GBP/USD Forecast: Out of overbought territory, and with upbeat fundamentals, cable is ready to climb

- GBP/USD has been licking its wounds after succumbing to dollar strength.

- An improving market mood may weigh on the greenback, while sterling benefits from vaccines.

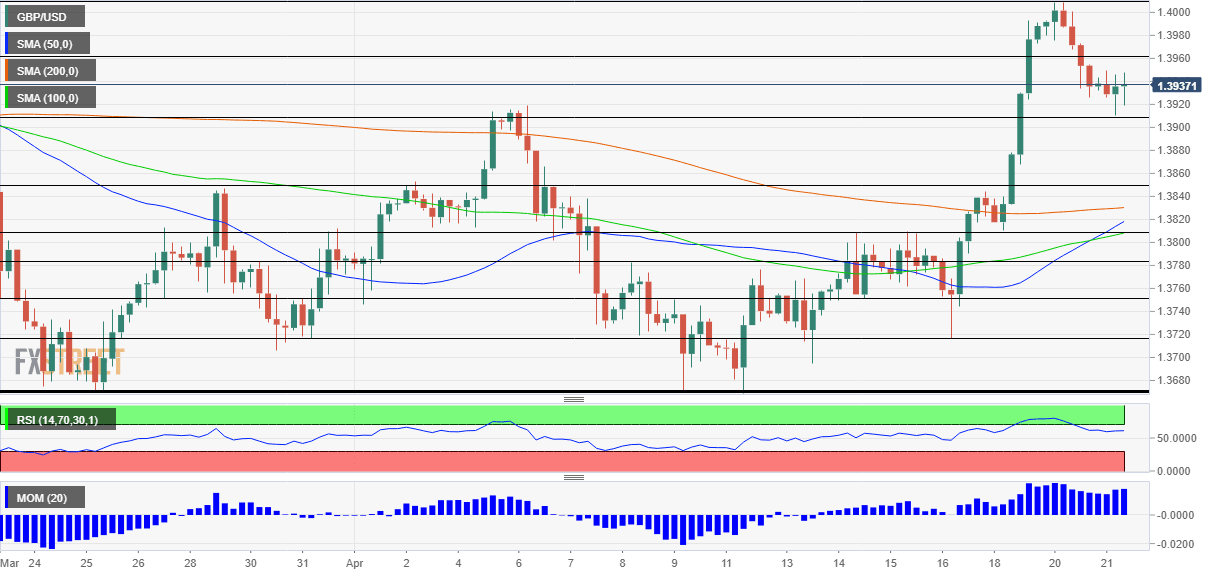

- Wednesday's four-hour chart is showing that cable is outside the overbought territory.

Winter is coming – Prime Minister Boris Johnson has warned his fellow Brits about chances of another wave of coronavirus on the other side of the summer. However, the UK's current state of affairs seems promising. Jabbing around half the population with one vaccine is proving immensely successful, and the next step of reopening seems all but certain.

Britain's Consumer Price Index marginally disappointed with 0.7% yearly in March, having a negligible impact on the sterling., nor does a speech by Bank of England Governor Andrew Bailey, who focused on diversity rather than monetary policy. The bigger moves come from the dollar.

The safe-haven greenback benefited from Tuesday's sell-off in stock markets, as investors flocked into the world's reserve currency. However, the winds are changing once again, with S&P 500 futures moving up. The US economy continues growing at a rapid pace – and virus figures are turning back down after a mini-wave beforehand. That should allow stocks to rise and the dollar to resume its falls.

After a flurry of activity around the infrastructure spending plans, the White House has recently moved to other topics, leaving the scene to the shifting market mood. Apart from the potential rise in equities, the drop of US ten-year yields below 1.60% is also pointing to a fresh descent for the dollar.

All in all, cable has reasons to rise.

GBP/USD Technical Analysis

Tuesday's fall from 1.40 has pushed the Relative Strength Index (RSI) below 70 – outside overbought territory and allowing for gains. Momentum remains to the upside and the currency pair is trading above the 50, 100 and 200 Simple Moving Averages.

OVerall, bulls are in the driver's seat.

Some resistance awaits at 1.3960, a level that capped GBP/USD in March. It is followed by the peak of 1.4010. Further above, 1.4050 and 1.4075 are eyed.

Support awaits at the daily low of 1.3910, followed by 1.3850 and 1.3810.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.