GBP/USD Forecast: Critical support in danger amid Brexit issues, dollar bounce

- GBP/USD has been under pressure as Brexit concerns join covid ones.

- The dollar may be poised for a comeback after several days under pressure.

- Friday's four-hour chart is pointing to further falls.

Riots on the streets of Belfast – exactly 100 days after Brexit serve as a stark reminder of the implications of Britain's exit from the EU and its complexities not only for trade but also for peace in Emerald Isle. Frustrations over the terms of the accord in Northern Ireland are only the latest factor to push the pound lower.

Britain is also grappling with a "dry month" of vaccine supplies, exacerbated by the recent debacle over AstraZeneca's jabs. Hesitancy around taking protection against the virus is set to rise after experts found a link between rare blood clots and inoculation. Another downside drive for the pound is profit-taking, which followed several weeks of gains.

The dollar is also playing a major factor in keeping the lid on any GBP/USD recovery. After two days of dovish messages from the Fed, the greenback is making a comeback alongside the increase in bond yields. Federal Reserve Chair Jerome Powell pushed the greenback lower by stating that he is worried about coronavirus infections rather than inflation, pledging to keep the pedal to the metal and keep on printing dollar. However, that effect has faded.

Why? Investors seem to have remembered that Powell's words are not news, just a repeat of previous messages. Moreover, the US economy is still on course to outperform its peers. A bump up in Chinese consumer and producer prices in March may serve as a hint that US inflation may also advance – forcing the Fed to raise rates sooner than later.

All in all, the potent mix of British concerns with a rush to the dollar are exacerbating cable's climbdown.

GBP/USD Technical Analysis

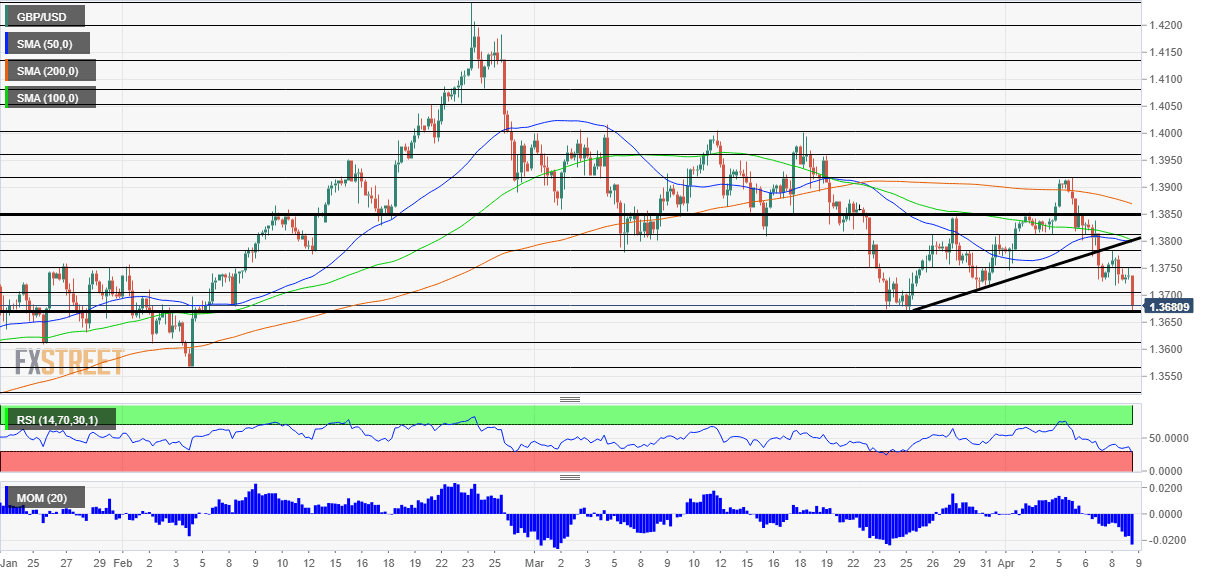

Pound/dollar has been extending its falls after breaking below the uptrend support line, as the four-hour chart is showing. Momentum remains to the downside and the Relative Strength Index is above the 30 level, outside oversold territory.

Overall, bears are in control.

Critical support awaits at 1.3670, which was March's low point. It is followed by 1.3610, a cushion from January, and then by the February trough of 1.3565.

Some resistance is at 1.3705, a low point in late March, followed by 1.3780, the weekly high, and then by 1.3920, which worked as support last week.

Bank to the Future: Interest rates return to market center stage

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.