GBP/USD Forecast: Technicals turn bearish ahead of US jobs report

- GBP/USD has dropped below 1.3300 on renewed dollar strength.

- Near-term technical outlook turns bearish as buyers fail to lift GBP/USD above key hurdles.

- Investors await November jobs report from the US.

GBP/USD has managed to snap a three-day losing streak on Thursday but failed to hold above 1.3300 as the greenback started to gather strength early Friday. The technical outlook seems to have turned bearish with key resistance levels staying intact.

Later in the day, the US Bureau of Labor Statistics will release the November jobs report. Investors forecast Nonfarm Payrolls (NFP) to rise by 550,000 following October's increase of 531,000.

However, market participants will pay close attention to the wage inflation rather than the headline NFP reading. Average Hourly Earnings is expected to rise by 5% on a yearly basis in November and a stronger-than-anticipated print could trigger another leg higher in the US Dollar Index as it would reaffirm the Fed's tightening prospects. Earlier in the day, Cleveland Fed President Loretta Mester noted that she would support at least one rate hike in 2022 and added that two hikes could be appropriate as well.

US Nonfarm Payrolls November Preview: Can we agree the labour market is healing?

Even if a disappointing jobs report weighs on the greenback, the dollar selloff is likely to remain short-lived as Fed policymakers won't have enough time to adjust their commentary ahead of the blackout period that starts on Saturday.

GBP/USD Technical Analysis

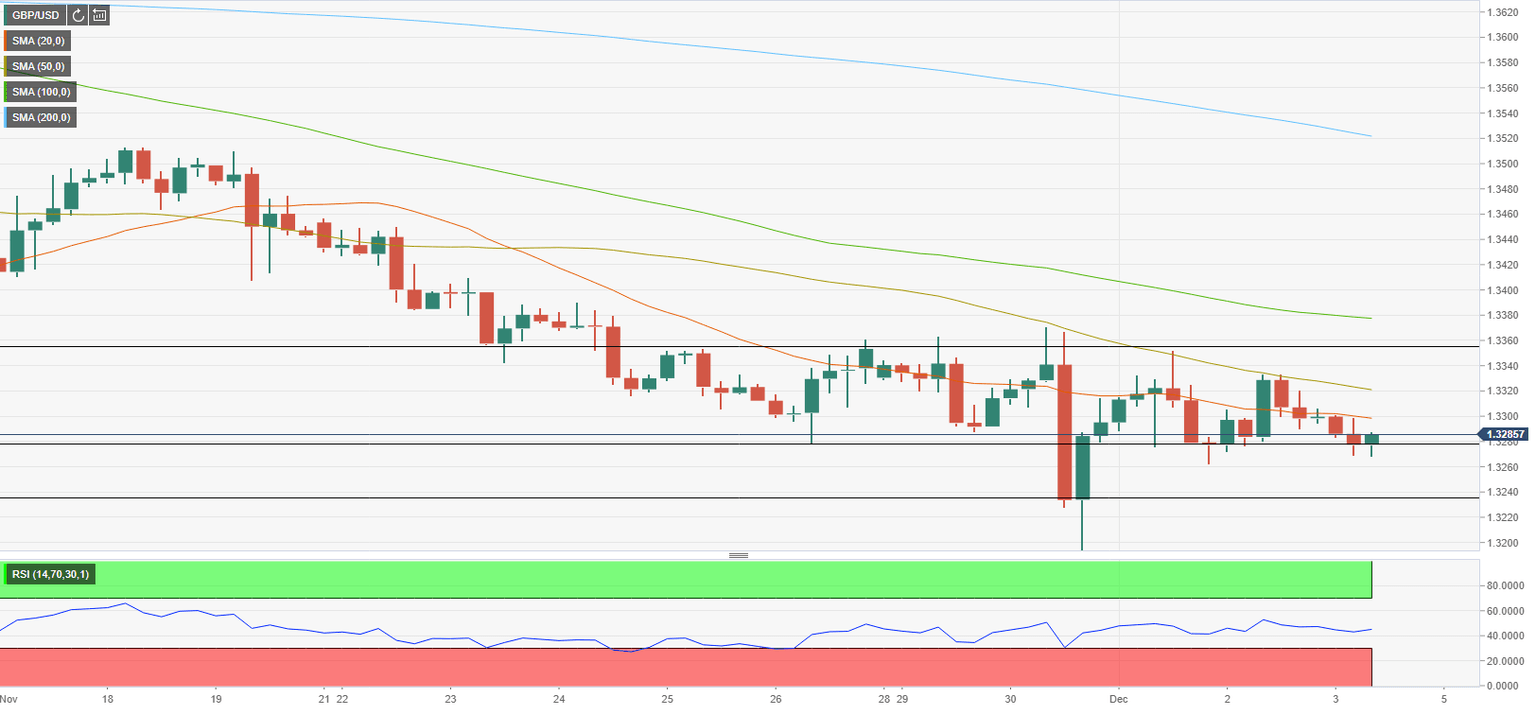

On the four-hour chart, GBP/USD trades below the 20-period and the 50-period SMAs. Additionally, the Relative Strength Index (RSI) indicator stays below 50, suggesting that sellers are starting to dominate the pair's action in the near term.

Currently, GBP/USD is testing 1.3280 static support. In case this level turns into resistance, the next target on the downside aligns at 1.3240 (static level) before 1.3200/1.3195 (psychological level/ November 30 low).

Resistances are located at 1.3300 (psychological level, 20-period SMA), 1.3320 (50-period SMA) and 1.3360 (static level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.