GBP/USD Forecast: Test of the 1.4000 threshold on the cards

GBP/USD Current price: 1.4097

- The UK Services PMI expanded by more than anticipated in May, hitting 62.9.

- High-yielding currencies fell during London trading hours amid the sour tone of equities.

- GBP/USD is technically bearish and poised to test the critical 1.4000 threshold.

The GBP/USD pair trades at around 1.4085, not far from a daily low at 1.4091. The pair peaked at 1.4202 for the day, as the pound found support in an upbeat Markit report, which showed that the UK’s Services PMI expanded by more than anticipated in May, hitting 62.9. Concerns about US tapering weighed on equities, which dragged lower high-yielding currencies. Resurgent demand for the dollar pushed the pair further lower after the release of better than expected US data.

On Friday, Markit will release the May UK Construction PMI, foreseen at 62.3 from 61.6 previously, although the focus will remain on US employment-related data and whether the Federal Reserve will have to speed up tightening its monetary policy.

GBP/USD short-term technical outlook

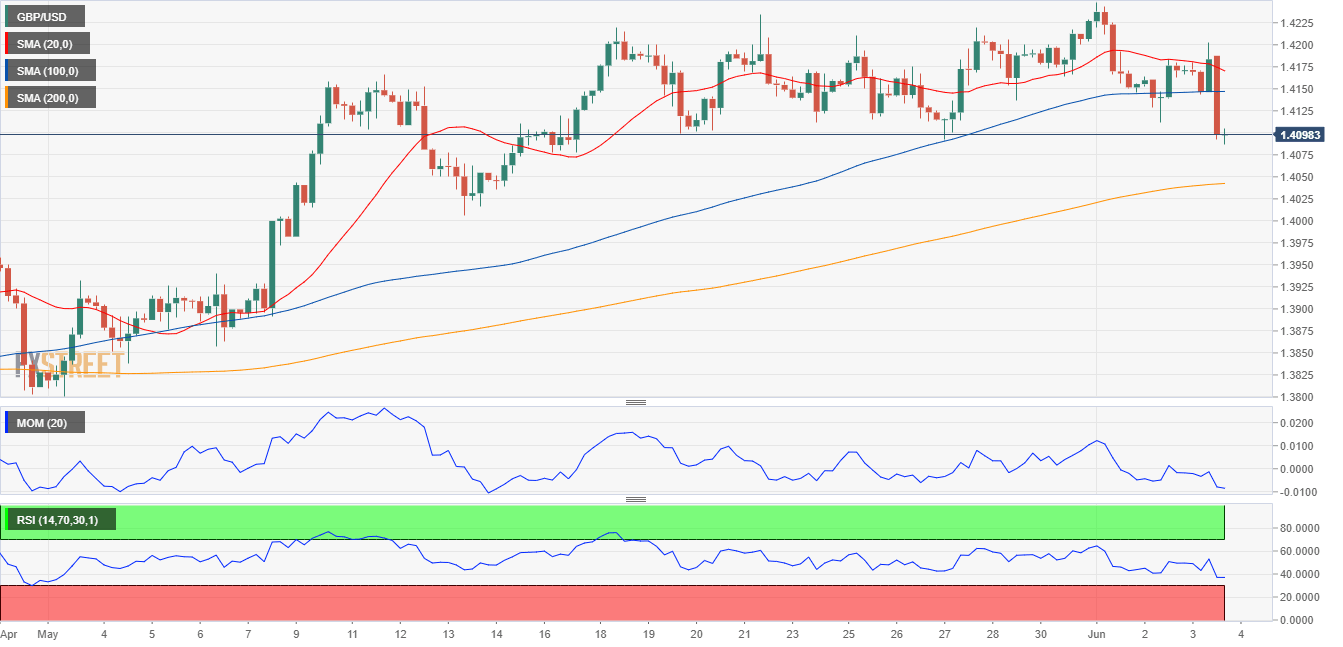

The GBP/USD pair trades near the mentioned low and seems poised to extend its decline. The 4-hour chart shows that it failed to sustain gains above its moving averages, with the 20 SMA now gaining traction above the 100 SMA, both above the current level. Technical indicators remain near daily lows within negative levels, with the Momentum aiming to recover but the RSI still heading south, in line with another leg south.

Support levels: 1.4070 1.4020 1.3965

Resistance levels: 1.4110 1.4160 1.4205

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.