GBP/USD Forecast: Further losses likely with a drop below 1.3100

- GBP/USD has started to edge lower ahead of key US data.

- Sellers could take action in case the pair drops below 1.3100.

- Investors remain cautious ahead of the weekend amid escalating geopolitical tensions.

GBP/USD has struggled to make a decisive move in either direction on Thursday and has started to edge lower in the early European session on Friday. The pair is closing in on 1.3100 support and the bearish pressure could increase in case that level fails.

Escalating geopolitical tensions on Russia's decision to force buyers to pay for Russian gas in roubles forced investors to seek refuge late Thursday. Moreover, Russian forces are reportedly relocating and reorganising rather than pulling back, reviving concerns over a prolonged military conflict.

The UK's FTSE 100 Index stays flat early Friday and the US Dollar Index consolidates Thursday's gains near mid-98.00s, not allowing GBP/USD to gain traction.

Later in the day, the US Bureau of Labor Statistics will release the March jobs report. Investors expect Nonfarm Payrolls (NFP) to rise by 490,000 following February's impressive increase of 678,000. Market participants will also pay close attention to the wage inflation reading, which is forecast to rise to 5.5% on a yearly basis from 5.1%.

The Fed is not really concerned about job growth and unless the wage inflation print misses the market expectation by a wide margin, the dollar should continue to outperform its rivals. Furthermore, investors might want to stay away from risk-sensitive assets heading into the weekend amid the uncertainty surrounding the Russia-Ukraine crisis.

A risk-averse market environment is likely to cause GBP/USD to stay under bearish pressure and the US jobs report could further weigh on the pair. A positive shift in risk sentiment accompanied by an NFP-inspired dollar weakness could open the door for a rebound but this seems to be the less likely scenario.

GBP/USD Technical Analysis

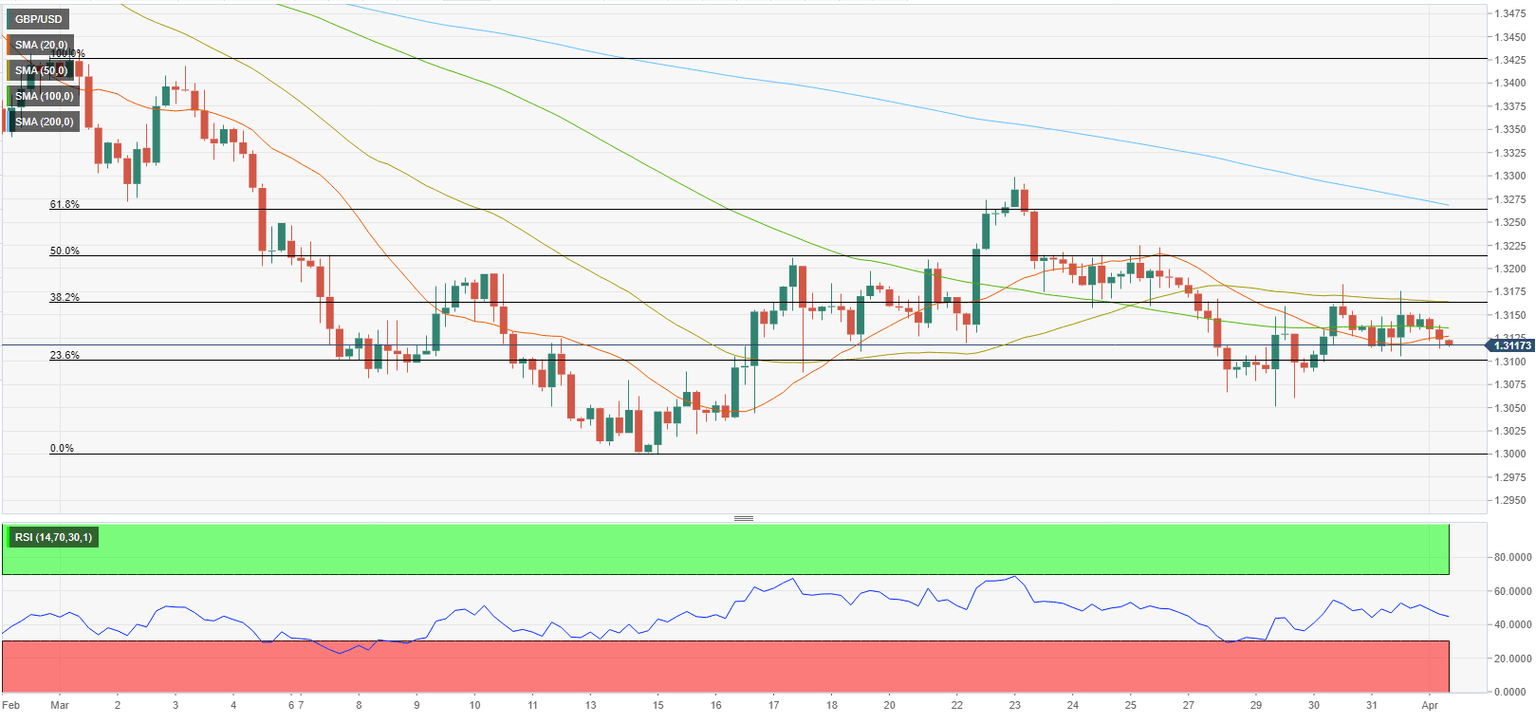

The Relative Strength Index (RSI) indicator on the four-hour chart is edging lower below 50 and GBP/USD stays below the 100-period and the 50-period SMA, pointing to a bearish shift in the near-term technical outlook.

1.3100 (psychological level, Fibonacci 23.6% retracement of the latest downtrend) aligns as key support. With a daily close below that level, additional losses toward 1.3050 (static level) and 1.3000 (psychological level, static level) could be witnessed.

On the upside, 1.3135 (100-period SMA) could be seen as interim resistance before 1.3160 (static level, Fibonacci 38.2% retracement, 50-period SMA) and 1.3200 (psychological level, Fibonacci 50% retracement).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.