GBP/USD Forecast: Recovering from the Fed? Not so fast, as sterling faces UK reopening risks

- GBP/USD has been trying to recover from the Fed's subtle hint of tapering bond buys.

- Virus variants risk the UK's reopening and weigh on sterling.

- Tuesday's four-hour chart is showing that bulls lost some ground.

Freedom Day may be less free than anticipated – The UK may dilute plans to relax COVID-19 rules on June 21 due to worries about the India variant. While the number of people infected with the B.1.617.2 strain of coronavirus remains small, it is growing rapidly – 28% from Monday to Wednesday.

The new worries about delaying the reopening come despite reassurances that existing vaccines cope with the variant. UK Prime Minister Boris Johnson seemed calm about the matter, but Health Minister Matt Hancock's concerns may now take over. A limited reopening means less economic activity.

On the other side of the pond, investors continue pondering on the Federal Reserve's meeting minutes from its April meeting. One long passage in the text consists of the subtlest of hints about tapering bond buys and that was enough to boost the dollar late on Wednesday.

See FOMC April Minutes: The first shoe drops

However, investors are reassessing the minutes and their meaning on Thursday. It is essential to note that Federal Reserve Chair Jerome Powell and most of his colleagues support leaving the policy unchanged for some time. and see the economy as having a "long way to go."

An update about the labor market is scheduled for later – weekly jobless claims, which are set to extend their downfall from the peak of the pandemic.

All in all, while the greenback has room to lose ground, the pound is somewhat hobbled as well.

GBP/USD Technical Analysis

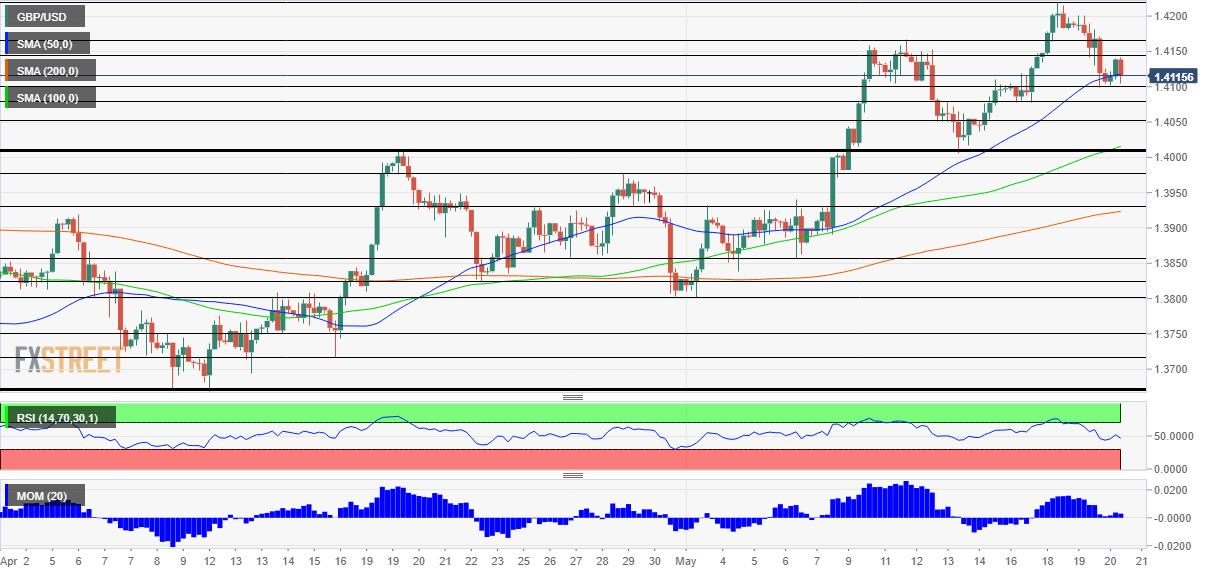

Pound/dollar continues benefiting from upside momentum on the four-hour chart but has dipped below the 50 Simple Moving Average, a sign of losing steam.

The daily low of 1.41 provides initial support. It is followed by 1.4075, 1.4050, and 1.4010.

Some resistance is at the daily high of 1.4140, followed by 1.4160 and 1.4220, May's peak.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.