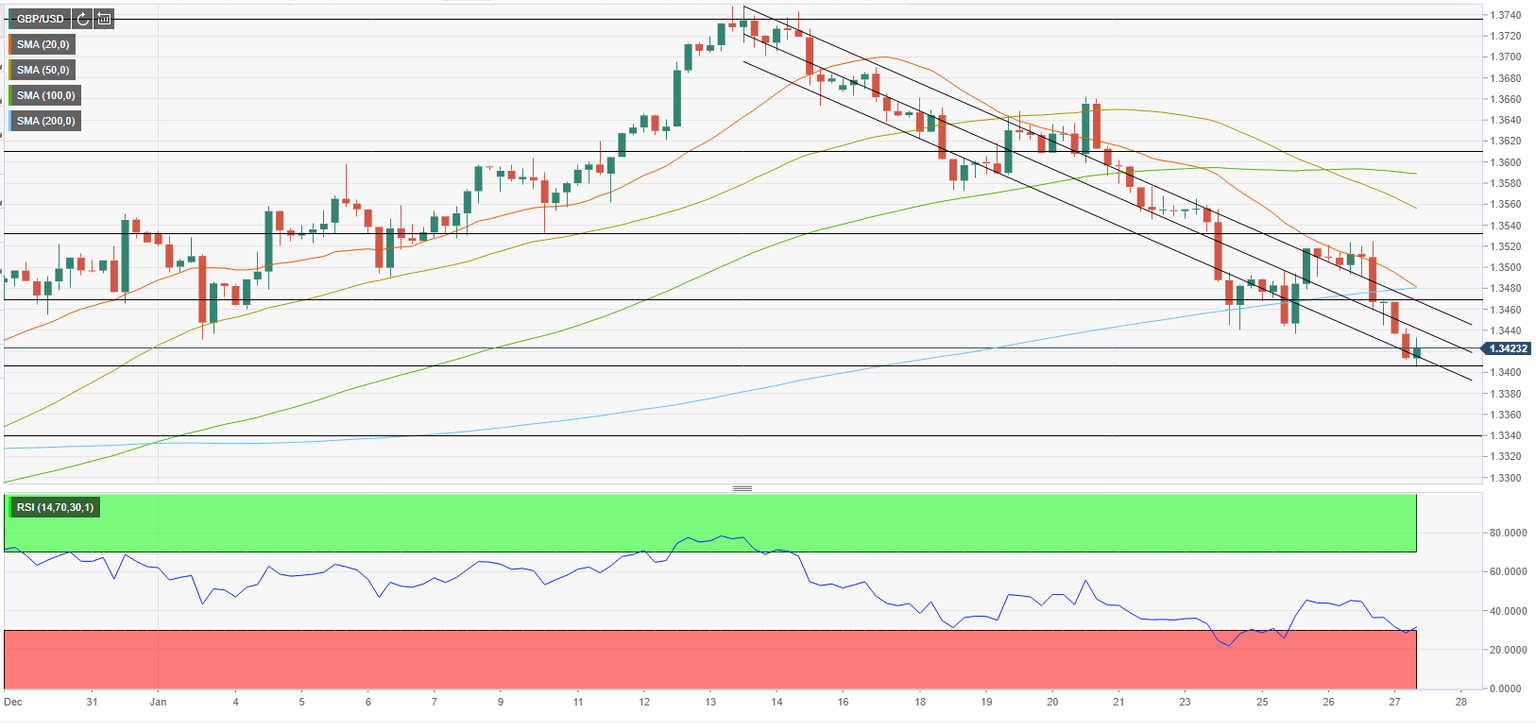

GBP/USD Forecast: Next bearish target aligns at 1.3350

- GBP/USD has staged a technical correction after falling toward 1.3400.

- Violation of 1.3400 support could open the door for an extended decline toward 1.3350.

- US Dollar Index tests key resistance on hawkish FOMC policy outlook.

GBP/USD has managed to recover modestly from the monthly low it set at 1.3405 earlier in the session but it's not out of the woods yet. In case buyers fail to defend 1.3400, the pair is likely to extend its slide toward 1.3350.

The FOMC Chairman Powell's hawkish tone during the press conference on Wednesday, despite the Fed's decision to leave policy settings unchanged, allowed the dollar to gather strength against its major rivals.

Powell said they will shift their attention to balance sheet reduction after the first rate hike and noted that policymakers were in favour of liftoff in March. The chairman also noted that the inflation situation was currently worse than it was in December and added that they had "quite a bit of room" to raise rates without damaging employment.

Whichever way you slice it, the Fed remains on track to tighten its policy in an aggressive way to counter inflation and the dollar is likely to continue to benefit from the hawkish policy outlook.

Later in the session, the US Bureau of Economic Analysis' first estimate of the annualized Gross Domestic Product (GDP) growth for the fourth quarter will be looked upon for fresh impetus. Following the Fed event, however, this report is unlikely to trigger a significant market reaction.

GBP/USD Technical Analysis

GBP/USD continues to trade within a descending regression channel coming from mid-January. The pair's latest recovery attempt seems to have lost its momentum near the middle line of this channel. Additionally, the fact that the Relative Strength Index (RSI) indicator on the four-hour chart stays well below 40 suggests that the latest advance was just a technical correction.

1.3400 (psychological level, Fibonacci 61.8% retracement of the latest uptrend) aligns as first technical support. If this level turns into resistance, the pair could target 1.3350 (static level).

On the upside, 1.3440 (middle line of the regression channel) forms the first resistance before the 1.3460/1.3470 area (200-period SMA, Fibonacci 50% retracement).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.