GBP/USD Forecast: Are pound bulls already losing faith?

- GBP/USD has started to edge lower after rising to a two-week high on Thursday.

- Four members of the BOE's MPC voted for a 50 bps hike in February.

- Nonfarm Payrolls in the US is expected to rise by 150,000 in January.

GBP/USD has advanced to its strongest level in two weeks at 1.3629 on Thursday with the initial reaction to the Bank of England's (BOE) rate decision but struggled to preserve its bullish momentum. The pair trades in negative territory below 1.3600 early Friday as markets gear up for the US January jobs report.

As expected, the BOE hiked its policy rate by 25 basis points to 0.5%. Surprisingly, four members of the BOE's Monetary Policy Committee (MPC) voted for a 50 basis points rate increase. Although the initial reaction to the vote spilt provided a boost to the British pound, BOE Governor Andrew Bailey acknowledged that the economic outlook was worsening and caused the GBP to erase its gains.

Bailey expressed clearly that they raised the policy rate because they were worried about inflation getting out of control, not because the UK economy was roaring. Commenting on the rate outlook, "it would not be surprising if we see a further increase but please don't get carried away," Bailey added.

Later in the day, the US Bureau of Economic Analysis' January jobs report will be watched closely by market participants. The US Dollar Index is staying calm after losing nearly 0.7% on Thursday, causing GBP/USD to stay stuck in its daily range.

Nonfarm Payrolls (NFP) in the US is expected to rise by 150,000 in January and the low bar opens the door for a positive surprise. More importantly, Average Hourly Earnings are forecast to increase to 5.2% on a yearly basis. Since the Fed is concerned about wage growth feeding into consumer inflation, a stronger-than-expected print could help the dollar stage a recovery and vice versa.

GBP/USD Technical Analysis

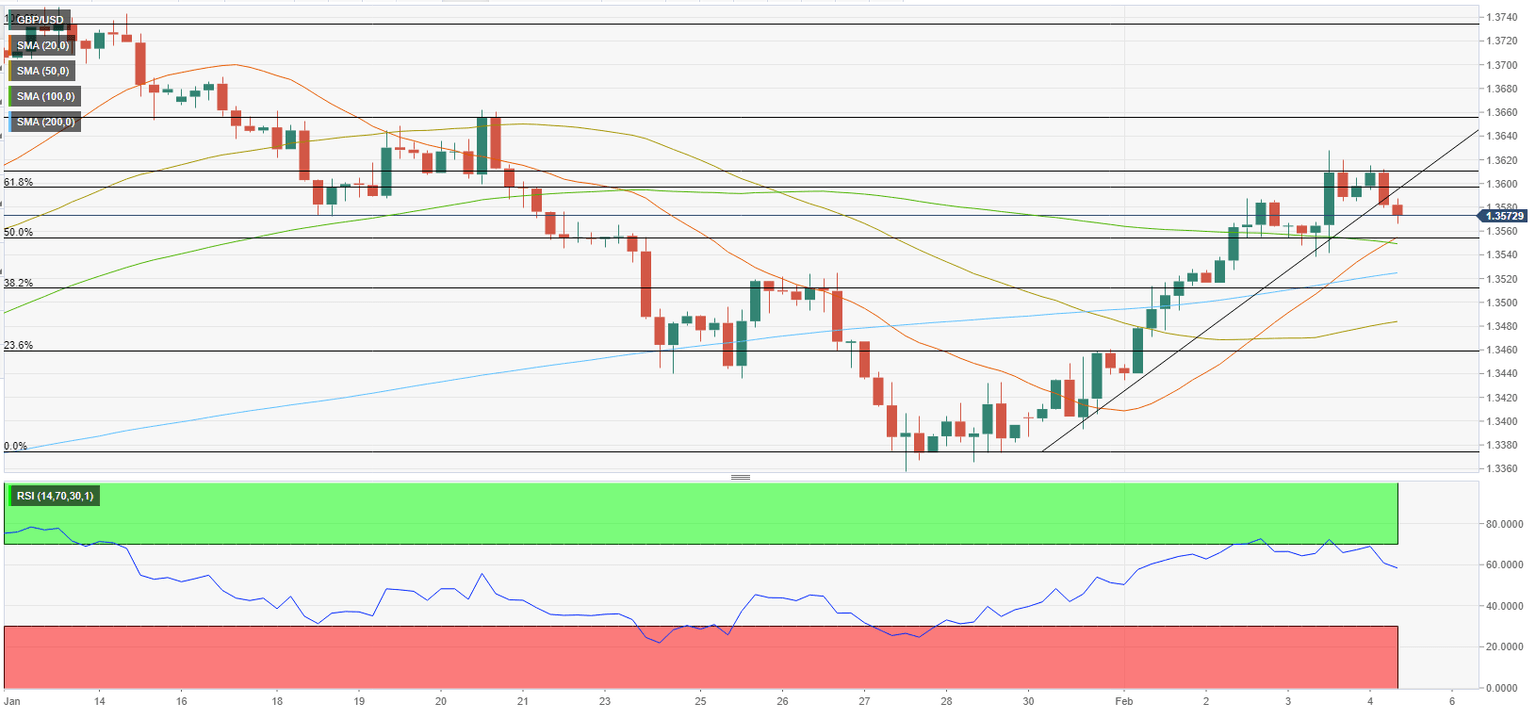

GBP/USD is trading slightly below the four-day-old ascending trend line and the Relative Strength Index (RSI) indicator on the four-hour chart is edging lower toward 50, pointing to a loss of bullish momentum.

On the downside, the 100-period SMA and the Fibonacci 50% retracement of the latest downtrend form strong support at 1.3560. In case this level fails, additional losses toward 1.3520 (200-period SMA) and 1.3500 (psychological level) could be witnessed.

On the other hand, the pair needs to rise above 1.3600 (psychological level) and confirm it as support before it can target 1.3660 (static level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.