GBP/USD Forecast: Pound Sterling could struggle to find direction before Fed and BoE

- GBP/USD trades in a tight range slightly above 1.2700 early Monday.

- The technical outlook highlights the pair's indecisiveness in the near term.

- Investors are unlikely to take large positions ahead of the Fed and the BoE policy announcements.

GBP/USD continues to move up and down in a narrow band at around 1.2700 early Monday after closing the previous week virtually unchanged. The near-term technical outlook fails to provide a directional clue but the Federal Reserve's and the Bank of England's (BoE) policy announcements later this week could help the pair break out of its range.

The cautious market mood at the beginning of the week helps the US Dollar (USD) stay resilient against its rivals and makes it difficult for GBP/USD to gather bullish momentum. Investors grow increasingly worried about the potential negative economic impact of escalating geopolitical tensions in the Middle East.

Over the weekend, UK navy ship HMS Diamond reportedly shot down a Houthi drone over the Red Sea. Meanwhile, three US troops were killed and dozens were injured on Sunday after a drone strike on a US base near Jordan's border with Syria. In case safe-haven flows dominate the financial markets in the second half of the day, GBP/USD could stay under pressure.

Early Monday, a survey conducted by US bank Citi and polling firm YouGov showed that the UK public inflation expectations for the twelve months ahead fell to 3.9% and 3.5% in November and December, respectively, from 4.2% in October. Long-term inflation expectation edged lower to 3.4%. This headline failed to trigger a noticeable market reaction.

GBP/USD Technical Analysis

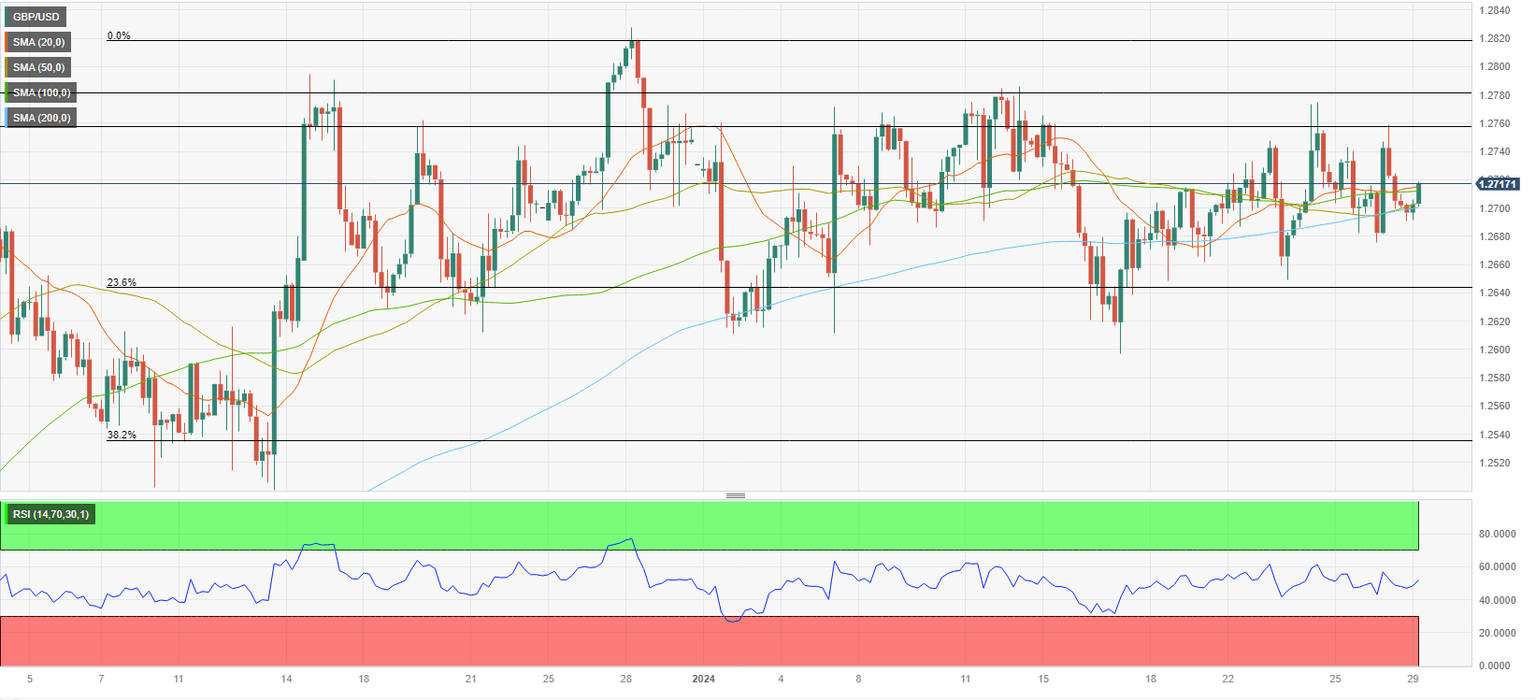

The Relative Strength Index (RSI) indicator on the four-hour chart stays near 50 and the 200-, 100-, 50- and 20-period Simple Moving Averages stay horizontal between 1.2700 and 1.2710, highlighting a lack of directional momentum in GBP/USD.

Resistance are located at 1.2760 (static level) and 1.2780 (static level) and 1.2820 (end-point of the latest uptrend). On the downside, additional losses toward 1.2650 (Fibonacci 23.6% retracement) and 1.2600 (psychological level, static level) could be seen if GBP/USD falls below 1.2700 and confirms that level as resistance.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.