GBP/USD Forecast: Kicking the can and the pound down the road

- GBP/USD has been unable to extend its gains amid Brexit uncertainty.

- The next Brexit steps, as well as top US figures, are on the agenda.

- Late October's daily chart is bullish for GBP/USD.

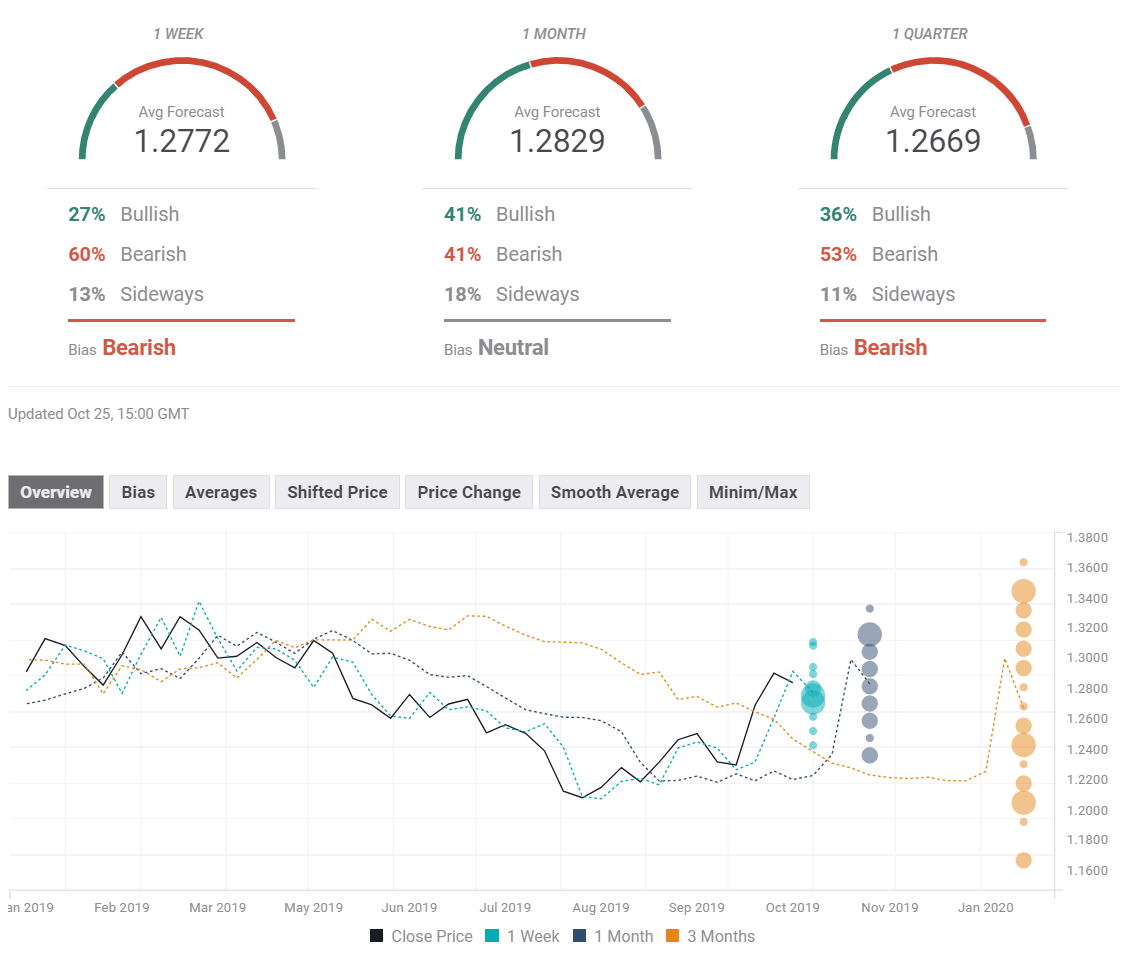

- Experts see short and long term falls, but expect a medium-term upswing in between.

