GBP/USD Forecast: Pound Sterling could face strong resistance at 1.2200

- GBP/USD recovered above 1.2150 in the European session on Thursday.

- 1.2200 aligns as a critical technical resistance for the pair.

- A correction in US T-bond yields could weigh on the USD.

GBP/USD came within a touching distance of 1.2100 on Wednesday and spent the Asian session in a tight channel on Thursday. In the European morning, the pair gathered recovery momentum and climbed above 1.2150.

US Treasury bond yields' rally continued mid-week as markets reacted to the lack of progress in US budget negotiations. Unless Republicans and Democrats reach an agreement to fund the government before the October 1 deadline, investors could refrain from betting on a risk rally. Reflecting the cautious market mood, US stock index futures trade virtually unchanged in the European session.

Top Senate Democrat Chuck Schumer said the next procedural vote on the Senate stopgap funding bill is expected to take place on Thursday.

Later in the day, the US economic docket will feature the final revision to the second-quarter Gross Domestic Product (GDP) growth and the weekly Initial Jobless Claims data. Market participants, however, are likely to stay focused on the action in the bond markets. A correction in US T-bond yields could hurt the USD and help GBP/USD edge higher. If the deadlock between the House and the Senate remains unresolved, the pair's technical correction could remain limited in the near term.

GBP/USD Technical Analysis

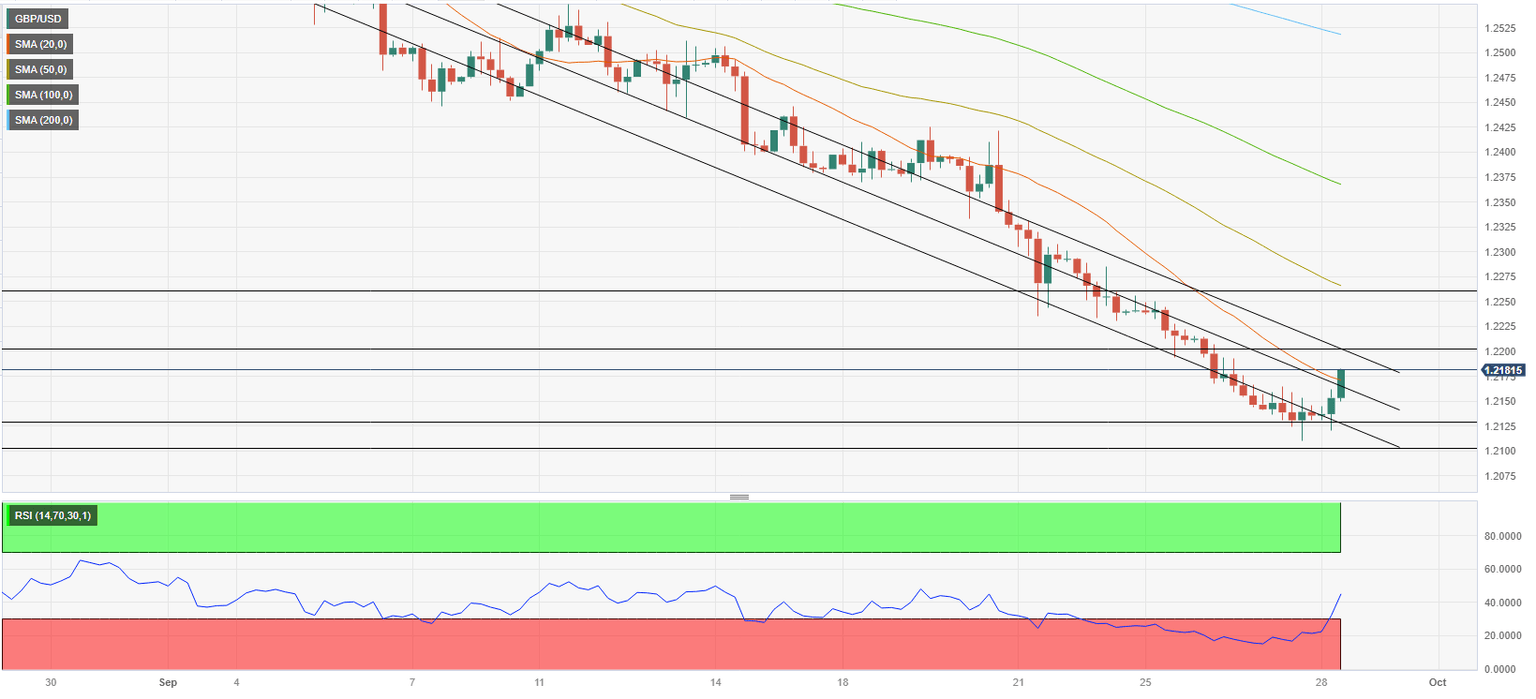

The Relative Strength Index (RSI) indicator on the 4-hour chart finally moved above 30, suggesting that the pair started to correct its oversold condition. The upper limit of the descending regression channel aligns as key resistance at 1.2200. In case GBP/USD manages to stabilize above that, 1.2260 (50-period Simple Moving Average (SMA), static level) and 1.2300 (psychological level, static level) could be set as next recovery targets.

On the downside, first support is located at 1.2150 (mid-point of the descending channel) before 1.2100 (psychological level, static level) and 1.2050 (static level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.