GBP/USD: an improvement in Cable really took off yesterday [Video]

![GBP/USD: an improvement in Cable really took off yesterday [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/GBPUSD/strong-pound-weak-dollar-17536259_XtraLarge.jpg)

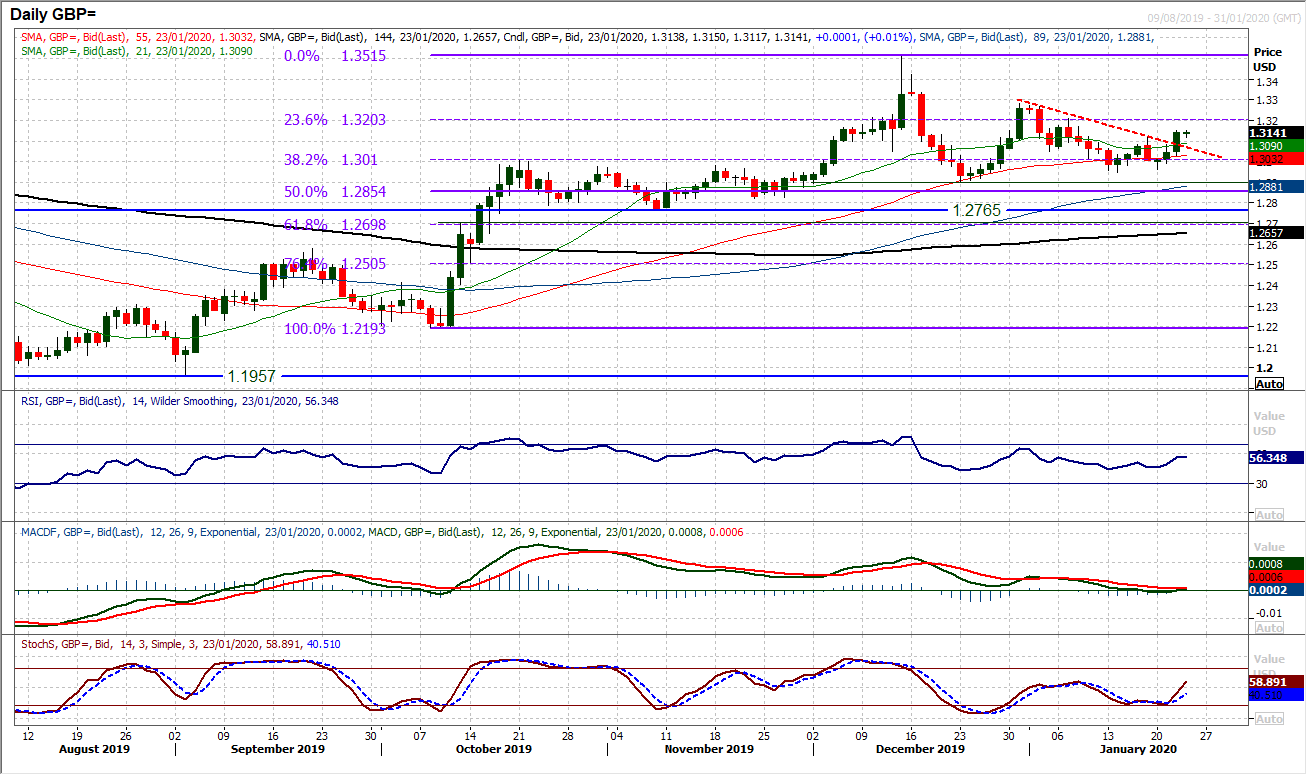

GBP/USD

An improvement in Cable really took off yesterday as a decisively strong positive candle broke not only a three week downtrend but also resistance at $1.3117. Once more the support band in the $1.2900/$1.3000 range has been used as a chance to buy. Momentum has swung higher once more from around key levels, with RSI back above 50 (from another low around 40) and MACD lines beginning to turn up from neutral. However, this move comes with a minor caveat today as an early unwind back is setting in (leaving potential resistance around $1.3150). It will be interesting to see how sterling responds today to the threat of US tariffs on UK car production. The hourly chart shows support between $1.3080/$1.3120which needs to hold to maintain recovery momentum. Below $1.3020/$1.3030 support would put the support levels on alert once more. It would seem the choppy ride on sterling will continue.

Author

Richard Perry

Independent Analyst