Parliament giveth, and parliament taketh away – forcing another delay in Brexit and creating new uncertainty for investors, and weighing on the pound. Brexit headlines are set to dominate as early elections are on the table, and the length of the Brexit extension is unknown.

It is important to note that events are moving fast, and at the time of writing, the EU postponed its extension decision to Monday, October 28.

This week in Brexit: Kicking the can

Brexit is full of twists and turns, but the main development that has occurred in the past week is that the UK is set to stay in the EU beyond October 31. Halloween will come and go without Prime Minister Boris Johnson dying in a ditch.

The drama began already on Saturday, when Sir Oliver Letwin, a Conservative, tabled a motion that forced the PM to ask for an extension. The House of Commons voted in favor, and the government decided to pull its "Meaningful Vote." Later that day, Johnson sent European Council President Donald Tusk an official request to postpone Brexit by three months – to January 31, 2020. Begrudgingly, only to fulfill the "Benn Act," and with accompanying letters explaining why a delay was not to his liking – but it happened – partially passing the ball to Brussels' court.

GBP/USD kicked off the week with a minor drop but then finally topped 1.30 when it became clear that despite the delay – Johnson advanced toward mustering a majority. And indeed, the PM succeeded where his predecessor Theresa May failed – getting parliament to approve his Brexit deal – albeit in principle. The House voted by a broad majority of 30 MPs to back the accord in its second reading.

However, the same MPs, only minutes later, voted down the government's timetable. Johnson wanted to fast-track Brexit legislation in three days and leave the EU by the Halloween deadline, but lost by a majority of 14. The Northern Irish Democratic Unionist Party's (DUP) ten MPs made the difference. Johnson's inclusion of customs checks between Northern Ireland and Great Britain and their sense of abandonment caused them to hit back. Johnson decided to pause further Brexit proceedings.

The EU then said it would decide on the length of the extension on Friday, October 25. Most countries coalesced around the three-month postponement, but France preferred a shorter extension.

GBP/USD remained on the back foot as Brexit was temporarily on the back burner, but another bombshell followed. Downing Street was torn between pushing through Brexit legislation – which seemed to have a fair chance of passing – and elections.

Johnson took the election gamble, announcing that he would allow parliament to resume and complete proceedings needed for approving Brexit by November 6 but only if they agreed to hold elections on December 12. The government announced it would table a motion for elections on Monday, October 28.

The pound took another hit amid rising uncertainty. It is unclear if the WAB legislation can conclude without a significant amendment. Moreover, several opposition parties do not want elections with Labour first pledging to secure that a no-deal Brexit is off the table.

To further complicate matters, the EU is also set to wait until Monday to decide on the length of the extension.

Next in Brexit: Chicken or the Egg?

The Brexit date has not officially moved – but there is little doubt the EU will approve an extension. But will the bloc announce its decision after parliament decides on the next steps, or will it be in the reverse order? Who will move first? One thing is certain – October 28 will be a volatile day in pound trading.

The same "chicken or egg, who came first?" question applies to parliament as well. Contrary to Brexit legislation, Johnson needs a two-thirds majority to bring elections forward. Labour has the power to bring his attempt down if enough MPs do not bother to attend – that is what they did in September.

In addition to the desire to prevent a hard exit from the EU, opinion polls are unfavorable to Jeremy Corbyn's party. However, the opposition may agree to Johnson's plan if the EU grants a three-month extension before the vote in the House of Commons. Corbyn has repeatedly called for elections, and delay of Brexit until 2020 will leave him with no excuses.

Another scenario is that the lack of trust in Johnson – that led members of his party to force him to postpone Brexit will lead to his ousting. The "rebel alliance" of opposition parties and several Conservative MPs may come together once again and table a Vote of No Confidence (VONC). Most parties and also several Labour MPs cannot stomach seeing Corbyn – a life-long hard-left ideologue – in 10 Downing Street. Perhaps if push comes to shove, they will do so, or Corbyn will make way to a veteran MP from his party. This scenario has a low probability, but cannot be ruled out. The pro-Brexit but Johnson-skeptic DUP may team up with Labour. Nothing can be ruled out.

