GBP/USD Forecast: Pound could stage downward correction if 1.2000 fails

- British pound has failed to benefit from hot inflation data.

- GBP/USD could edge lower toward 1.1950 if buyers fail to defend 1.2000.

- The pair could come under bearish pressure in case safe-haven flows return.

GBP/USD has failed to preserve its bullish momentum early Wednesday and started to fluctuate in a tight channel near 1.2000. The souring market mood could help the greenback stage a rebound and weigh on the pair in the second half of the day.

Earlier in the day, the data published by the UK's Office for National Statistics (ONS) revealed that the Consumer Price Index (CPI) jumped to 9.4% on a yearly basis in June from 9.1% in May. Although this reading came in higher than the market forecast of 9.3%, the British pound struggled to find demand.

Bank of England Governor Andrew Bailey acknowledged on Tuesday that a 50 basis points (bps) rate hike will be on the table at the August policy meeting. According to Reuters' calculations, markets nearly fully price in a 50 bps BOE rate hike in August and Wednesday's inflation report did little to nothing to change the market positioning. Hence, hawkish BOE bets might not be enough to fuel another leg higher in the British pound.

Meanwhile, US stock index futures are posting modest losses during the European trading hours. In case Wall Street's main indexes turn south after the opening bell, the US Dollar Index, which is already down more than 1% this week, could reverse its direction and weigh on GBP/USD.

It's also worth noting that market participants will keep a close eye on the US Existing Home Sales data for June later in the session. A bigger-than-expected decline could limit the dollar's potential recovery gains and help GBP/USD find demand.

GBP/USD Technical Analysis

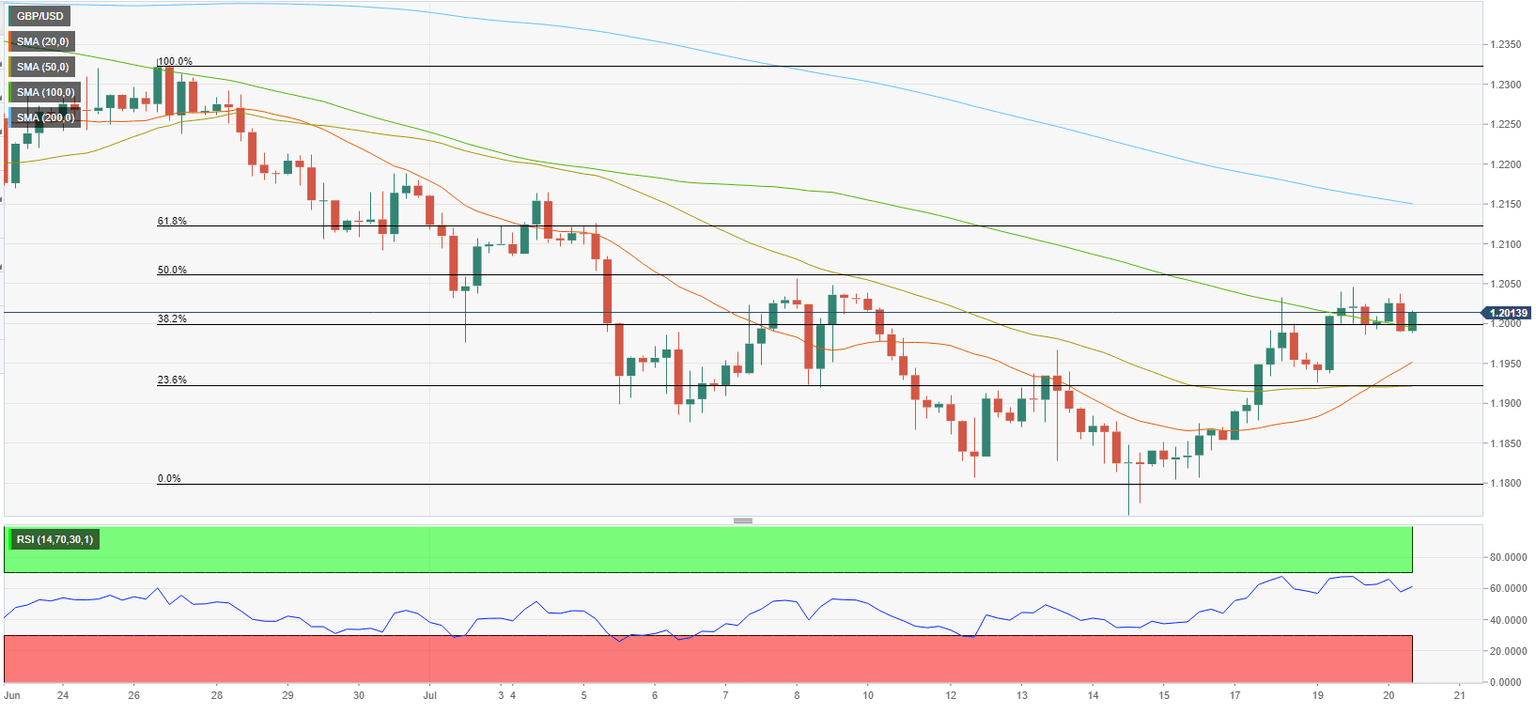

GBP/USD trades within a touching distance of 1.2000 (psychological level, Fibonacci 38.2% retracement of the latest downtrend, 100-period SMA on the four-hour chart). In case this level turns into resistance, additional losses toward 1.1950 (20-period SMA) and 1.1920 (Fibonacci 23.6% retracement, 50-period SMA) could be witnessed.

On the upside, resistances are located at 1.2060 (Fibonacci 50% retracement), 1.2100 (psychological level) and 1.2130 (Fibonacci 61.8% retracement).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.