GBP/CHF – Short-term Cypher could offer a medium-term target

Fundamental

With UK’s Hanckock stating that the NHS is on standby to start delivery of the vaccine from next month, we have seen a move to the upside in GBP this morning.

From a technical perspective, I believe this offers a good selling opportunity.

Traders buy risk currencies when stocks fall and sell risk currencies when stocks rise. The risk currencies of the USD, CHF and JPY are looking close to turning points.

With Brexit worries, I believe that the ‘buy GBP’ stance will be short-lived

Also, GBP in inversely correlated with the FTSE (UK100). I think the index has more upside to come.

FTSE

Technical

We have formed a bearish Crab formation between 1.2172-1.2176 on the one-hour chart

GBP/CHF one-hour

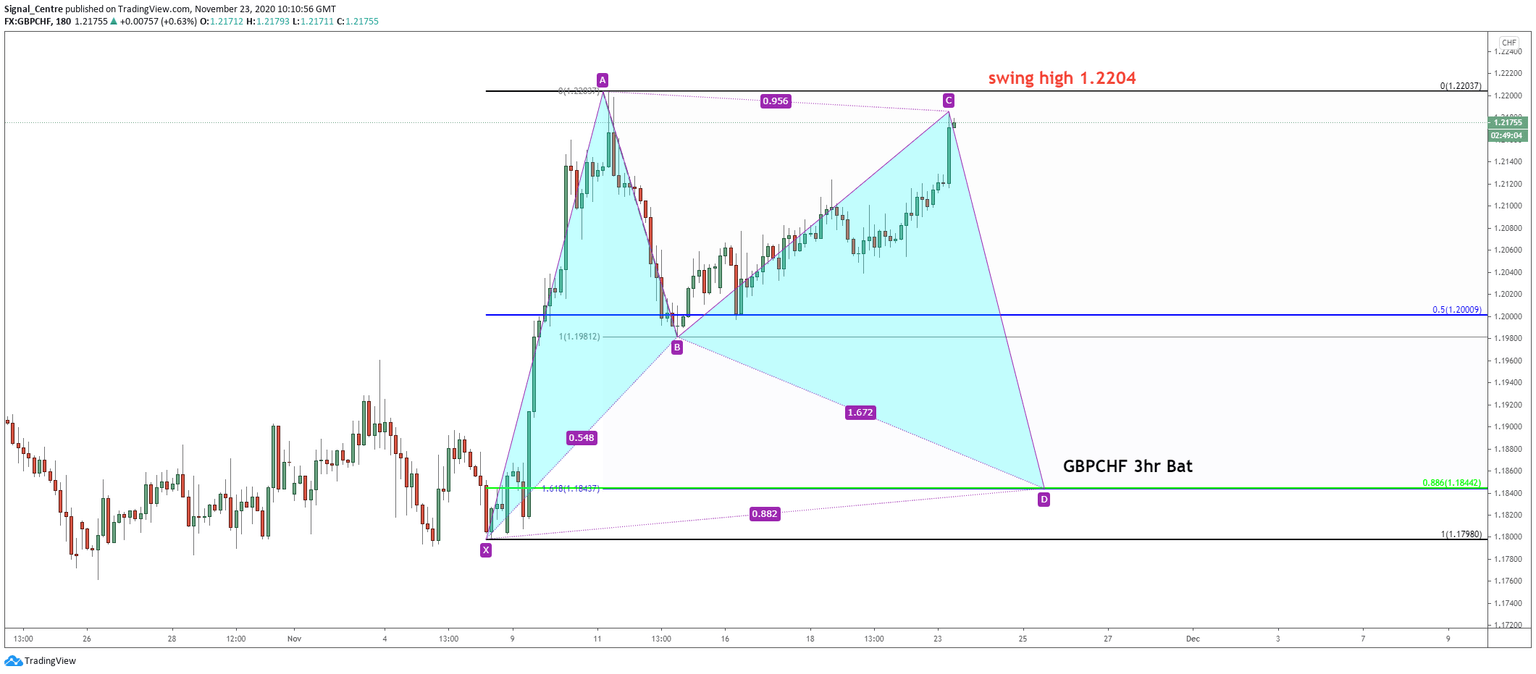

The main reason that I like this setup is that the three-hour chart highlights a potential target at 1.1845 (forming a bullish Bat pattern). The outlook is broken on a move above 1.2205 (swing high)

GBP/CHF 3-hour

Author

Ian Coleman

FXStreet

Ian started his financial career at the age of 18 working as a Junior Swiss Broker at Godsell Astley and Pearce (London). He quickly moved through the ranks and was Desk Manager at RP Martins at the age of 29.