GBP/USD Forecast: Dreadful data, hard UK decision, and loss of uptrend support all point down

- GBP/USD has succumbed to dollar strength and retreated from the highs.

- The PM's decision on the lockdown and US data are eyed.

- Tuesday's four-hour chart is pointing to the downside.

To ease or not to ease? And how exactly? That is a critical question for Prime Minister Boris Johnson amid conflicting figures and forces. In the meantime, GBP/USD has dipped amid a fresh wave of dollar strength.

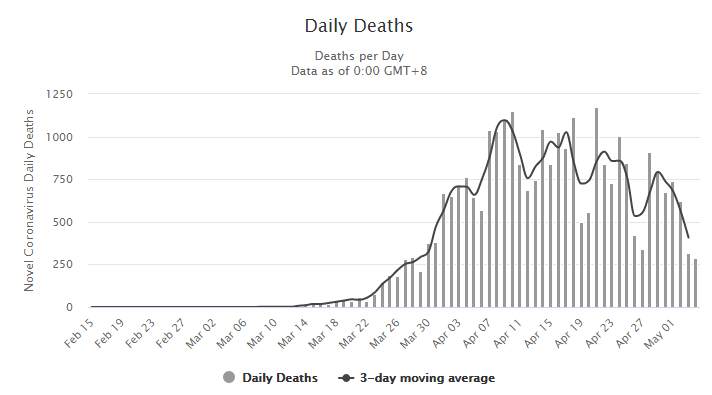

The UK reported 288 COVID-19 deaths on Monday, the lowest since March, yet this sharp fall levels more than double that statistics can be attributed to the "weekend effect" – underreporting on Saturdays and Sundays that is later followed by a bounce. Nevertheless, the trend remains encouraging.

Source: WorldInfoMeter

On the other hand, the amount of excessive deaths remains elevated, indicating losses of life directly related to the illness or caused by people unable to receive help for other issues is much higher.

Conservative MPs have reportedly been urging the PM to ease lockdowns as the economy is struggling. Around a quarter of Britain's workforce is furloughed – temporarily out of work and receiving funds from the government. That is taking a toll on public coffers. The Bank of England, which publishes its rate decision on Thursday, may be ready to help out

See Bank of England Preview: Pound plunge with projections or surge with stimulus? Timing raises suspicions

Opening up too quickly may endanger workers and unions are demanding they are consulted. Keir Starmer, leader of the opposition, called for reaching a national consensus on the next steps.

Markets would like to see an increase in economic activity, yet are also aware of the risks of a second wave – devastating to consumer and business confidence. Markit's final Services Purchasing Managers' Index for April came out at 13.4 – above the initial read but pointing to a deep depression.

The US dollar has been gaining strength as the market mood is souring once again. The ISM Non-Manufacturing PMI for April is projected to plunge, reflecting the paralysis of America's services sector. The publication also provides a hint toward Friday's all-important jobs report.

See US ISM Non-Manufacturing PMI Preview: Will April’s statistics reignite the safety trade?

Earlier in the day, California's announcement about easing shelter-in-place order boosted stocks and weighed on the safe-haven dollar. The large western state's economy is larger than the whole of the UK's. Governors are grappling with easing lockdowns amid a projection that the total number of US COVID-19 deaths could double to around 134,000 in early June.

Overall, loosening restrictions and terrible economic statistics are in the spotlight.

GBP/USD Technical Analysis

Pound/dollar has dropped below the uptrend support in a more decisive manner than beforehand. Momentum on the four-hour chart has turned negative and the currency pair dropped below the 50 and 100 Simple Moving Averages. All in all, the bears are in the lead.

Support awaits at 1.2405, which is May's low, followed by 1.2380, a swing low in late April. The next lines are 1.2360 and 1.23.

Some resistance awaits at 1.2445, where the 50 and 100 SMAs nearly converge, followed by a daily high of 1.2480. The next levels are 1.2520 and 1.575.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.

-637242668329838828.png&w=1536&q=95)