GBP/USD Forecast: Bulls retain control as BoE rate hike bets increase

- British pound has been outperforming its major rivals since the start of the week.

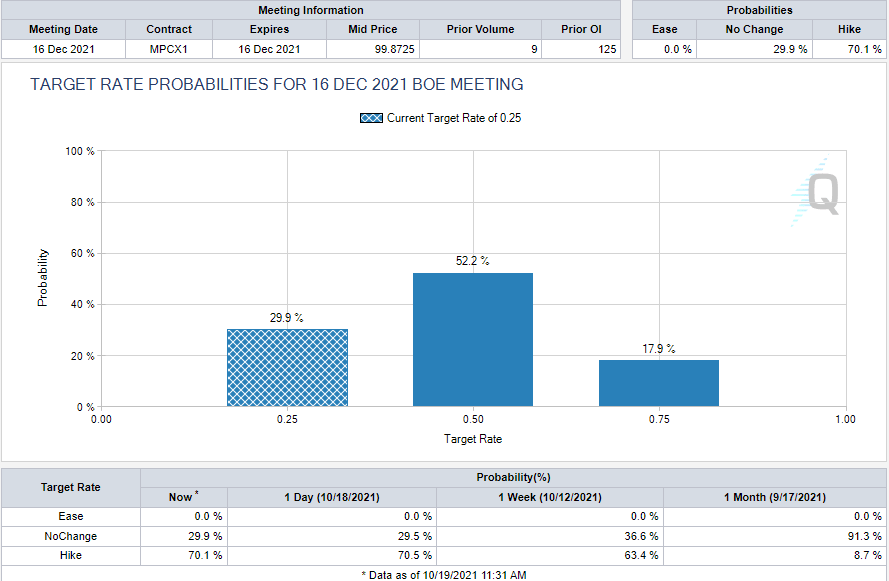

- Markets are pricing in 70% probability of a BoE rate hike by the end of the year.

- 1.3800 and 1.3850 align as the next targets for GBP/USD.

The GBP/USD pair closed the fourth straight trading day in the positive territory on Monday and has managed to preserve its bullish momentum during the European trading hours on Tuesday.

As investors remain focused on the Bank of England's (BoE) policy outlook in the absence of Brexit-related developments, the British pound continues to outperform its rivals. At the time of press, GBP/USD was trading at its highest level in a month a tad below 1.3800.

Over the weekend, BoE Governor Andrew Bailey argued that they will have to act to contain inflation and inflation expectations.

Reflecting the impact of this comment on rate hike expectations, the 2-year UK gilt yield gained more than 20% on a daily basis. Furthermore, the CME Group's BoEWatch Tool now shows that markets are pricing in a 52.2% probability of a 25 basis points rate hike by the end of the year and a 17.9% chance of a 50 basis points hike. The odds of the BoE leaving the target rate unchanged is currently 29.9%.

Source: cmegroup.com

Meanwhile, the broad-based selling pressure surrounding the greenback is providing an additional boost to GBP/USD on Tuesday. The US Dollar Index is currently trading at multi-week lows near 93.60 pressured by a 1% decline in the benchmark 10-year US Treasury bond yield.

US stock index futures are up between 0.2% and 0.3%, suggesting that the dollar could have a difficult time attracting investors if risk flows continue to dominate the financial markets in the second half of the day.

Later in the session, September Building Permits and Housing Starts data will be featured in the US economic docket but investors are likely to pay little to no attention to these readings.

GBP/USD technical analysis

GBP/USD continues to trade within the ascending regression channel coming from late September. Currently, the pair is testing the upper limit of this channel and the Relative Strength Index (RSI) indicator on the four-hour chart is staying near 70, suggesting that a technical correction could be seen before additional gains.

The last time the RSI rose above 70 on October 15, GBP/USD corrected toward the middle line of the ascending channel. At the moment, this line is located at 1.3760, forming the initial support there before 1.3730 (20-period SMA, lower line of the channel) and 1.3700 (psychological level, 200-period SMA).

On the upside, the first resistance could be seen at 1.3800 (static level, psychological level) before 1.3850 (static level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.