GBP/USD daily outlook: Most likely to see lower prices in the correction

The analysis is based on Harmonic Elliott Wave and H.E.R (Harmonic Equilibrium Routing)

Daily outlook

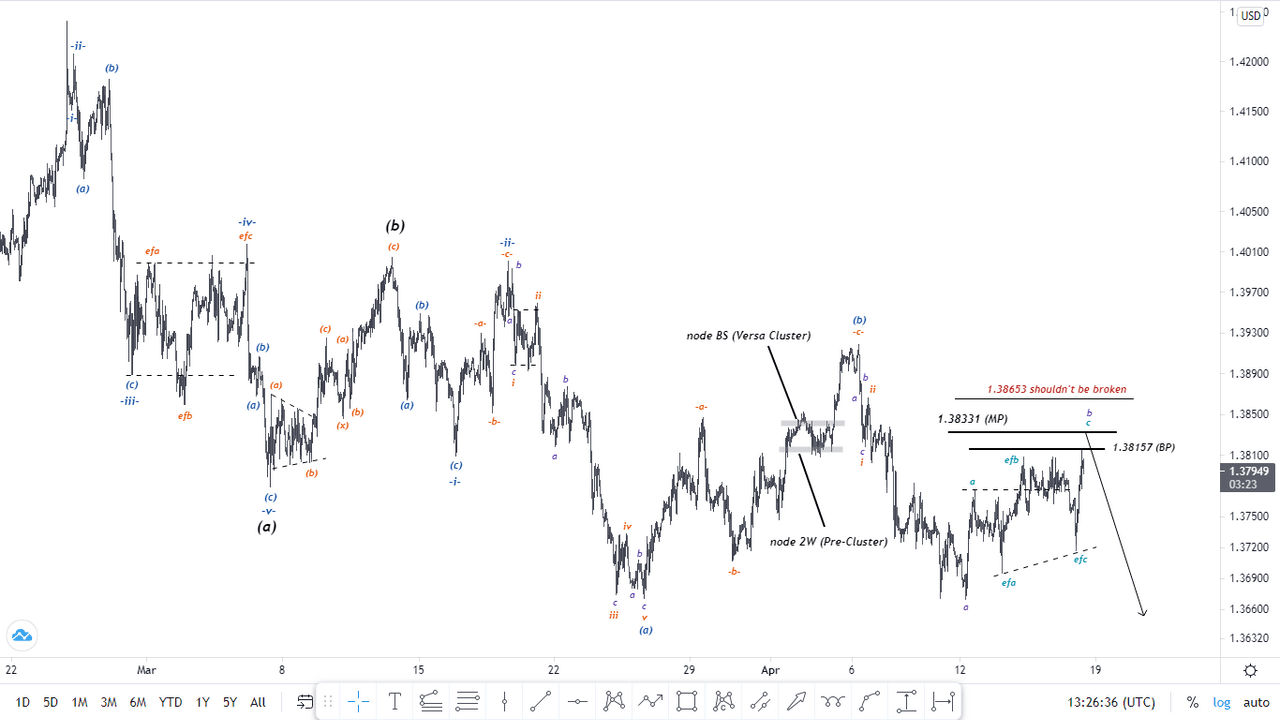

(30 Minutes Chart)

if we look at 4-hours or daily chart we'll find out the price is on wave -b- of wave (iii).

i suppose the correction isn't completed yet, and we'll might see lower levels for the GBP/USD. as it's shown in the chart below, the correction is on wave (c), and wave -iii- of (c) has more way down.

-

1.38331 (MP): wave c is able to see the level then starts its down-trend. (node BS: Versa Cluster).

-

1.38159 (BP): price touched the level and might start wave c of iii from now. (node 2W: Pre-Cluster).

-

1.38653: if price breaks the level, the analysis will be failed.

Author

Elizabeth Nersesian

HarmonicEquilibriumRouting

Elizabeth Nersesian is a Russian/Iranian technical analyst and trader which started her early experience in 2014 in Forex Market.