GBP/JPY: The buyers are eying to go long

GBPJPY made a strong bullish move on the daily chart. The price produced a Morning Star on the chart, and the very next candle headed towards the North breaching the last swing high. This is an explicit ABC pattern which suggests that there is still room for the price to move towards the upside. Today's intraday price action has been bearish, which indicates that the price may go towards the breakout level again to have a correction. If that happens, a bullish daily candle at the breakout level may attract the buyers to go long on the pair.

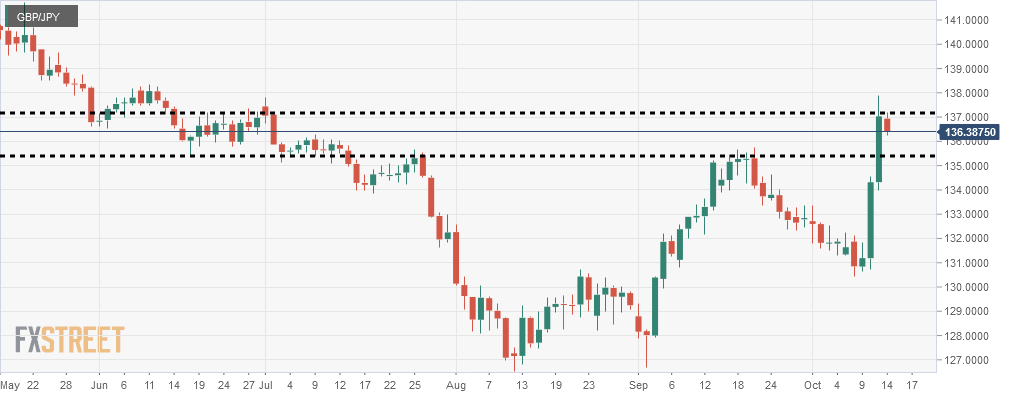

Let us have a look at the GBPJPY daily chart.

The chart shows that the price produced a Double Bottom and then headed towards the level of 135.5000. It then started having a pullback and came up to the level of 131.0000. After creating a Morning Star, the price made a breakout at the highest high of the wave on last Friday. The price would have continued its bullish move today as well if it had made a breakout at the level around 137.5000. It still may make an upside breakout today and continue its bullish move, though. However, a pullback and a daily bullish reversal candle at the level of 135.5000 shall attract more buyers to go long on the pair again.

In the case of an upside breakout, the price may find its resistance at the levels below

139.6100

140.6200

142.4500

Among these levels, 142.4500 may play a vital role. If the level is held, it might drive the pair towards the South. On the other hand, a breakout at that level might add buying pressure and push the price towards the North further.

Let us observe the GBPJPY H4 chart.

The H4 chart shows that the price has been having a correction. The level of 135.5000 may be held since it is a flipped resistance. The H4 buyers shall be eyeing on the level and the price action around it. An H4 bullish engulfing candle at the level shall be considered as a good signal to go long on the pair as far as the H4 chart is concerned.

The GBP or JPY does not have any high impact news event today. Overall price action and having no news event may make the pair get sluggish and have a corrective day. Tomorrow the GBP has a high impact news event "BOE Gov Carney Speaks" at GMT 09.30. The news event may create extreme volatility and end up producing signals for the buyers to go long on the pair tomorrow.

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and