GBP/JPY tests 200.00 barrier – Breakout or fresh rejection ahead?

GBP/JPY is teetering near the psychologically significant 200.00 level after rebounding from a low near 198.00. The pair is consolidating within a tight range, suggesting a pause before the next directional move. Technical indicators reveal indecision, while macroeconomic factors are tilting the balance slightly in favor of the yen.

Technical analysis

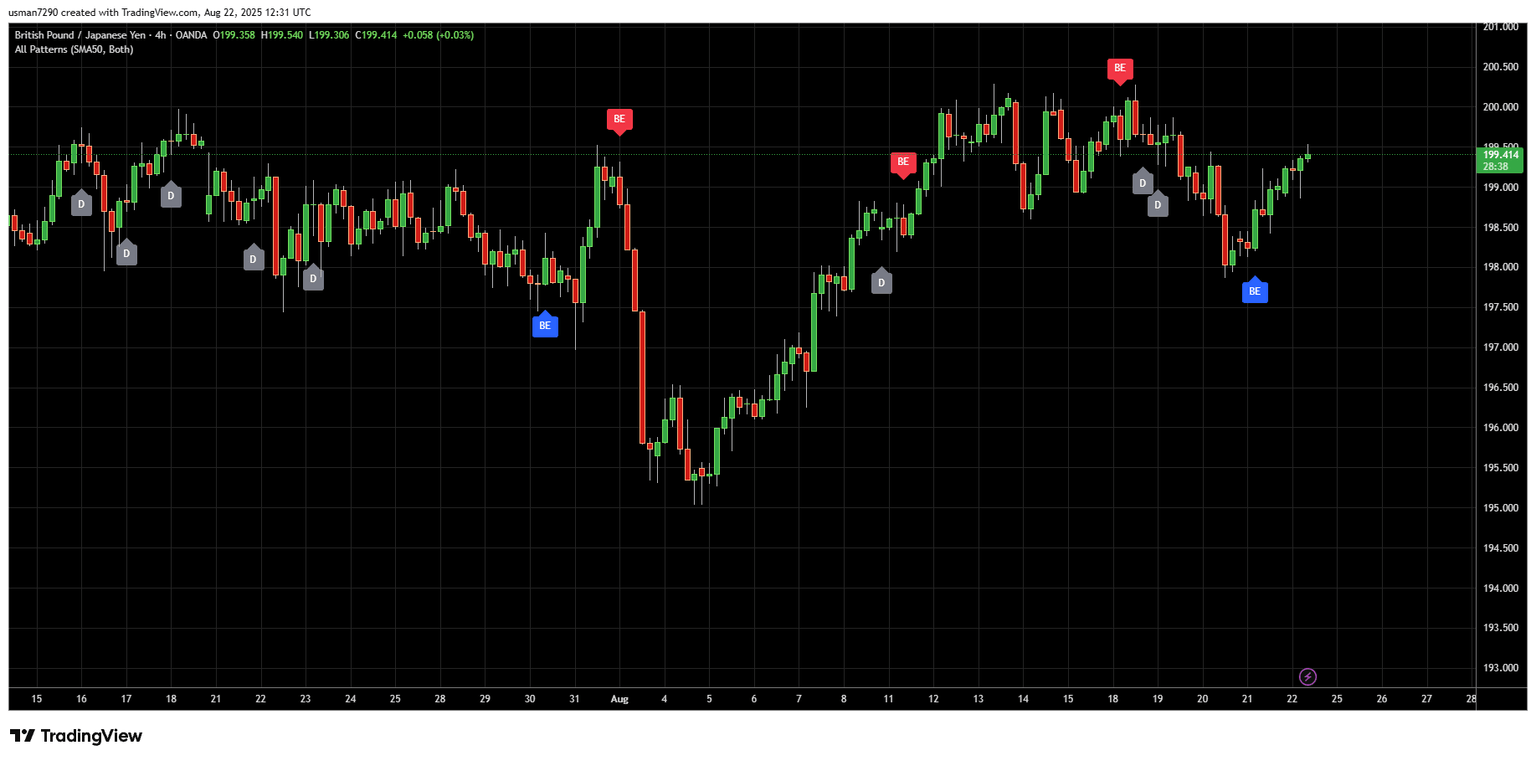

On the 4-hour chart, GBP/JPY appears range-bound between roughly 198.0–200.0. The recent low near 198.0 provided solid support, with the pair rallying toward resistance at 199.5–200.0. Momentum indicators from FXLeaders show RSI hovering around 41, indicating mild bearish bias, while ADX near 29 reflects relatively strong underlying trend strength despite the current consolidation.

Confluence resistance lies at 200.00–200.25 (watch this zone closely for breakout or fade), with support clusters between 199.0 and 198.8. The 50-day SMA is near 199.49, and the 200-day EMA around 199.10—both providing dynamic zones for potential reaction.

Meanwhile, ActionForex continues to frame the intraday bias as neutral, allowing for further consolidation below 200.26. However, as long as the 195.01 support holds, the broader near‑term outlook remains structurally bullish. A firm clearance of 200.26 could resume the rise toward 204.14, based on the Fibonacci projection from earlier swings.

Fundamental analysis

Fundamental narratives tilt toward yen strength—GBP faces headwinds from slowing UK growth, softening inflation, and growing speculation of a dovish stance from the Bank of England. In contrast, the yen benefits from safe-haven demand amid global uncertainties and lingering talk of potential yen-supportive verbal interventions by the Bank of Japan.

Key upcoming releases add to this tension. Japan is due to publish machine orders and trade balance data—stronger figures would bolster JPY and pressure GBP/JPY lower. Simultaneously, the UK will release inflation-related data (CPI, core CPI, PPI, RPI), along with the auction of 30-year UK Gilts; elevated inflation or positive bond auction outcomes could support GBP, offering some hope for a bullish turn .

Broader cross-asset influences—such as moves in oil prices, Gilt and JGB yields, and major currencies like USD and EUR—could also shape GBP/JPY’s trajectory today.

Conclusion and trade ideas

GBP/JPY remains trapped just under the 200.00 ceiling, with the latest rebound hinting at bullish potential but fundamentals favoring yen resilience. A clean break above 200.25 could open the door toward 202.00 and beyond, while repeated rejections at this level would likely see the pair slide back toward 198.00. Traders should stay nimble, keeping stops tight and watching UK inflation data and Japan’s trade figures closely, as these will be key catalysts for the next decisive move.

Author

Usman Ahmed

Forex92

Usman Ahmed is a currency trader and financial market analyst with more than a decade of active trading experience.