- The Sunday Times reports that preparations for a deal are far more advanced.

- Despite denials, expectations are rising toward a cabinet meeting on Tuesday.

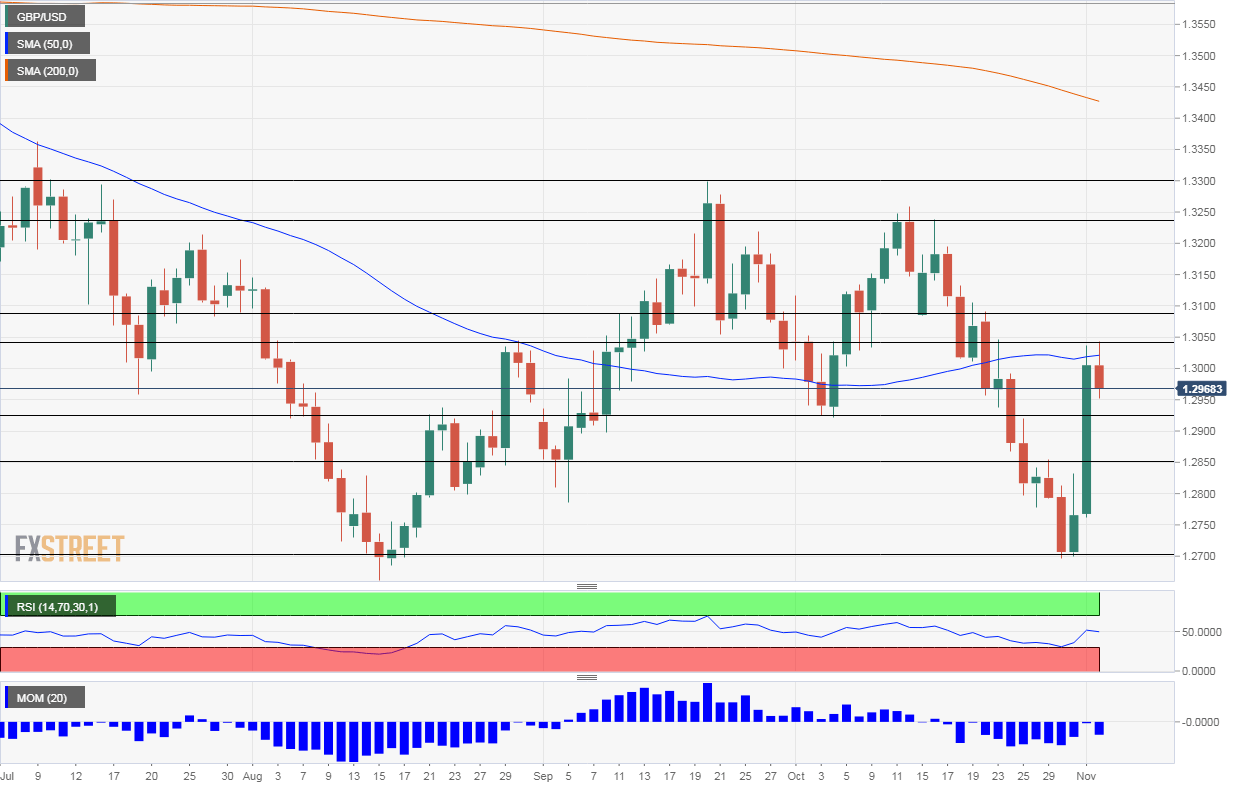

- The GBP/USD could kick off the week with a weekend gap.

Following up on previous reports of progress in talks, the Sunday Times reported that preparations for a deal "are far more advanced than previously disclosed. The London-based paper says that the UK has received concessions from the European Union that will enable the whole of Britain to remain in the customs union.

Prime Minister Theresa May will convene her cabinet on Tuesday, as usual. However, the ministers were not given the agenda of the meeting. The secrecy raises the option that a Brexit deal is in the works. Downing Street has labeled the suggestions made by the Times as "speculation" but has not denied them outright.

The GBP/USD closed the week below 1.3000, but significantly higher than the trough of 1.2968 seen earlier in the week. Hopes for a Brexit accord drove the pair higher, but these were focused on another report for a post-Brexit arrangement only for the financial services sector and some positive commentary from Brexit Secretary Dominic Raab.

The fresh Sunday Times report suggests that both sides are getting closer and that an EU Summit may be called for the week of November 12-16.

GBP/USD - Sunday Gap?

The optimism could send the GBP/USD higher as a new trading week begins. The 1.3040 was the high point on Friday before cable dropped back down. 1.3080 was a swing low in mid-October and also served as support in July.

1.3240 was a swing high in mid-October and 1.3300 was the peak in September and the is also a round number. Higher above, we are back to levels last seen in July, such as 1.3360.

On the downside, 1.2925 was the low point in early October. It is followed by 1.2850 that capped the pair before the recent upswing and also provided support in late August. 1.2700 was the trough last week.

More: GBP/USD: Downside trend break sets the stage for 1.3060-1.3100

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 ahead of US data

EUR/USD stays in a consolidation phase slightly below 1.0700 in the European session on Wednesday. Upbeat IFO sentiment data from Germany helps the Euro hold its ground as market focus shifts to US Durable Goods Orders data.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold manages to hold above $2,300

Gold struggles to stage a rebound following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% ahead of US data, not allowing XAU/USD to gain traction.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.