GBP/USD Forecast: Buyers await a break above 1.2100

- GBP/USD has met modest selling pressure at the beginning of the week.

- UK and US markets will be closed in observance of the New Year holiday.

- Sellers could stay in control unless 1.2100 turns into support.

GBP/USD has lost its traction and started to edge lower on Monday after having closed the last trading day of 2022 marginally higher. The technical picture points to a slightly bearish outlook in the short term but the pair's action is likely to remain subdued with major global stock and bond markets remaining closed in observance of the New Year holiday.

Over the weekend, data from China revealed that the business activity in the manufacturing sector contracted at its strongest pace in December in nearly three years with the NBS Manufacturing PMI dropping to 47. Additionally, the Non-Manufacturing PMI plunged to 41.6 from 46.7 in November, missing the market expectation of 51.4 by a wide margin.

When trading conditions normalize with major markets returning to action on Tuesday, safe-haven flows could start dominating the financial markets. In that scenario, the US Dollar is likely to hold its ground against its risk-sensitive rivals.

Meanwhile, the Rail, Maritime and Transport union (RMT) announced that members at Network Rail and 14 train operators will stage two 48-hour strikes from Tuesday and Friday in the UK this week.

GBP/USD Technical Analysis

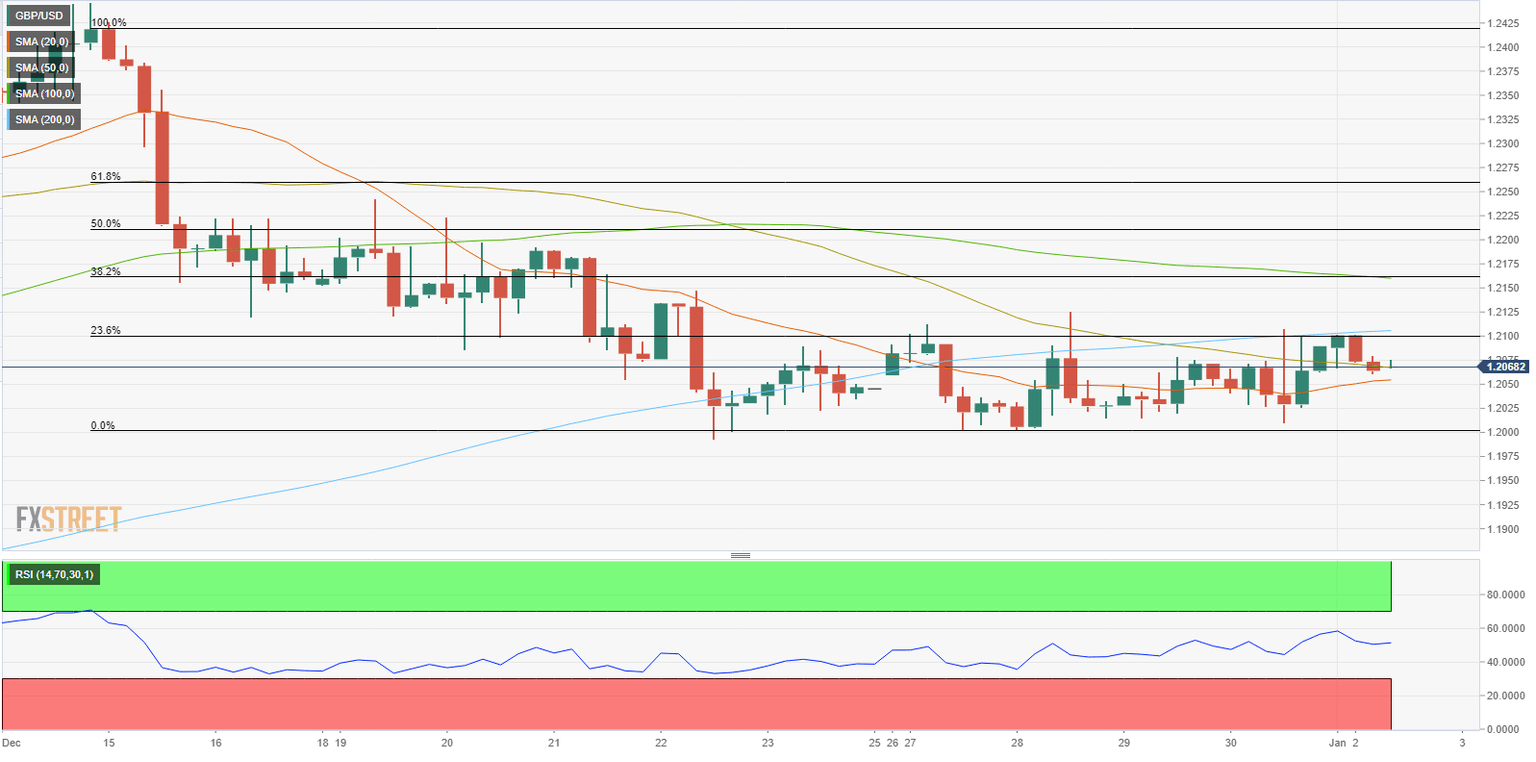

GBP/USD stays below the 200-period Simple Moving Average (SMA) on the four-hour chart which is currently located at 1.2100. The Fibonacci 23.6% retracement of the latest downtrend reinforces that resistance as well. In case the pair rises above that level and starts using it as support, additional gains toward 1.2150 (100-period SMA, Fibonacci 38.2% retracement) and 1.2200 (Fibonacci 50% retracement, psychological level) could be witnessed.

On the downside, initial support is located at 1.2050 (20-period SMA) ahead of 1.2000 (psychological level, end-point of the downtrend).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.