GBP/JPY rally falters near 200.00

-

GBP/JPY stalls weekly rally near 200 level on Bessent’s BoJ criticism.

-

Long-term range intact; more sellers waiting below 20-day SMA.

GBP/JPY turned red after seven consecutive green days as the yen recouped some ground following comments from the US Treasury Secretary Steve Bessent, who criticized the Bank of Japan’s stance on inflation, calling for higher interest rates. A historic make-or-break meeting between the US and Russian leaders on Friday may have shifted some funds towards the safe-haven yen too.

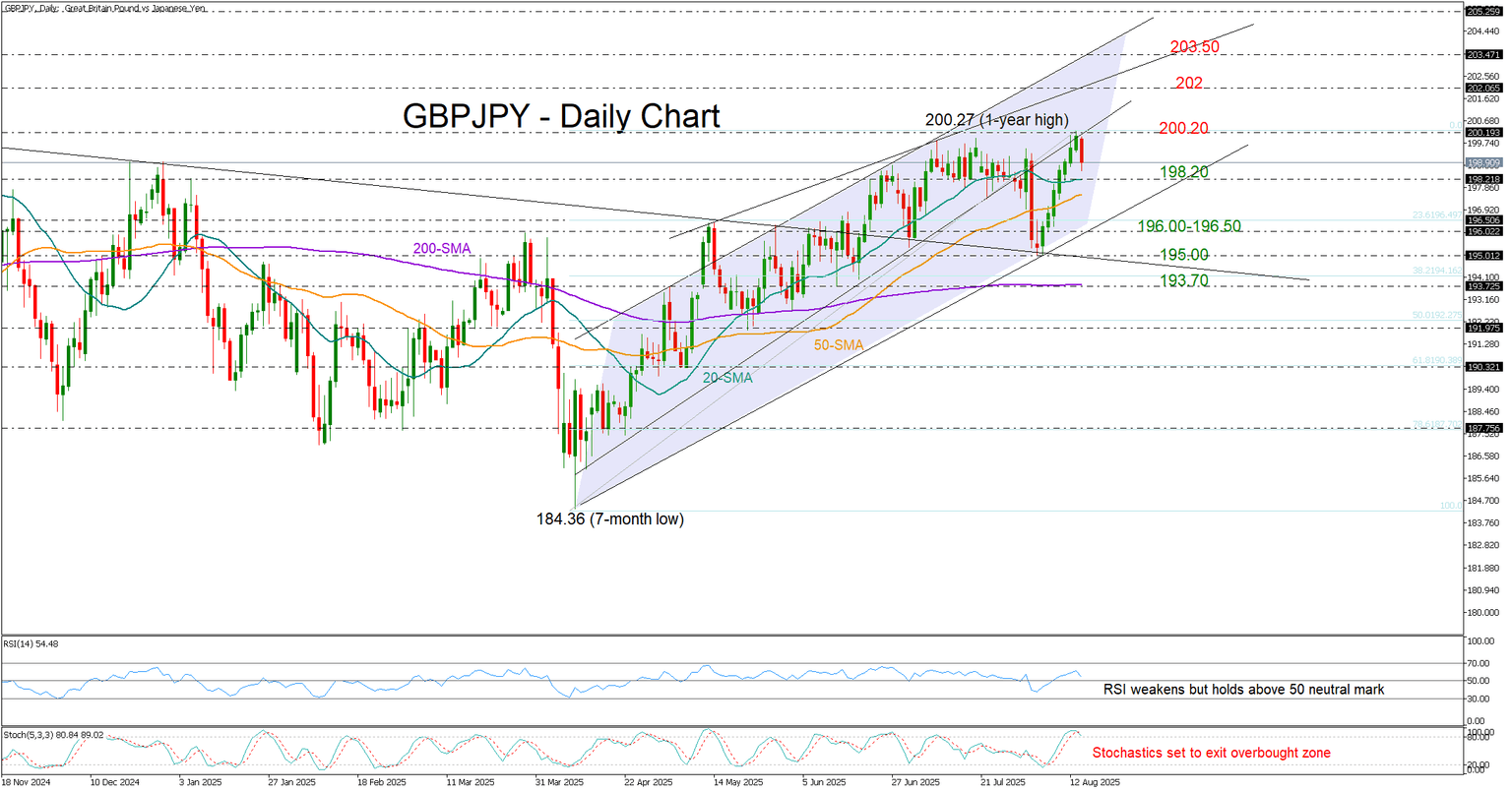

Technically, the pullback emerged near the 200 psychological level and the top of a long-term range in place since October 2024, which also capped gains in July. This raises the risk of a retracement in the coming sessions, particularly as the stochastic oscillator is turning lower.

However, the RSI remains comfortably above its 50 neutral level, suggesting that the bears may not gain full control unless the 20-day simple moving average (SMA) at 198.20 breaks. A drop below that point could stretch towards the tentative support trendline seen at 196.00-196.50. Additional weakness from there could re-test August’s low near 195.00, before signaling a potential bearish trend reversal and bringing the 200-day SMA at 193.70 into view.

If buyers regain momentum and push the price back above the one-year high of 200.27, the next resistance could appear around 202, followed by the 203.50 barrier.

In summary, GBP/JPY could enter a corrective phase after a weekly rally to a fresh one-year high. The next bearish leg may unfold if the price falls below the 20-day SMA at 198.20.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.