GBP/USD Forecast: Pound Sterling faces stiff resistance at 1.2100

- GBP/USD has managed to shake off the bearish pressure.

- Buyers could show interest in case the pair manages to clear 1.2100 hurdle.

- Volatility is likely to remain low on the last trading day of the year.

GBP/USD has managed to climb above 1.2050 early Friday after having snapped a two-day losing streak on Thursday. With trading conditions remaining thin on the last trading day of the year, however, the pair could have a hard time making a decisive move in either direction.

The decisive rebound witnessed in Wall Street's main indexes forced the US Dollar to stay on the back foot on Thursday and allowed GBP/USD to edge higher. Early Friday, the UK's FTSE 100 Index trades marginally lower on the day and US stock index futures are losing between 0.25% and 0.55%, pointing to a cautious market mood. Unless risk flows return ahead of the New Year holiday, the pair's upside is likely to remain capped.

Meanwhile, The Times reported earlier in the day that British Prime Minister Rishi Sunak was planning to halve the financial support provided to businesses on energy bills on growing concerns about the costs.

The ISM Chicago will release the Purchasing Managers Index data later in the session, which is unlikely to trigger a noticeable market reaction. Bond markets in the US will close early, further limiting the action in currency markets.

GBP/USD Technical Analysis

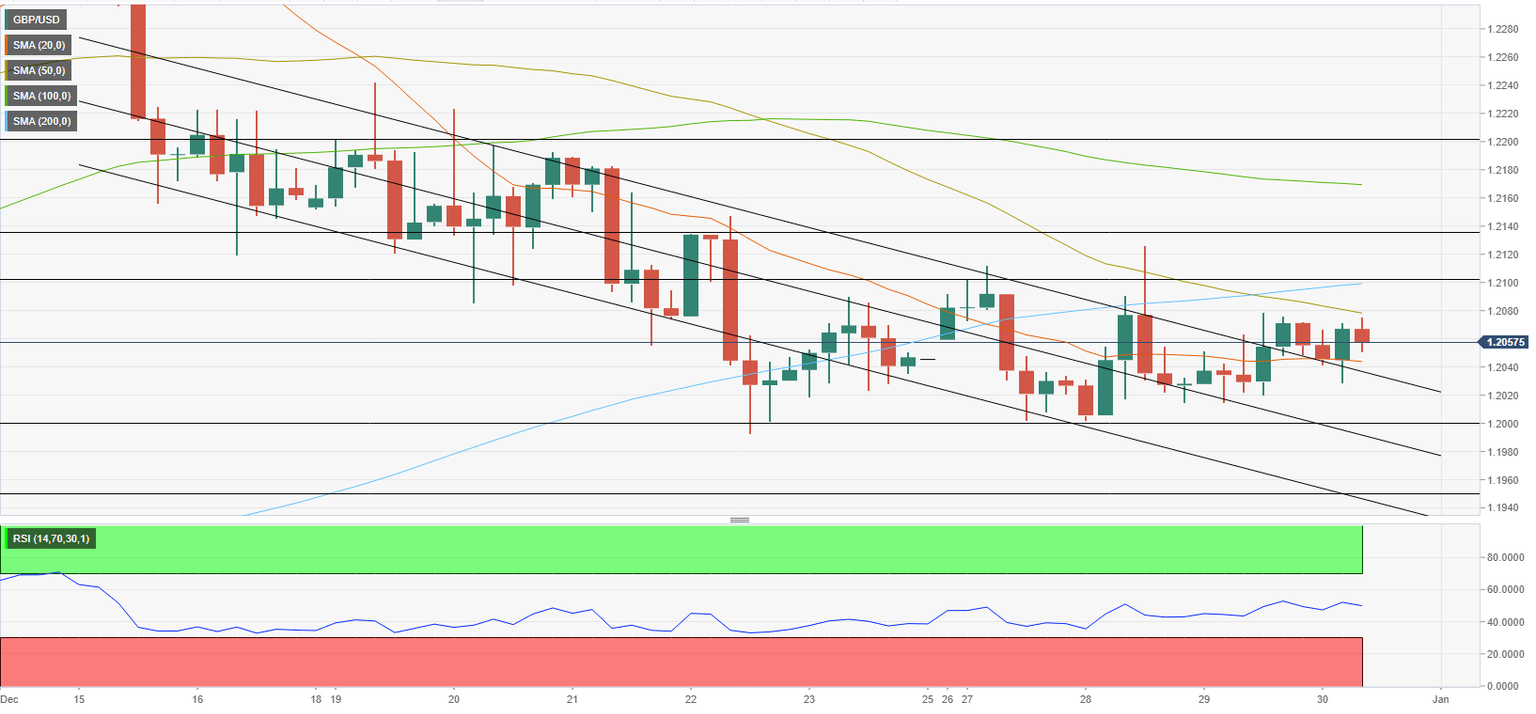

GBP/USD managed to hold above the descending regression channel after having climbed above it on Thursday, suggesting that sellers remain uninterested for the time being. Additionally, the Relative Strength Index (RSI) indicator on the four-hour stays near 50.

On the upside, 1.2080 (50-period Simple Moving Average (SMA)) aligns as interim resistance before 1.2100 (200-period SMA, static level). A four-hour close above the latter could attract buyers and pave the way for additional gains toward 1.2140 (static level).

1.2040 (20-period SMA) is the first support before 1.2000 (psychological level, static level) and 1.1950 (static level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.