GBP/USD Forecast: Sterling rejected at resistance, long list of worries could send it lower

- GBP/USD has retreated from the highs as inflation concerns send the dollar higher.

- Worries about UK tax hikes, rising covid cases and other factors are weighing on cable.

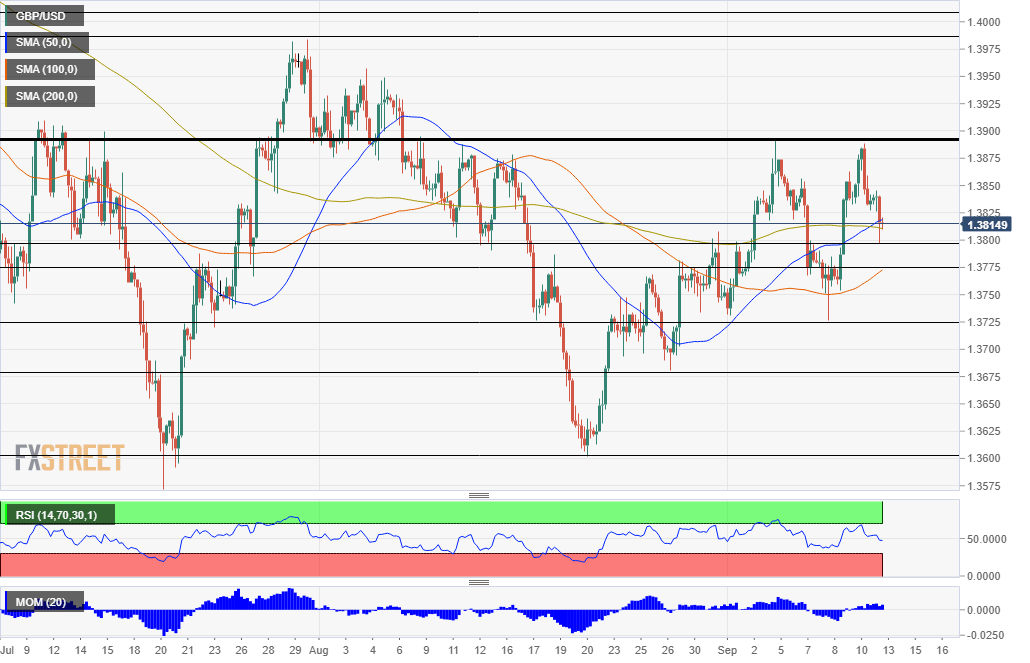

- Monday's four-hour chart is painting a mixed picture.

If at first, you don't succeed, try, try again – but what happens if that second attempt fails? GBP/USD has been rejected at the critical 1.3895 level in what could prove as a decisive blow to its recovery. There may be more in store.

The most recent downside driver is China's persistent pursuit of its tech companies. Beijing is reportedly mulling breaking up AliPay, the financial arm of Alibaba, a company owned by billionaire Jack Ma. The curb against companies in the world's second-largest economy is weighing on global stocks and supporting the safe-haven dollar.

The greenback previously benefitted from elevated producer price figures for August, which rose by 0.7% in June, more than expected. All eyes are now on Tuesday's critical Consumer Price Index (CPI) statistics.

If inflation remains high, the Federal Reserve would taper its bond-buying scheme this year. Investors were disappointed that the Fed did not seem to react to weak Nonfarm Payrolls for August. While a September taper is off the agenda, the next meeting is in play.

In the UK, the government is contemplating raising taxes to pay for a new social care program, and that is pressuring the pound. More details are due later in the week about fiscal spending and also covid policy. Coronavirus infections remain at an elevated level in Britain, and that is deterring consumers.

Overall, GBP/USD has reasons to extend its falls – at least until US inflation figures prove otherwise.

GBP/USD Technical Analysis

Pound/dollar has been rejected at the 1.3895 line once again. It has happened a total of four times since early August, showing the line's strength. Without a break above that level, bulls are compromised.

Cable is benefiting from upside momentum on the four-hour chart but has dipped below the 50 and 200 Simple Moving Averages – a bearish sign.

Beyond 1.3895, the next line to watch is 1.3950, and then 1.3985 and 1.4010.

Looking down, support awaits at the daily low of 1.38, followed by 1.3775, then 1.3725, 1.3675 and 1.36.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.