GBP/USD Forecast: Near-term support holds, fundamentals point to additional gains

- GBP/USD has declined to the lower limit of the ascending channel.

- Retail Sales in the UK fell unexpectedly in September, PMIs improved in October.

- Dollar's uninspiring performance and fundamentals point to additional gains.

The British pound has started the last day of the week on the back foot pressured by the disappointing Retail Sales data from the UK, which showed a contraction of 0.2% in September vs the market expectation for an increase of 0.5%. Nevertheless, the upbeat October PMI figures seem to be helping the GBP stay resilient against the dollar.

IHS Markit reported on Friday that the economic activity in the UK's private expanded at a stronger pace in early October than it did in September with the Manufacturing PMI and the Services PMI improving to 57.7 and 58, respectively.

More importantly, the survey's underlying details regarding price pressures seem to be playing into the hands of the Bank of England's rate hike prospects.

Commenting on the findings, Chris Williamson, Chief Business Economist at IHS Markit, said that growth is accompanied by an unprecedented increase in inflationary pressures. "The record readings of the PMI survey’s price gauges will inevitably pour further fuel on these inflation worries and add to the case for higher interest rates."

On Brexit-related developments, British Prime Minister Boris Johnson is reportedly ready to compromise on the European Court of Justice's role in interpreting the application of the EU law in Northern Ireland.

Meanwhile, the risk-on market atmosphere is not allowing the dollar to continue to gather strength ahead of the weekend.

After snapping a six-day losing streak on Thursday, the US Dollar Index is staying in the negative territory below 93.60 as investors remain hopeful for an agreement on US President Joe Biden's spending bill.

Under current circumstances, the fundamental outlook supports the bullish view in the near term.

GBP/USD technical analysis

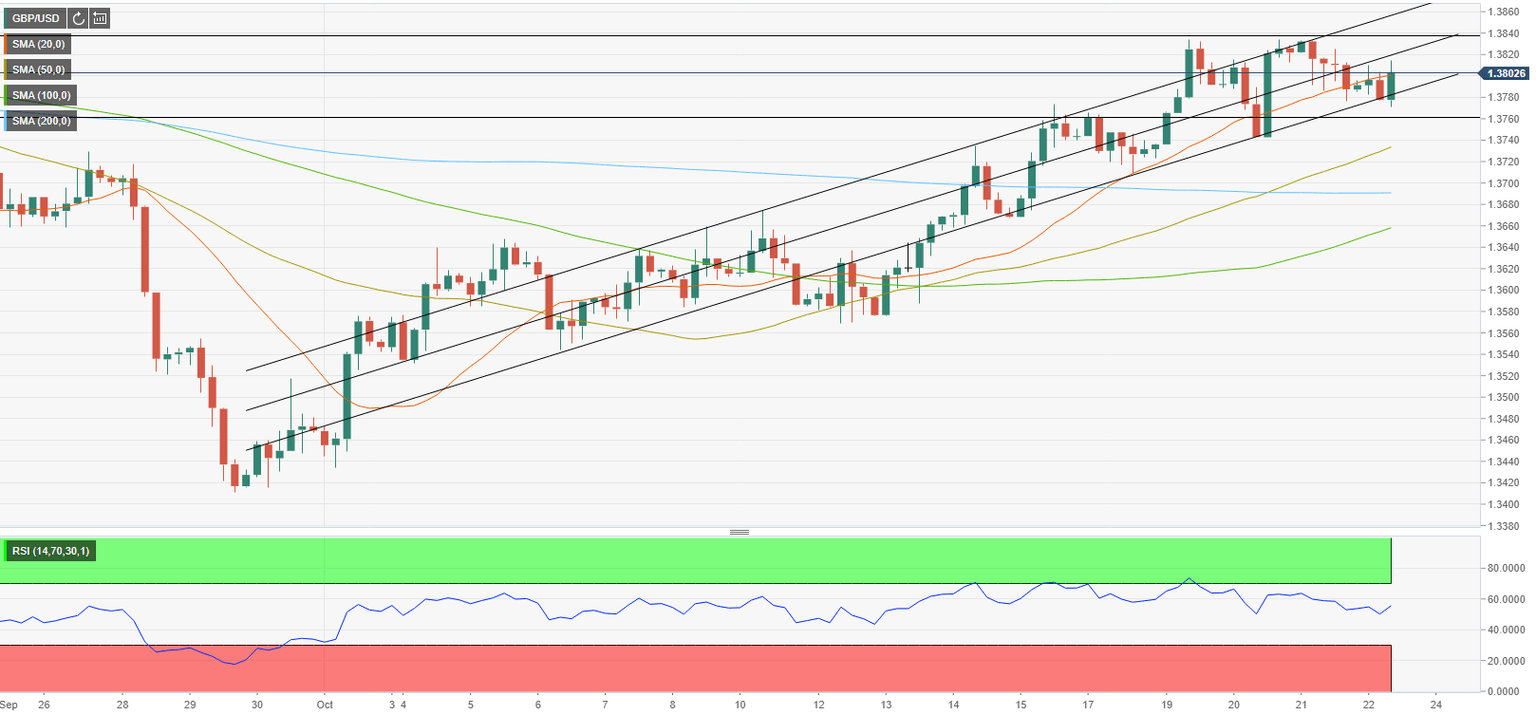

GBP/USD tested the lower limit of the ascending regression channel after the disappointing Retail Sales data but this level stays intact for the time being. Additionally, the Relative Strength Index (RSI) indicator on the four-hour chart is edging higher toward 60, suggesting that sellers are struggling to retain control.

In case the pair breaks below 1.3780 (trend support) and makes a daily close there, the technical outlook could turn bearish. In case that happens, a slide toward 1.3760 (static level) and 1.3700 (psychological level, 200-period SMA) could be witnessed.

On the other hand, the middle line of the channel is forming the first resistance at 1.3820 ahead of 1.3840/50 (static level, upper line of the channel) and 1.3880 (static level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.