GBP/USD Forecast: Bulls ignoring political risks

GBP/USD Current price: 1.4133

- UK political risks set temporarily aside amid the prevalent dollar’s weakness.

- The UK keeps marching toward a return to normal after reporting no new covid deaths.

- GBP/USD is poised to extend its advance despite extreme overbought conditions in the near-term.

The British Pound soared to 1.4158 against the greenback, regardless of persistent political risks. UK Prime Minister Boris Johnson called on Sunday for talks with Scotland, Wales and Northern Ireland after Scotland SNP's pro-independence party won parliamentary elections. On a positive note, local elections in the UK further strengthened Conservative Prime Minister Boris Johnson's party, with the opposite Labour party losing a parliamentary seat.

Meanwhile, the UK keeps marching towards normality. The country reported zero new covid-related deaths for the first time in over a year and continues with its reopening program. On May 17, the country will allow larger outdoors and indoor meetings, while social distancing with close family and friends will be a matter of personal judgement. Data wise, the UK will report April BRC Like-for-Like Retail Sales during the Asian session, seen at 14.8% from 20.3% in March.

GBP/USD short-term technical outlook

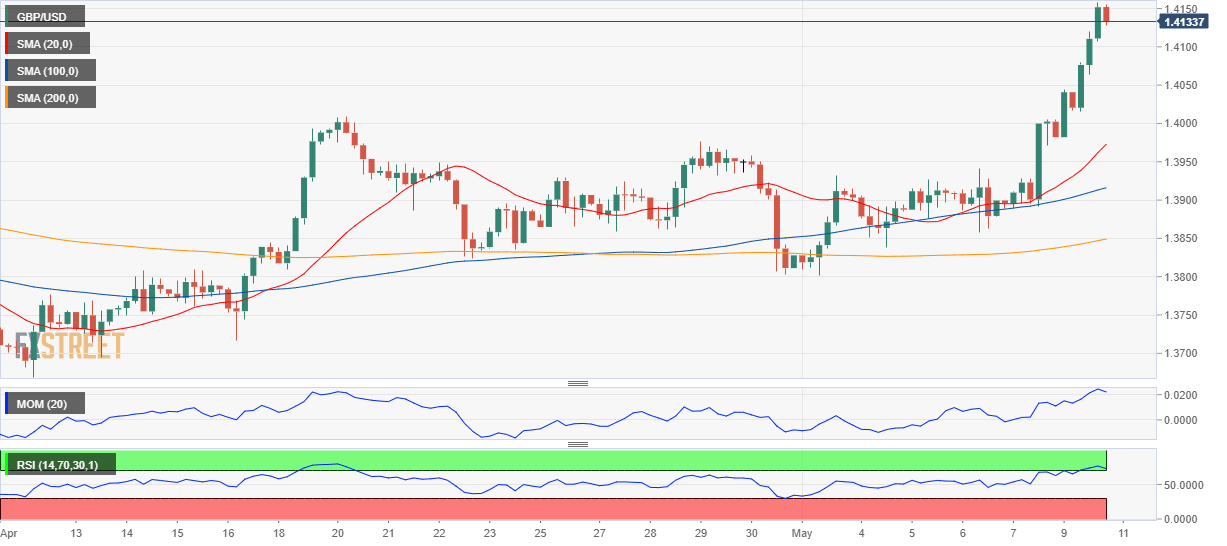

From a technical point of view, the GBP/USD pair seems poised to extend its advance, despite extreme readings. The 4-hour chart shows that the price consolidates gains in the 1.4140 region, over 150 pips above a bullish 20 SMA, which accelerated north above the longer ones. Technical indicators hold within extreme overbought levels, with no signs of changing course. The immediate resistance is 1.4181, February 25 daily high, with a break above it exposing this 2021 high at 1.4237.

Support levels: 1.4110 1.4065 1.4020

Resistance levels: 1.4180 1.4235 1.4290

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.