillion stimulus bill. Republicans – including Mitt Romney which is considered moderate – seem reluctant to back additional spending. While Democrats have room to move forward on their own, support from the opposition would ensure a large package and a quick delivery.

How will Biden move forward on the economy? After presenting his pandemic plan on Thursday, the new Commander-in-Chief is slated to deliver a speech on the economy later on Friday. Hints about he moves forward are critical to markets.

The president may either go for quick and small wins – pushing non-controversial issues in early February – or aiming for the larger package. The latter would take time. Markets would like to see more funds and the sooner, the better. The safe-haven dollar would drop when markets rise and advance if they retreat.

Returning to the UK, Markit's preliminary Purchasing Managers' Indexes for January are set to show a thriving manufacturing sector while the larger services sector struggles – a result of the lockdown. However, investors will want to hear about progress in the vaccination campaign.

Britain has already administered jabs to around 7.5% of the population but has yet to reach the target rate of 500,000 inoculations per day. Any acceleration would be welcome.

Overall, after several days of optimism, there are reasons for a correction, but the mood may still improve.

GBP/USD Technical Analysis

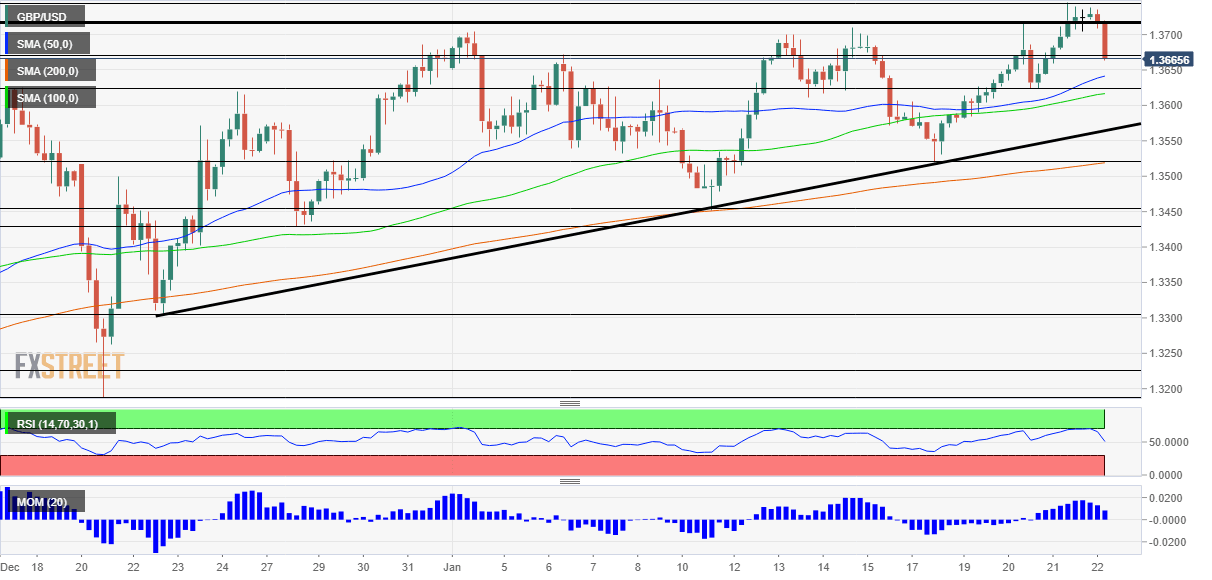

The break above the ascending triangle proved premature as cable fell back below the previous highs. That move higher may still materialize as momentum on the four-hour chart remains to the upside. Moreover, GBP/USD is trading above the 50, 100 and 200 Simple Moving Averages.

Overall, bulls lost one battle, but remain in the lead.

Some resistance awaits at 1.3680, which capped the currency pair in early Janaury. It is followed by 1.3720, the previous 2021 peak, and then by most recent one, 1.3740.

Support is at 1.3620, which was a stepping stone on the way up, followed by 1.3525, a cushion seen last week. Further down, 1.3450 and 1.3430 await GBP/USD.

GBP/USD Price Forecast 2021: Cable braces for calendar comeback amid three exits

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.