There may be additional twists and turns with opinion polls playing a significant part in parties' considerations for pushing for new elections.

The pound is set to rise on more certainty – indications that parliament will vote and pass the Brexit accord. If the House of Commons attaches a confirmatory vote to the Brexit deal – opening the door to revoking Brexit – that would be optimal for sterling. However, this is highly unlikely.

In case the chances for a no-deal Brexit rise, sterling is set to suffer. That may happen if France pushes for a tight schedule, or if parliament is unable to debate the deal nor opt for elections, and time passes by toward the deadline the EU chooses.

Overall, political uncertainty remains sky-high.

Other UK events: Manufacturing PMI stands out

While Brexit tends to overshadow every additional development, and that Brexit deadline of October 31 that appears on the calendar is set to move.

A speech by Silvana Tenreyro. Member of the Bank of England is of interest around a week before the bank sets interest rates. More importantly, Markit's Purchasing Managers' Index for the manufacturing sector will likely remain below 50 – indicating an ongoing contraction in the industry.

Here is the list of UK events from the FXStreet calendar:

US events: Packed calendar

The US-Sino trade talks have continued in the background but have made little progress. White House adviser Larry Kudlow hinted that some topics could spillover from the first phase to the second one. Further headlines are set to move markets.

It will be a week to remember on the US calendar – and it may confirm or disprove fears of a recession. On Tuesday, Consumer sentiment will provide new information about the shoppers – which push the economy forward. Super Wednesday features ADP's Non-Farm Payrolls, a hint for Friday's jobs report. It is instantly followed by the first read of Gross Domestic Product for the third quarter – which is set to show a slowdown. Durable Goods Orders for September fell below expectations, lowering estimates for GDP.

The Fed concludes the day with a rate cut – but that is far from being guaranteed. High uncertainty may trigger elevated volatility. Last but least, Friday's post-Halloween jobs report could also spook markets.

For a full guide and everything you need to know, see Halloween Week: Guide to five critical US events that may spook markets about a recession

Here are all the top US events on the economic calendar:

GBP/USD Technical Analysis

GBP/USD has dropped below the steep uptrend support line that accompanied it since mid-October, but still enjoys robust upside momentum on the daily chart. Moroever, it continues trading above the 50, 100, and 200-day Simple Moving Averages, and the Relative Strength Index has fallen below 70 – thus not pointing to overbought conditions anymore.

All in all, bulls remain in control. Resistance awaits at 1.2870, which was a support line in April. It is followed by a dense region starting from the mid-October peak of 1.2989, the recent five-month high of 1.3013, and 1.3040, which dates capped cable in May. Further above, 1.3135 was a resistance line in the spring. It is followed by 1.3180 and 1.3270, which were significant technical levels early in the year.

Support awaits at 1.2785, which was a swing low in late October. Next, we find 1.2705, which was the initial high and almost converges with the 100 SMA. Lower, 1.2580 was the high point in September. IT is followed by the round number of 1.25, which worked in both directions during the summer.

GBP/USD Sentiment

Political uncertainty has reached new highs with Boris Johnson's Brexit election bombshell. If parliament fails to come together and move in any direction, GBP/USD may fall. However, events are moving fast, and it is becoming harder to predict anything.

The FX Poll is providing mixed signals. Experts are bearish in the short and long terms, while they see a medium-term upswing. All targets have seen downgrades, with the most notable one being for the long term. Are experts exasperated with the neverending Brexit saga?

Related Forecasts

- EUR/USD Forecast: US growth, employment, and Fed updates

- USD/JPY Forecast: Will fear push it lower? A busy week awaits

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.

-637075726403933367.png&w=1536&q=95)