GBP/USD Forecast: Pound Sterling could weaken further unless risk mood improves

- GBP/USD turned south and declined toward 1.2700 following Monday's rebound.

- Technical outlook points to a buildup of bearish momentum.

- Wall Street's main indexes remain on track to open in negative territory.

Following a bearish start to the week, GBP/USD gained traction in the American session on Monday and closed the day in positive territory. After a sideways action in the Asian session, the pair came under pressure and started to push lower toward 1.2700.

The positive shift seen in market mood made it difficult for the US Dollar (USD) to preserve its strength in the second half of the day on Monday and helped the pair edge higher. Disappointing trade data from China and Moody's decision to cut credit ratings of several small-to-mid-sized US banks caused markets to lean toward safer assets on Tuesday.

Reflecting the risk-averse environment, US stock index futures are down more than 0.5% in the European session. Moreover, the UK's FTSE 100 Index was last seen losing 0.6%. In case Wall Street's main indexes open deep in the red and continue to stretch lower, the USD could outperform its rivals and put additional weight on GBP/USD's shoulders in the second half of the day.

Goods Trade Balance data for June will be the only data featured in the US economic docket, which is unlikely to trigger a noticeable market reaction.

Comments from Federal Reserve (Fed) officials on the monetary policy outlook could influence the USD's valuation. A dovish tone could cause markets to refrain from pricing in a one more Fed rate hike this year and force the USD to lose interest.

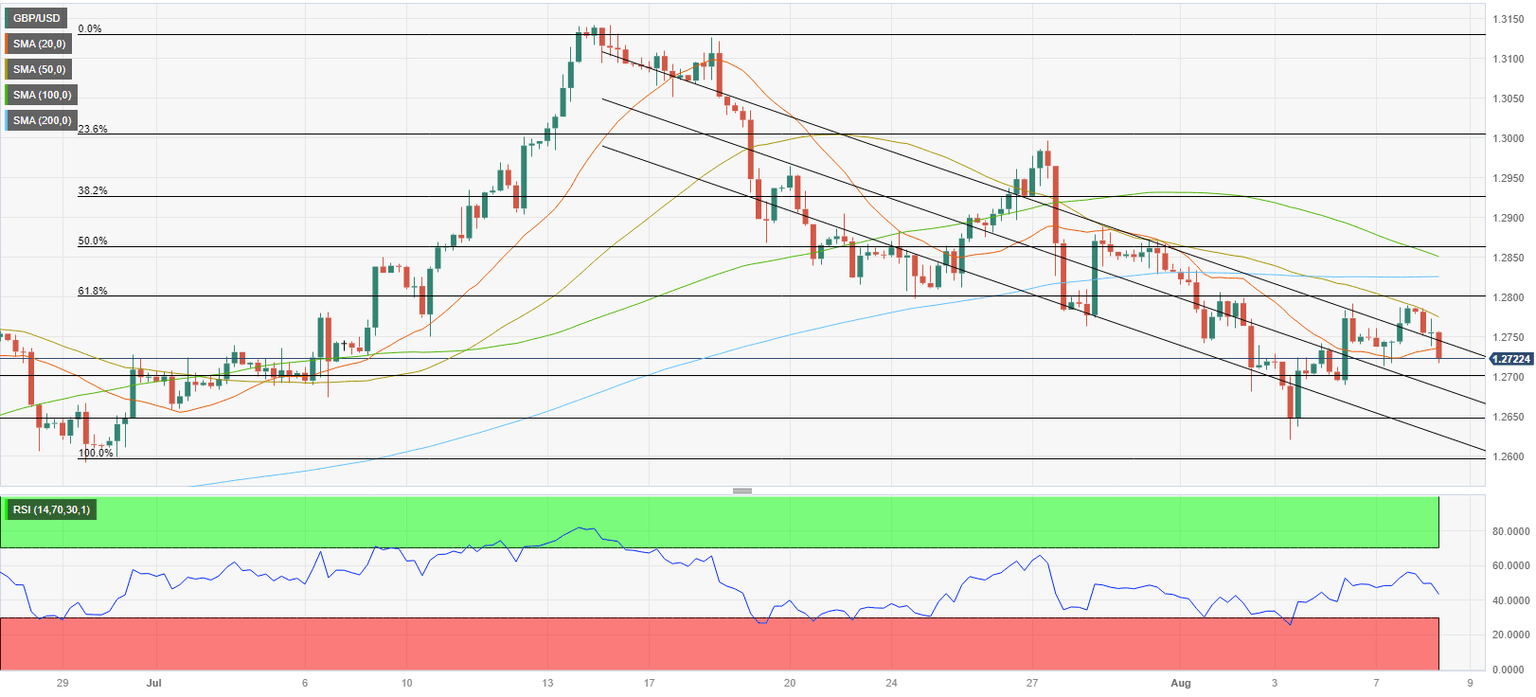

GBP/USD Technical Analysis

GBP/USD returned within the descending regression channel and recently declined below the 20-period Simple Moving Average (SMA) on the 4-hour chart. Additionally, the Relative Strength Index (RSI) indicator fell toward 40, highlighting a buildup of bearish momentum in the near term.

1.2700 (psychological level, static level) aligns as first support before 1.2650/1.2660 (mid-point of the regression channel, static level) and 1.2600 (static level, beginning point of the latest uptrend).

In case GBP/USD stabilizes above 1.2750 (upper limit of the descending channel, 20-period SMA), next resistances could be seen at 1.2800 (psychological level, Fibonacci 61.8% retracement) and 1.2820 (200-period SMA).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.