GBP/USD Forecast: Pound stays under bearish pressure despite upbeat UK data

- GBP/USD has declined to the weakest level since November 2020.

- UK economy grew at a stronger pace than expected in January.

- The pair is likely to stay under bearish pressure as long as 1.3100 resistance holds.

The British pound has met fresh selling pressure early Friday and has slumped to its weakest level since November 2020 near 1.3050. Unless the pair manages to stage a rebound and hold above 1.3100, it is likely to extend its slide toward 1.3000 in the near term.

Earlier in the day, the data published by the UK's Office for National Statistics revealed that the economy grew by 0.8% on a monthly basis in January, compared to the market expectation of 0.2%. Additionally, Industrial Production and Manufacturing Production expanded by 0.7% and 0.8%, respectively, in the same period and both of these prints surpassed analysts' estimates.

Despite the upbeat data releases from the UK, however, GBP/USD is having a difficult time shaking off the bearish pressure amid broad-based dollar strength.

The US Dollar Index, which gained more than 0.5% on Thursday, continues to push higher toward 99.00 on Friday. Rising US Treasury bond yields on the hot US inflation data and heightened concerns over a global economic slowdown help the dollar outperform its rivals.

Later in the session, the University of Michigan will release the preliminary US Consumer Sentiment Index data for March. Investors are likely to ignore this report and look to stay away from risk-sensitive assets ahead of the weekend. The UK's defence minister stated on Friday that Russia was likely to re-posture its forces for renewed offensive activity in the coming days.

GBP/USD Technical Analysis

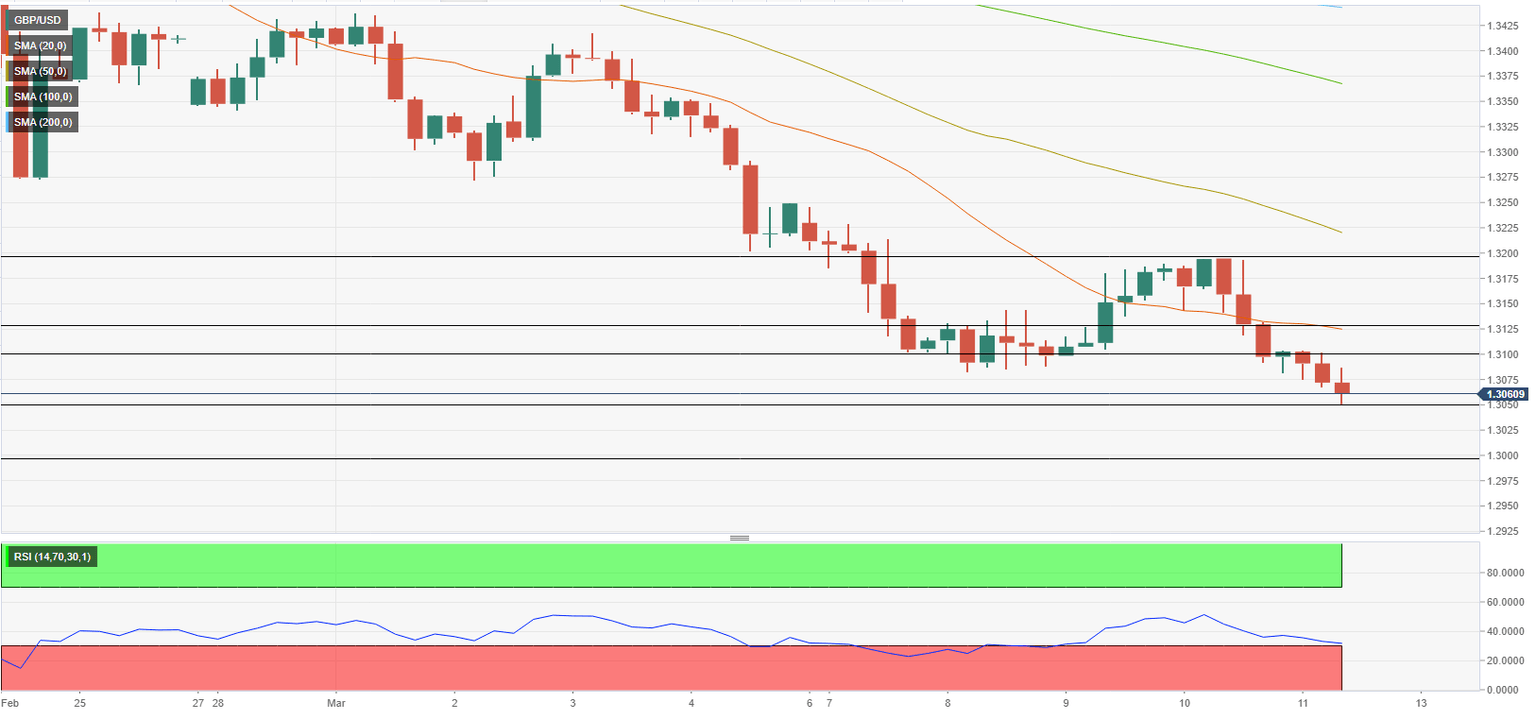

On the four-hour chart, the Relative Strength Index is about to cross below 30, suggesting that GBP/USD will turn technically oversold in the short term. Even if the pair makes a technical correction, the technical outlook will remain bearish unless it clears 1.3100 (psychological level).

On the downside, 1.3000 (psychological level) aligns as the next bearish target but the pair needs to close a four-hour candle below 1.3050 (static level) before stretching lower.

Above 1.3100, 1.3130 (20-period SMA, static level) could be seen as the next resistance before 1.3200 (psychological level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.