GBP/USD Forecast: Pound Sterling struggles to attract buyers

- GBP/USD started to inch lower toward 1.2700 following a quiet Asian session.

- Near-term technical picture highlights lack of buyer interest.

- The pair could extend slide if 1.2700 support fails.

GBP/USD registered small gains last week as Pound Sterling managed to hold resilient against its rivals on hawkish Bank of England (BoE). The pair, however, stays on the back foot to start the new week as investors refrain from taking large positions ahead of key data releases and events.

After the data from the UK revealed last week that wage inflation held strong and core consumer inflation remained sticky early summer, markets started to price in a higher terminal BoE rate.

Commenting on the UK inflation readings and how they could influence the BoE's monetary policy, "the BoE will hike key rates another two times until year-end. It might have to take further action in 2024 as well," said Commerzbank analysts.

"If, over the coming weeks, the market gets the impression that the BoE might hesitate after all to fight inflation risks in order not to dampen the economy too much, that would be disastrous for Sterling," they added.

Pound Sterling price in the last 7 days

The table below shows the percentage change of Pound Sterling (GBP) against listed major currencies in the last 7 days. Pound Sterling was the strongest against the Australian Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.54% | -0.18% | 0.67% | 1.49% | 0.59% | 1.23% | 0.42% | |

| EUR | -0.53% | -0.75% | 0.14% | 0.95% | 0.04% | 0.71% | -0.13% | |

| GBP | 0.21% | 0.72% | 0.88% | 1.70% | 0.77% | 1.44% | 0.63% | |

| CAD | -0.68% | -0.13% | -0.90% | 0.83% | -0.08% | 0.53% | -0.26% | |

| AUD | -1.51% | -0.97% | -1.74% | -0.82% | -0.91% | -0.29% | -1.08% | |

| JPY | -0.57% | -0.04% | -0.78% | 0.09% | 0.86% | 0.65% | -0.18% | |

| NZD | -1.21% | -0.70% | -1.46% | -0.57% | 0.22% | -0.66% | -0.82% | |

| CHF | -0.41% | 0.13% | -0.63% | 0.27% | 1.09% | 0.19% | 0.80% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

The US economic docket will not offer any high-impact data releases on Monday. In the meantime, US stock index futures gained traction following a bearish opening to the week and were last seen rising between 0.25% and 0.6%. A positive opening in Wall Street could cause the US Dollar to lose interest as a safe haven and help GBP/USD hold its ground.

On Wednesday, S&P Global will release preliminary August Manufacturing and Services PMI reports for the UK and the US. More importantly, major central bankers will speak on policy outlook at the Jackson Hole Symposium that will get underway this Thursday.

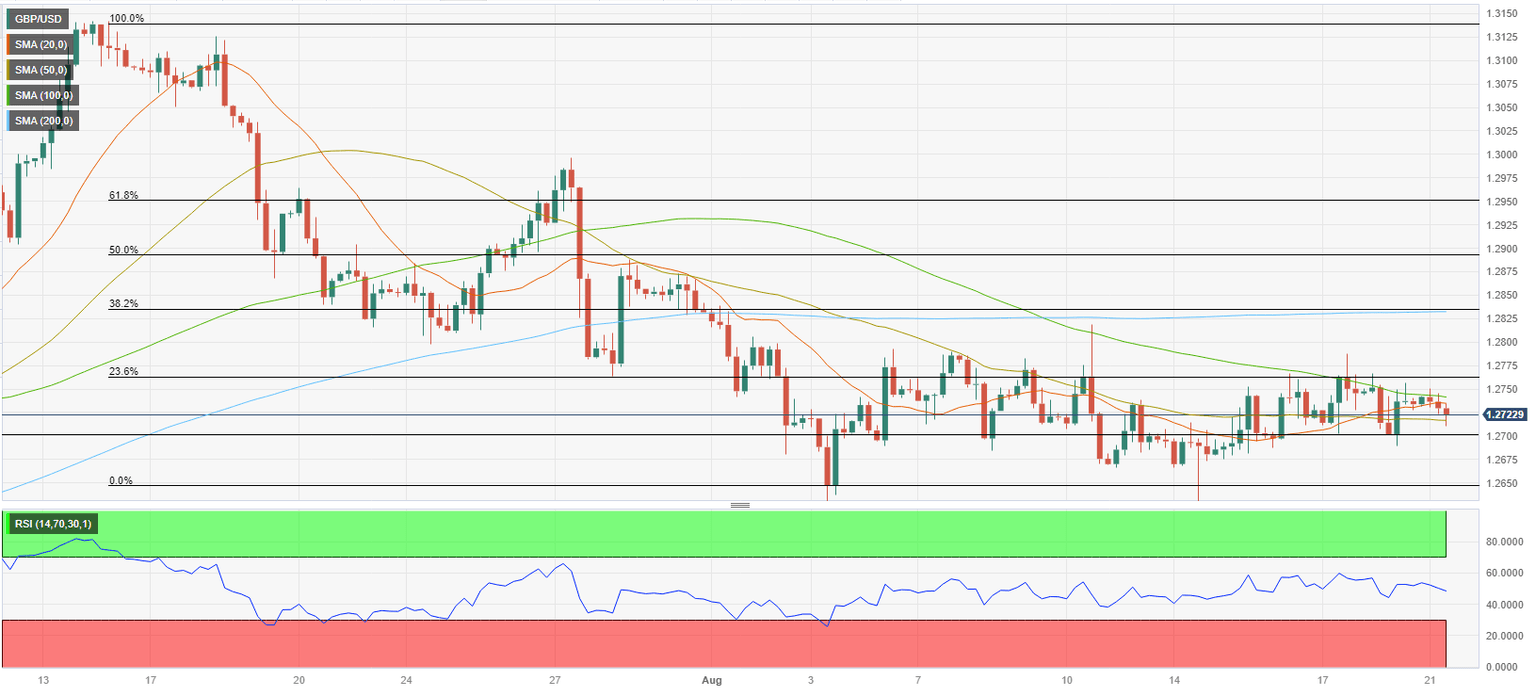

GBP/USD Technical Analysis

GBP/USD closed the last two 4-hour candles below 20- and 50-period Simple Moving Averages (SMA), while the Relative Strength Index (RSI) indicator retreated below 50, reflecting the lack of buyer interest.

On the downside, 1.2700 (psychological level, static level) aligns as immediate support ahead of 1.2650 (static level) and 1.2615 (August 15 low).

If GBP/USD manages to rise above the 1.2750-1.2760 resistance area, where the 100-period SMA and the Fibonacci 23.6% retracement of the latest downtrend are located, it could gather bullish momentum and target 1.2800 (psychological level, static level) and 1.2830 (200-period SMA, Fibonacci 38.2% retracement).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.