GBP/USD Forecast: Sterling exits overbought conditions, ready to rally with some Fed fuel

- GBP/USD has been retreating as the US dollar gains some ground.

- Britain's progress against the virus and the Fed's dovishness could push it to higher ground.

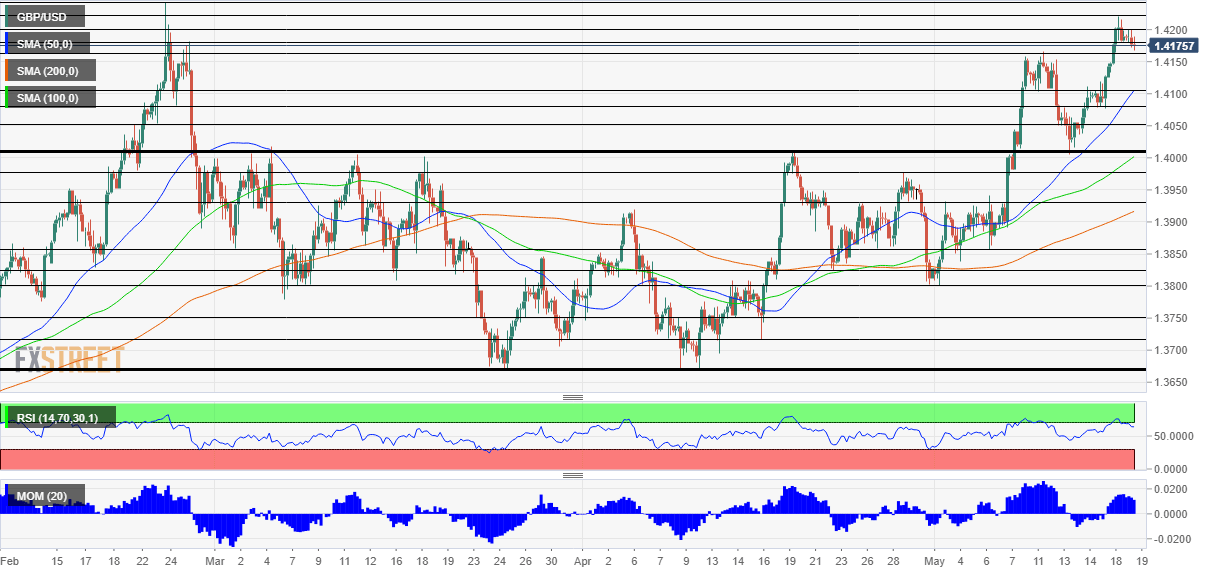

- Wednesday's four-hour chart shows that cable is out of overbought conditions.

Using the previous resistance line as support – a classic technical move that is good news for the bulls is now unfolding in GBP/USD. Before looking at the charts, it is essential to understand what fundamentals look like in cable.

The US dollar has been correcting some of its losses, clawing its way back up as US Treasury yields recover from the lows. Returns on 10-year bonds are up to just around 1.66% as investors have fresh fears about rising inflation. The mood swing back to "risk-off" seems unrelated to any event.

Back on Monday, a long list of Federal Reserve officials reiterated their stance that rising inflation is transitory and that the economy has a long way to go. Nevertheless, markets are never a one-way street. This relative calm from the world's most powerful central bank is about to end.

Later on Wednesday, the Fed publishes its meeting minutes from the latest decision back in April – and it will likely show that the voices calling for tapering bond-buying remain far and few between. The document may convince investors that the current pace of dollar printing – $120 billion per month – is set to continue for longer, devaluing the currency and pushing back the timeline for raising rates.

April FOMC Minutes Preview: Can there be one monetary policy for inflation and jobs?

Such a slide of the dollar will find a perky pound. Fears about a rapid spread of the COVID-19 variant first found in India seem to have been exaggerated. Overall, coronavirus cases remain depressed and the vaccination campaign continues at full steam.

Moreover, Bank of England Governor Andrew Bailey rejected enacting negative interest rates anytime soon, adding to the sense that the BOE is optimistic about the economy.

Overall, fundamentals are in place for more gains, waiting for a green light from the Fed.

GBP/USD Technical Analysis

The Relative Strength Index (RSI) on the four-hour chart has dropped below 70, exiting overbought conditions. Pound/dollar continues benefitting from upside momentum and trades well above the 50, 100 and 200 simple moving averages. All in all, bulls are in control.

The resistance-turned-support mentioned earlier is at 1.4150, which capped cable last week. It is followed by 1.41, 1.4075 and 1.4050.

Resistance is at 1.42, which is the daily high and it is followed by 1.4220, May's peak – and then by the all-important 1.4240 level, which is the yearly high.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.