GBP/USD continues its rally: Third day of buying

The GBP/USD pair has risen to 1.2711, marking the third day of sustained buyer activity. This upward movement comes from comments from Bank of England Governor Andrew Bailey, who hinted at potential interest rate cuts in 2025 if the consumer price index (CPI) continues its downward trajectory.

In a recent interview, Governor Bailey discussed the possibility of a decisive easing in monetary policy, suggesting a total reduction of 100 basis points in 2025, which could bring the interest rate down to as low as 3.75% per annum. While this outlook is seen as positive, investors are currently more focused on the short term, with expectations set for the BoE's rate to remain unchanged in December 2024. Any substantial rate adjustments are anticipated to be implemented next year.

Governor Bailey also noted that UK inflation is declining more rapidly than anticipated, with current consumer prices nearly 1% below previous forecasts. This contrasts with official statistics, which recorded a CPI rise from 1.7% in September to 2.3% in October, suggesting that inflation pressures are not fully alleviated yet.

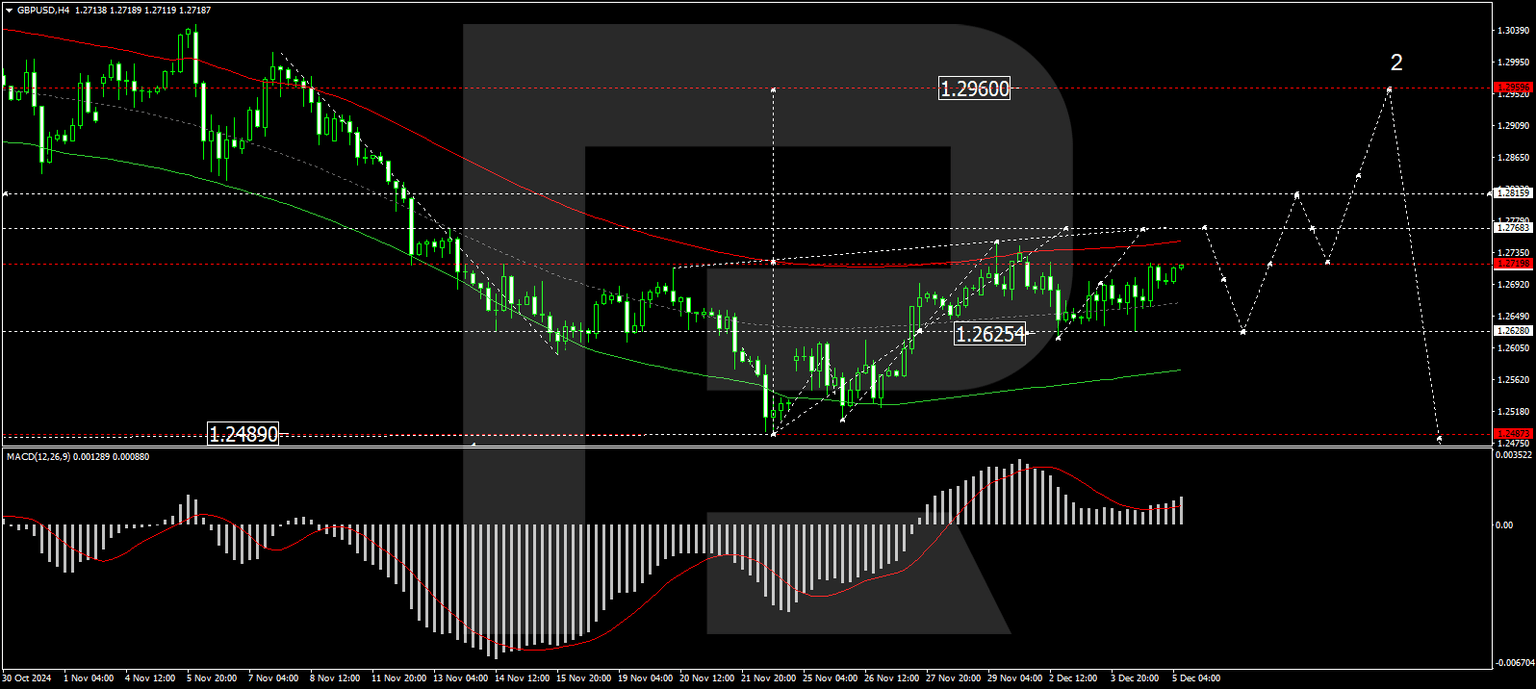

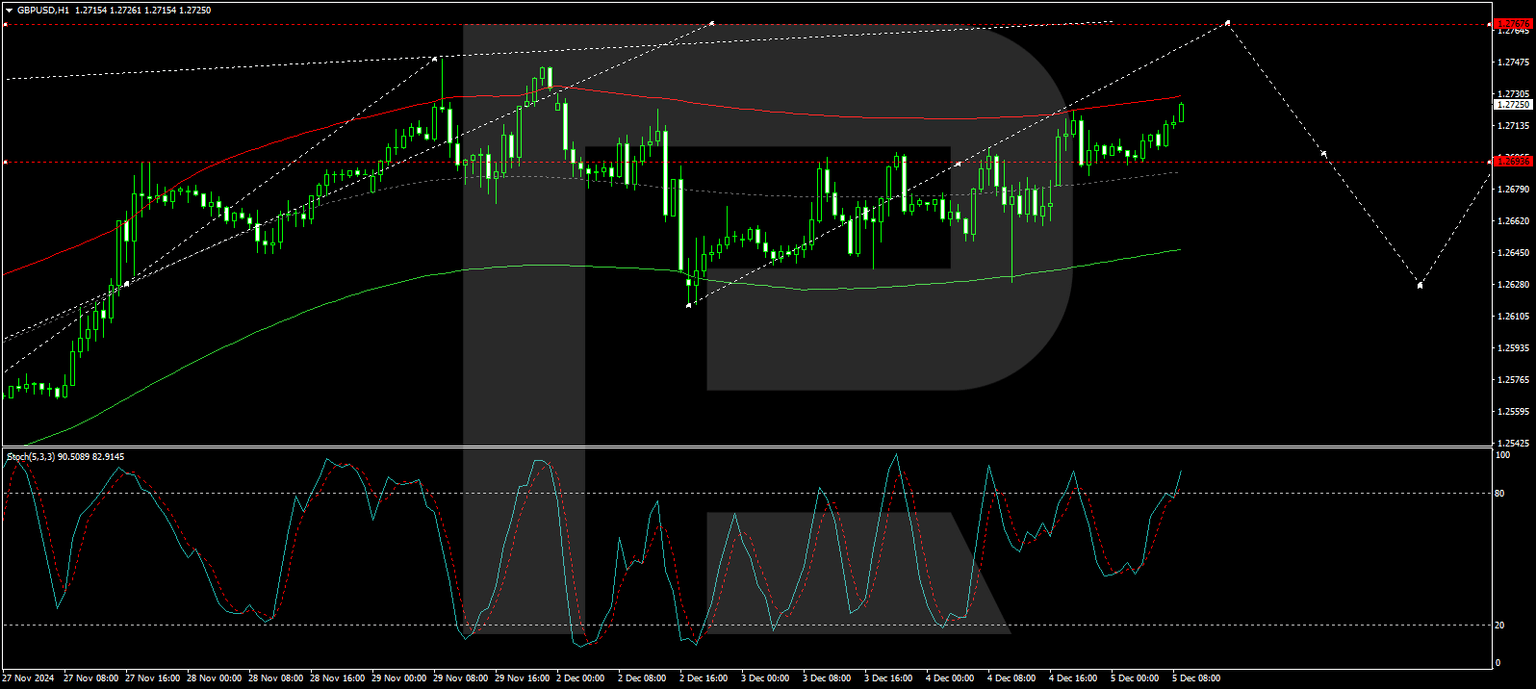

Technical analysis of GBP/USD

H4 chart: the GBP/USD is currently on an upward trend, targeting 1.2767. Once this level is reached, a retracement to 1.2628 is expected, testing it from above before potentially initiating another growth phase towards 1.2815, with prospects of extending to 1.2960. The MACD indicator supports this bullish scenario, with its signal line positioned above zero and trending upwards.

H1 chart: the pair has found support at 1.2628 and is building a growth structure towards 1.2767. Once achieving this level, a corrective phase to 1.2628 may ensue. This analysis is supported by the Stochastic oscillator, which shows the signal line moving upwards from above 50 towards 80, indicating continued upward momentum in the near term.

Author

Andrey Goilov

RoboForex

Higher economic education. Andrey Goilov has been working on the Forex market since 2005. A financial analyst and successful trader. Preference in trading is highly volatile instruments.